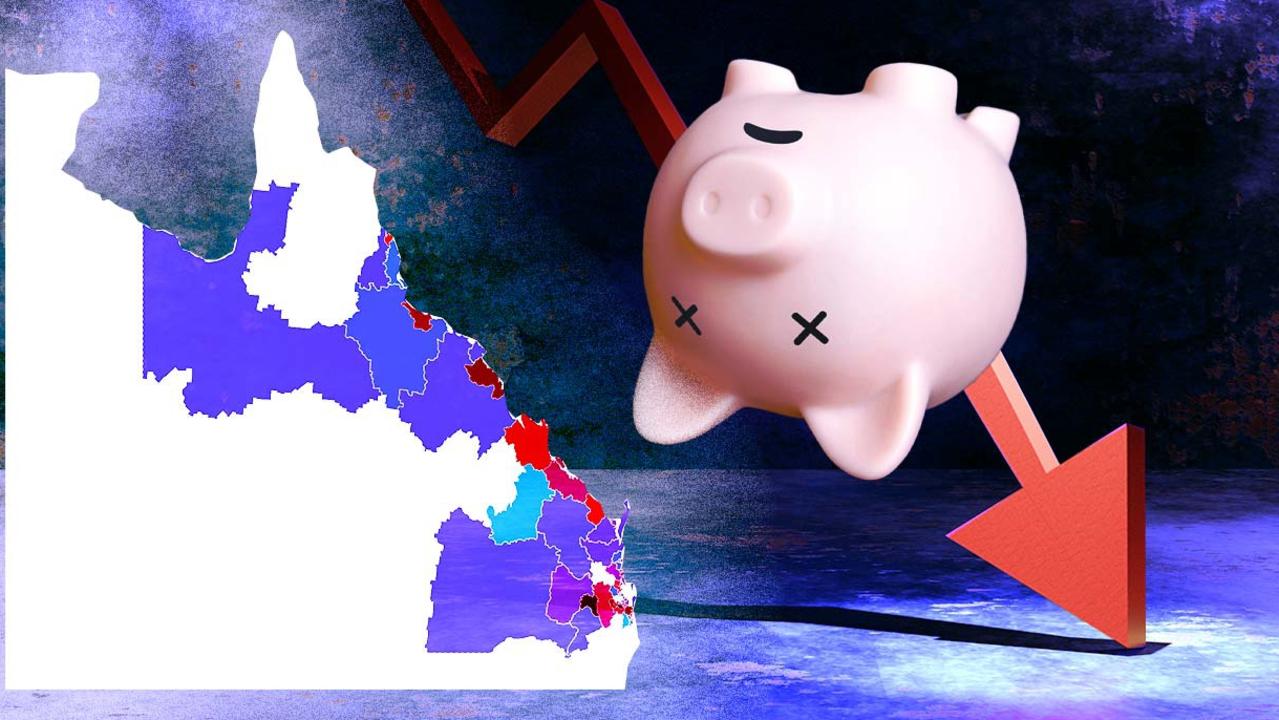

Mapped: Queensland’s bankruptcy hot spots revealed

Queenslanders are doing it among the toughest in Australia when it comes to staying afloat. SEE THE WORST SUBURBS

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

Queenslanders are doing it among the toughest in Australia when it comes to staying afloat during a cost of living crisis.

Personal insolvencies across Australia have spiked in the 2023 June quarter, according to new statistics released by the Australian Financial Security Authority (AFSA) with 2,705 new personal insolvencies in the three-month period – up 17 per cent from 2,301 in June 2022.

The data shows personal insolvencies increased in all states and territories, except for South Australia and Western Australia where numbers remained steady.

Queensland had the second highest rate of personal insolvencies with 709, just behind NSW with 792 and ahead of Victoria with 491.

Toowoomba emerged as one of Australia’s worst bankruptcy hot spots, with a total of 35 personal insolvencies in the three months to June.

Browns Plains was next on the list, with 34 people declaring bankruptcy in the June quarter.

That’s followed by Mackay (29), Ormeau - Oxenford (28), Ipswich (27) and Townsville (27).

The CreditorWatch Business Risk Index for June 2023 shows an increasingly challenging landscape for Australian businesses.

CreditorWatch Chief Executive Officer Patrick Coughlan said Southeast Queensland has the highest risk of business failure in the country.

“When we look at the top 10 worst areas in Australia, I think five of them come from that area; like Surfers Paradise, Southport, the wider Gold Coast and Ormeau-Oxenford,” he said.

“Personal insolvency rates are quite high in that area, the median income isn’t overly high, rental and property costs are high, so that quickly offsets the median income.”

Mr Coughlan said it will get worse before it gets better.

“Insolvencies will continue to rise and we expect those to rise probably another 10 to 20 per cent and that will be dependant on interest rate increases and how sticky inflation is,” he said.

Mr Coughlan said there was a seven per cent chance of failure for any food or beverage business in Australia.

“From a probability of default or failure perspective, food and beverages is number one - the highest risk industry in Australia at the moment, he said.

That is followed by transport, arts and recreation.

AFSA Chief Executive Tim Beresford said many Australians are facing challenging financial times.

‘If you are in financial difficulty, there is help available and we urge you to seek trusted advice to help find a solution that works for your circumstances.’ he said.

There was a total of 9,930 personal insolvencies in the 2022–23 financial year – around four per cent higher than the 2021–22 annual figure of 9,545.

The AFSA figures revealed in the June quarter, just over a quarter of personal insolvencies were business-related (730).

AFSA’s Chief Data Analytics & Intelligence Officer, Ignatius McBride said the increases reflect the expected gradual return to average levels following record-low numbers.

‘We have seen historical lows in personal insolvencies in recent years, particularly during 2021–22 following targeted economic responses to the pandemic from industry and government,’ Mr McBride said.

‘This marginal national increase is in line with forecasts, as we expect to see personal insolvencies revert towards the 10-year average in the next two years.”

In January, AFSA noted that business-related personal insolvencies accounted for $11.4 billion, or roughly two-thirds, of debt in the system.

“The average debt for a business-related personal insolvency is $830,502 – over 5.8 times larger than a non-business-related personal insolvency ($141,733),” it noted.

Overall, personal insolvencies increased in Australia, with a total of 2,705 new declarations recorded in the June quarter 2023 – up 17.6 per cent from the previous year.

The June quarter numbers:

- 1,569 were bankruptcies

- 1,099 were debt agreements

- 35 were personal insolvency agreements

- 2 insolvent deceased estates

- 730 personal insolvencies were business-related – up from 558 from June 2022.

2022-23 financial year figures:

- 5,844 were bankruptcies

- 3,942 were debt agreements

- 121 were personal insolvency agreements

- 23 insolvent deceased estates

- 2,435 personal insolvencies were business-related – up from 2,327 from 2021-22.

Insolvencies by location:

- Compared to the rest of the country, Queensland has the second highest rate of personal insolvencies.

- In New South Wales, 792 people formally declared personal insolvency. Victoria had 491 entries while Western Australia only had 233.

More Coverage

Originally published as Mapped: Queensland’s bankruptcy hot spots revealed