Barefoot Investor urges government to adopt ‘lock and alert’ plan to thwart scammers

Scott Pape wants the federal government to muster some political ticker and adopt this clever plan to stop scammers getting hold of our personal records. And it won’t cost us a cent.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Minister,

Minister,

The cyber hacks on Optus and Medibank have justifiably freaked everyone out.

And as you know the 17 million records that have been stolen in the last month are a drop in the ocean compared to the number of data breaches that never make it into the media.

So today I’m writing to you with a simple solution.

It basically involves putting a ‘lock’ on every Australian’s private financial information – plus an ‘alert’ that lets us know anytime someone comes near our personal data.

In this month’s budget the Government put aside $5.5m to investigate the hacks. However, setting my idea up won’t cost the Australian people (or the Government) a single cent.

All you’ll need is to muster up some political ticker, Minister.

Let me explain:

A criminal can hack a person’s ID and then apply for credit in their name.

When the bank gets the criminal’s application, their system automatically checks the customer’s credit file.

Importantly, the customer does not get an alert telling them the bank has checked their credit file.

The criminal can use this to their advantage, often clocking up dozens of credit card and personal loan applications as quickly as they can.

So, the most logical solution would be to put a ‘lock and alert’ system on our credit reports. That is, lock every credit file so no one can see it (without the customer’s consent) and send an immediate alert to the customer if someone tries to access it.

But there’s one problem (or three actually).

There are three credit bureaus in Australia (Equifax, Experian and illion) who keep credit files on practically every Australian adult.

They are owned by large investors, and last year they collectively made $521m in revenue selling our private data to financial institutions, according to IBISWorld.

The problem is, putting a lock on our credit files would put a lock on their profits. They’re not going to let it happen, and they pay highly paid lobbyists to make sure the government doesn’t allow it.

Those lobbyists will tell you, Minister, that “it can’t be done”.

But it can. In fact, in America, the government has already forced credit bureaus to offer it. And in Australia the ‘lock and alert’ technology already exists, via an app called Credit Savvy.

So, my suggestion is that the government (i.e. YOU, Minister) should force the credit bureaus to automatically lock down our credit files and provide us with an alert service. This will block criminals while still allowing legitimate credit inquiries to be made.

The fact is, Minister, these credit bureaus are like Facebook. Our private data is the product they sell, and their customers will pay handsomely for that data. Let’s be honest: the credit bureaus’ only allegiance is to their shareholders.

Yet your allegiance is to the Australian people you have the honour of representing. So, we need you to stare down these billion-dollar companies and stand up for us.

As the Minister for Financial Services, I know your worst nightmare is that one of our banks will get hacked, which some analysts (like Standard & Poor’s) suggest is only a matter of time.

Right now you have the power to protect all Australians with a stroke of a pen.

Will you?

Tread Your Own Path!

P. S. I invited the Minister to respond (in 140 characters or less). Here is his response:

“Sounds good. We’ll take a look. Stephen”.

Vanguard Super?

Hi Scott

I came across an article stating that Vanguard is now in the Superannuation business and will be competing against the likes of Australian Super, HostPlus etc. What is your view on this? Andrew

Hi Andrew

Yes, this week Vanguard officially launched their super fund offering.

They’re charging 0.58 per cent per annum, which is one of the lowest in the market for standard default funds with balances under $50,000.

There are cheaper superannuation index funds available.

Yet here’s what’s interesting about this:

First, Vanguard has said they’ll look to lower their fees over time as they grow. I’m inclined to believe them, because that’s what they have a history of doing.

Second, this ain’t your bog-average super fund.

Research from SuperRatings found there is a “high risk at retirement” for many of the current top-returning super funds. That’s because most of our biggest super funds throw everyone – young and old – into a one-size-fits-all investment pot.

Instead, Vanguard’s offering is a life cycle fund that invests your super based on your age. In simple terms, they automatically reduce the amount of riskier assets, like shares, in your portfolio as you get older and closer to retirement. In all, they make 36 of these adjustments up to your 83rd birthday (with no switching fees), which is far and away the most comprehensive of any Australian super offering.

So what do I think?

I think this is great news for every Australian – regardless of whether you switch to Vanguard or not.

The super fund industry trousers an outrageous $30bn a year in fees – money that could and should be going towards our retirement.

Hopefully now that one of the world’s biggest fund managers – with a relentless focus on lowering costs – has set up shop, they’ll keep everyone on their toes.

For disclosure, I invest in some Vanguard index funds.

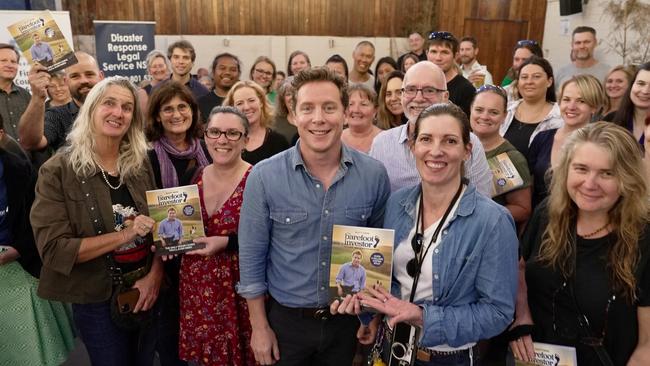

Thank You for Coming to Lismore

Hey Scott,

I came to your Beer with Barefoot session last night – and wow – it was packed! I was so excited to get to meet you in person and you bought me a beer and signed my book. It’s been almost nine months since we lost our house and we’re still struggling. I left last night with a clear plan and knowing I had help. Thank you for supporting the community of Lismore, it’s the lift we really needed.

Lauren

Hey Lauren

It was lovely to meet you there. And it was a real pleasure to come to Lismore. After meeting so many people like you who shared heartbreaking stories, I’m blown away by what an amazing, resilient community you have.

A big thank you to the Lismore Book Warehouse, and to the publican at the Metropole for putting on such a great event!

Barefoot Kid Refuses to Go to Sleep

Dear Scott,

I gave my son, 10, your new book this afternoon … and he can’t put it down. He’s on page 104! He won’t go to sleep until he finishes it! He says it’s amazing! Loves the ‘little tips’ and stories the most.

Perhaps this book will change his life like Barefoot Investor has changed mine.

Thank You!

Sasha

Hey Sasha,

What a little champion!

And your son’s not alone:

We launched the book on Monday … and by Monday night my inbox was full of kids (and their parents) writing emails to me, bragging that they’d already finished the whole book.

That’s only happened to me once before:

The day I launched the original Barefoot Investor book.

But this time it’s even better … because it’s happening with kids.

I’ve said that Barefoot Kids is the best book I’ve ever written, and I believe it.

So I’m putting it out there early: there is something very special about this book.

Thank you for sharing, Sasha. I look forward to hearing about the epic money adventure your son is now on!

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

More Coverage

Originally published as Barefoot Investor urges government to adopt ‘lock and alert’ plan to thwart scammers