Liquidators appointed Sanad Capital Pty Ltd

The company behind a $350m surf park and resort on the Sunshine Coast has been forced into liquidation weeks after the director’s second company was revealed to owe creditors more than $19m.

Sunshine Coast

Don't miss out on the headlines from Sunshine Coast. Followed categories will be added to My News.

A Sunshine Coast-based development and investment company, which was behind plans to build a water park, wave pool and resort at Glenview, has been handed to liquidators under a Supreme Court order.

Australian Securities and Investments Commission documents revealed the Birtinya-based company, Sanad Capital Pty Ltd, directed by Bradley Sutherland, had been placed into liquidation.

Liquidator, Tracy Knight from Bentleys, was appointed to the company by a Supreme Court order on April 24, 2024, according to the ASIC documents.

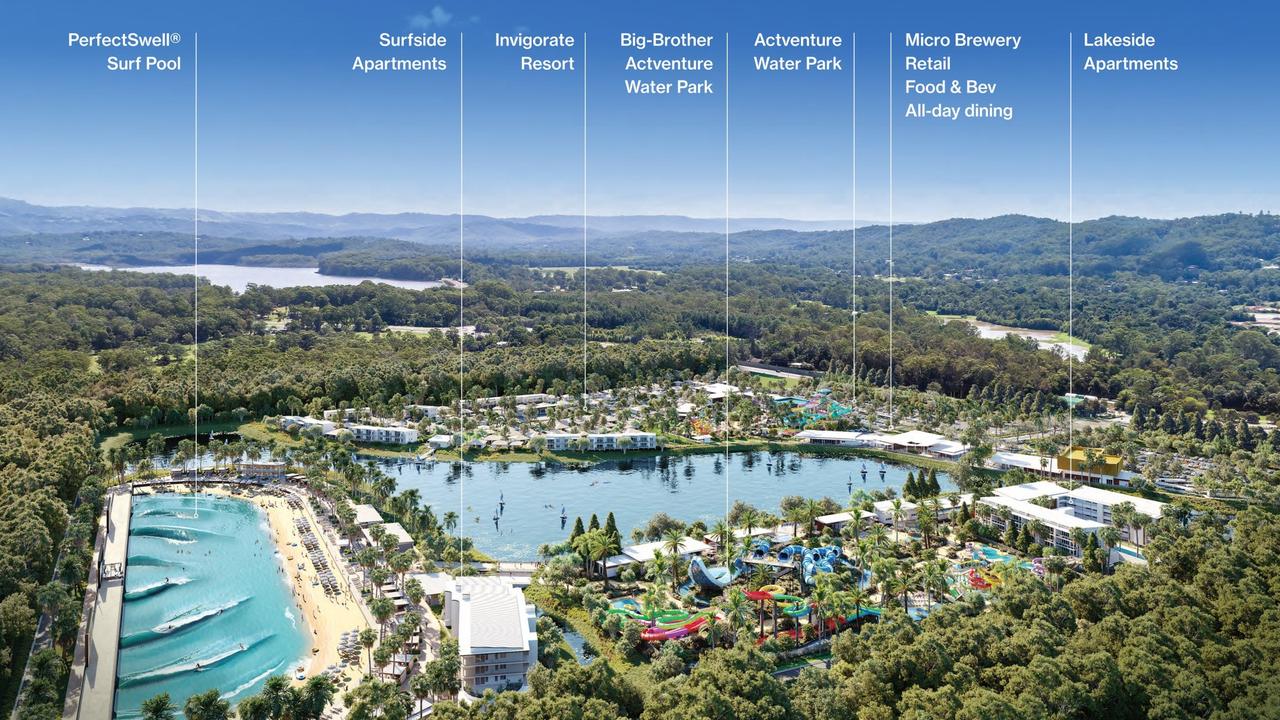

The company was behind plans to build the Actventure water park and resort, estimated to cost around $350m, including a $40m wave pool on Steve Irwin Way in Glenview.

Ms Knight said so far she was aware of a creditor owed an estimated debt of $7.6m.

“I am aware that the petitioning creditor’s debt is $7.6 million arising as a result of a guarantee by Sanad of obligations of Nurrowin Pty Ltd under a financing agreement,” Ms Knight said.

Mr Sutherland also acted as the director of the separate company, Nurrowin Pty Ltd.

Nurrowin, which was the landowner of the Glenview block destined to house the development, was placed into voluntary administration in November last year and the land was subsequently listed for sale.

The end of administration term report for Nurrowin published on ASIC on April 15 this year stated the company owed more than $19m to a total of eight creditors.

An estimated $11,690,851 is owed to two secured creditors, while the remaining $7,451,212 is owed to six unsecured creditors.

The development plans were approved for the block on Steve Irwin Way to include 160 villas, a wave pool and two separate water parks in August 2023.

However, the development approval process was not without controversy, with Sanad Capital waging an appeal in the Planning and Environment Court against a rival developer and the Sunshine Coast Council over a similar project at the Glass House Mountains.

Sanad Capital had attempted to appeal the council’s decision to approve the rival developer’s project shortly after their own, but the appeal was dismissed on June 15, 2023.

The 25ha property was listed for sale earlier this year, with expressions of interest closing on March 7, 2024, however the real estate confirmed with this publication the block had not yet been sold.

According to property data the block last sold in 2015 for approximately $4m.

Sanad Capital has been contacted for comment.

More Coverage

Originally published as Liquidators appointed Sanad Capital Pty Ltd