Wagners enjoys strong 2018 start, but local projects slim

WAGNERS is experiencing one of its strongest starts to any year in 2018 - but Toowoomba is not part of that success.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

WAGNERS is experiencing one of its strongest starts to any year in 2018 - but Toowoomba is not part of that early success.

Chairman Denis Wagner said the construction materials business had its hands full with several contracts and jobs in Brisbane and the Northern Territory.

However, Mr Wagner said Wagners' activity in Toowoomba was slower than normal.

"It'll be the strongest start to the year that we've had for many years," he said.

"Most of our work at moment is in the NT and in Brisbane, which is concrete, transport and contract crushing.

"We have a lot of haulage work in north-west Queensland and in the Northern Territory.

"Our cement and concrete business is quite busy in Brisbane and we're growing our concrete business in Brisbane.

"There's not a lot in Toowoomba but hopefully that will change - we do have a contract with the Toowoomba Second Range Crossing."

Mr Wagner said product from the company's composite fibre technology plant, which was a major selling point for investors over its rivals like Adelaide Brighton and Boral, could reach the overseas markets within six months.

"We expect there will be some significant inroads into the international market over the next six months for the composite fibre technology," he said.

"We've got people on the ground in the US, New Zealand and the UK and we're getting a lot of enquiries.

"Hopefully it will come to fruition within six months."

The positive start follows the business' successful float on the Australian Stock Exchange on December 8.

WHY WAGNERS' SHARE PRICE IS STILL STRONG

A LEADING investment expert in Toowoomba believes the success of Wagners' share price on the Australian Stock Exchange is partially because of the timing of the float.

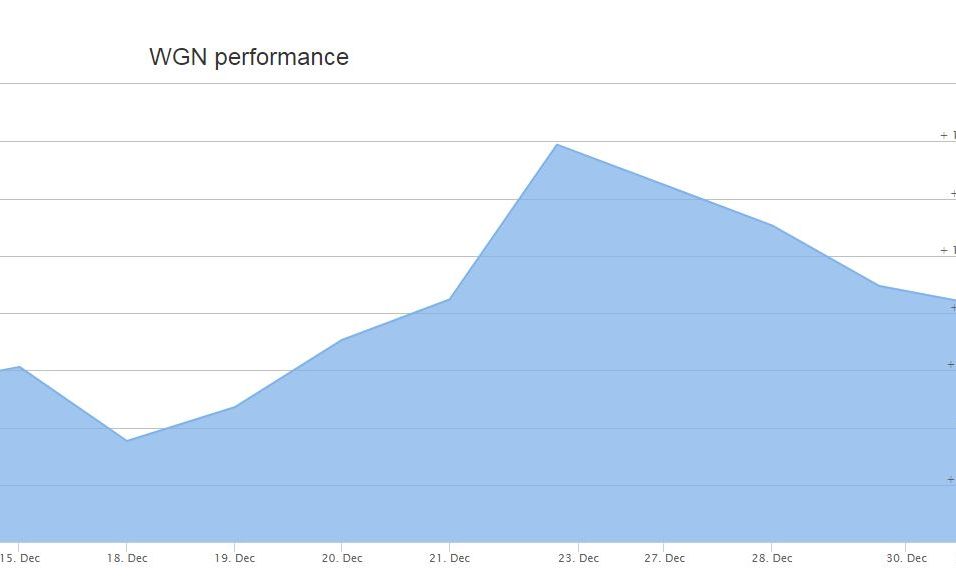

As of January 3, Wagners shares are valued at $3.75 each, more than 10 per cent above the initial float price of $3.31 on December 8.

At one point before Christmas shares were trading at $4.

Dornbusch Partners' investment adviser Andrew Wielandt said while the strong showing was an indication of investor confidence in the business, the choice to float in December had also helped spike the price.

"In the finance world, usually from December to about when the Australian Open starts, there isn't a lot of volume, (because) people who follow it closely won't be back at their desks until later in the month," he said.

"December is the second-best month of the year, because there are less sellers and unless there's some big-picture problem, everyone downs tools and that's one of the reasons the market has a stronger month.

"They timed it pretty well."

A top adviser for Morgans, who helped organise the Wagners float with Credit Suisse, called the company a "truly great Australian company" in an investor newsletter, urging clients to buy or hold.

"It just ticks all the boxes - exceptional, independent management with a long term view, wonderful strategy from the board down, proprietary products where they don't need to patent because the machines that make these unique products are even manufactured in-house," Geoff Voller said.

"I just think in five and ten years' time the share price will be multiples of what it is today and WGN will be on the radar of all the largest fund managers, not just the sprinkling of Australian fund managers that are aware of the detail so far.

"It is therefore a perfect "bottom drawer" super fund stock to buy and hold."

Originally published as Wagners enjoys strong 2018 start, but local projects slim