‘Positive but weak’: Australian economy extends per capita GDP slump record into a seventh quarter

As higher for longer interest rates and inflation continue to bite, Aussies have been hit with more bad news on the economic front.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

The Treasurer has attempted to hang his hat on wages growth as the Australian economy posts its seventh straight quarterly drop in GDP per person.

National accounts figures released by the Australian Bureau of Statistics on Wednesday show an unexpected slump with gross domestic product growing just 0.8 per cent in the September quarter.

“We see this in the numbers today … labour productivity is in free fall,” shadow treasurer Angus Taylor said.

Mr Taylor flagged the sluggish productivity and growth made an interest rate cut unlikely.

“At the end of the day the Reserve Bank looks at the balance between supply and demand. With a collapse in productivity, the supply is going in exactly the wrong direction,” he said.

“They (RBA) need to see strong productivity if it is going to be easier to bring down inflation and interest rates and we have seen core inflation rising.”

The data shows GDP grew 0.3 per cent thanks largely to government infrastructure projects and energy rebates. For the 12 months until September 2024, the economy grew by 0.8 per cent.

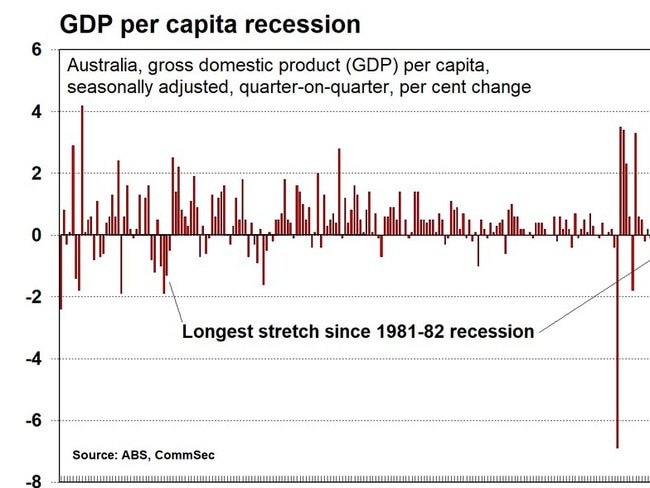

But households are largely spending less and business investment remains subdued, with GDP growing by negative 0.3 per cent on a per capita basis.

Treasurer Jim Chalmers acknowledged economic growth came in under market expectations, but contended government spending had padded the economy from a hard-landing recession.

“The most encouraging aspect and the most important aspect of today’s national accounts is what it says about real incomes growth,” Mr Chalmers said.

“This growth in real incomes reflects the progress we are making when it comes to moderating inflation but also solid wages growth and very importantly the government’s cost of living tax cuts.”

Compensation of employees increased 1.4 per cent as whole, led by the private sector. In particular, a rise in wages, bonuses, headcounts and new enterprise agreements in the information media, telco, construction and financial services industries drove this.

“Australians would be much worse off and growth in our economy would be even weaker without our responsible and balanced approach to the budget and without our cost-of-living support,” the Treasurer said.

“The Australian economy continues to be positive but it is weak.”

ABS head of national accounts Katherine Keenan said the economy grew for the 12th quarter in a row but had continued to slow since September 2023.

The strength this quarter was driven by public sector expenditure, with government spending outstripping consumer spending.

Household spending was flat in the September quarter following a fall of 0.3 per cent in June.

The largest detractor from growth was electricity and gas spending due to the implementation of the energy bill relief rebates. These rebates are treated as a shift from household to government expenditure in the national accounts.

“The rebate-driven fall in household electricity spending was offset by growth in other categories,” Ms Keenan said.

“Clothing and footwear rose in response to unseasonably warm weather and essential spending grew moderately with continued growth in rent, health and education services.”

Spending by Australian travellers overseas also contributed to growth in tourism categories like hotels, cafes and restaurants, and recreation and culture.

Independent economist Saul Eslake said prior to release, the RBA would be closely watching the household savings ratio, which is up to 3.2 per cent over the quarter.

“One of the things the RBA will be looking at very closely (is) if the household savings ratio has picked up. In other words, have households saved their tax cuts or spent them,” he said on Tuesday.

“In their judgment, aggregate demand (spending) by household, businesses and governments is still ahead of aggregate supply.

“They can’t do anything about aggregate supply but they can bring demand down in line with aggregate supply.”

Oxford Economics head of macroeconomic forecasting Sean Langcake agrees.

“We expect GDP growth will slowly pick up in the coming quarters. The fundamentals for an improvement in consumption growth are favourable,” he said.

“But this improvement will be unspectacular, with the economy set to endure below trend growth in the near term while capacity constraints continue to bite,” he said.

While the growth rate wasn’t strong in September, it was an uptick from the first half of the year when growth in the June quarter was only 0.2 per cent.

This means for the year until June 30 2024, Australia had its weakest growth outside of the coronavirus pandemic.

Excluding Covid, the annual GDP reading was the weakest result since the end of the early 1990s recession.

IG market analyst Tony Sycamore said Wednesday’s figures showed the impact of the RBA’s restrictive policy settings.

“The RBA’s latest forecasts from the November Statement of Monetary Policy suggest an expectation that growth will pick up to 1.5 per cent by December 2024 before climbing to 2.3 per cent by June 2025,” he said.

“However, today’s data shows the growth trajectory diverging further from projections, casting doubt on the RBA’s hopes for a smooth landing.

“With no RBA rate cuts on the horizon just yet, all eyes are on whether this week’s boost in retail sales for October was a one-off event or if it signals a more sustained improvement in consumer and business confidence.”

Managing expectations ahead of Wednesday’s national accounts data, the Treasurer said the trends were expected to continue into the near term.

However, Mr Chalmers said Australia was still “on track” for a soft landing from restrictive high inflation.

“Growth would be even weaker without the contribution from public demand,” he said.

“Most of this (government spending) was from the states, and the biggest part of the Commonwealth’s share was defence spending,” he said.

“In the latest numbers, state and local public demand contributed 60 per cent of public demand growth.”

Reserve Bank governor Michele Bullock last week came out in support of Australia’s big spending budget, saying the economy “would be worse without it”.

During her speech at the Committee for Economic Development of Australia annual dinner, Ms Bullock said government spending had helped keep the economy growing.

“Government spending is helping to keep the economy, at least on an even keel at the moment,” she said.

“If it wasn’t there, if it wasn’t filling that gap, then things might well be much worse in terms of the employment market.”

Ms Bullock supported the government on increasing the number of public sector jobs, saying these are roles Australia needs.

“I don’t buy into the idea that growth in non-market sector employment is not a good thing. It is a good thing. We need these people,” she said

“It’s teachers. It’s nurses. It’s aged care workers. These are all people that we need.”

Originally published as ‘Positive but weak’: Australian economy extends per capita GDP slump record into a seventh quarter