Australian property: how much harder is it to save for a house deposit now vs 15 years ago

First-home buyers could have to wait a jaw-dropping amount of time to save the deposit needed to get on the property ladder, new research reveals.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

First-home buyers could take up to 15 years to save the deposit needed for their Great Australian Dream, according to new research.

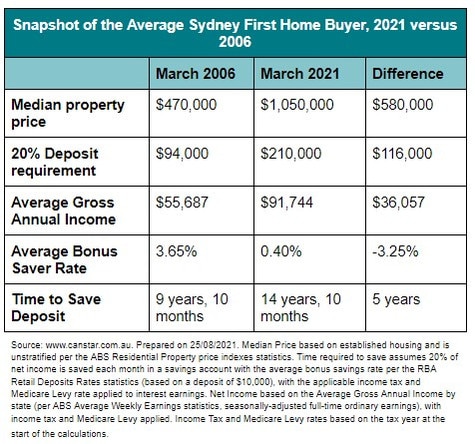

The time it would take for the average Sydney first-home buyer to save a 20 per cent house deposit has increased by five years to a jaw-dropping 14 years and 10 months since 2006, comparison website Canstar’s analysis reveals.

RELATED: How 21-year old bought two blue-chip homes in a year

Aussie nanna’s reality check for greedy buyers

Real life Monopoly man reveals how he got 39 homes

Young couple’s slick $300K flip on ‘love shack’

Over that period, the median house price has more than doubled from $470,000 to $1.05m.

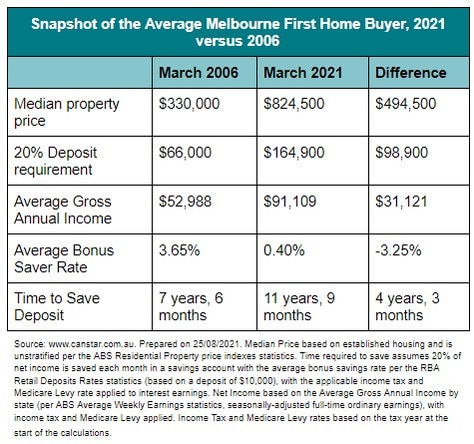

The average first-home buyer in Melbourne could now expect to take 11 years and nine months to save for a house – four years and three months longer than it would have taken in 2006. The median house price in Melbourne has jumped from $330,000 to $824,500.

In Canberra, an average first timer now needs to take three years and four months more to save than 15 years ago.

The savings time needed in the nation’s capital is currently 10 years and 11 months, after the median increased from $385,000 to $825,000 since 2006.

Perth is the only Australian city where entry into the housing market can now be achieved faster (by one year) than back in 2006.

Although Perth’s median moved from $370,000 to $538,000 in that time, the local market experienced extreme price booms and busts so the city’s price growth underperformed when compared with wage.

According to Canstar’s data, while median house prices in almost all capital cities climbed by an average of 4.6 per cent a year since 2006, incomes had only inched up 3.6 per cent.

In this same time frame, interest rates dropped from an average of 3.65 per cent to just 0.4 per cent.

Canstar’s home loans expert, Steve Mickenbecker highlighted while prices hit record highs, interest rates were at all-time lows, making it harder than ever to reach that 20 per cent savings target.

“Saving a deposit is the main pain point for first-home buyers, and rising house prices keep piling on the pain,” he said.

“While investors and refinancers are revelling in today’s low-rate environment, these low rates are bad news for anyone saving for their first home.

“Interest on any deposit savings provides only token assistance, while low lending rates are encouraging investors into the market and driving up prices,” Mr Mickenbecker explained.

To calculate the time needed for first-home buyers to save, Canstar researchers compared the cost of a median house in each capital city with average ABS salary data by state.

Their number crunchers then assumed that prospective buyers put 20 per cent of their monthly net income into a savings account earning the average RBA interest rates over that time.

MORE: Housing big spenders fear going bust when interest rates rise

Australian property value tipped hit whopping $9 trillion

One in five Aussies believe cryptocurrency is the secret to homeownership

The data only refers to detached houses, and does not include the cost of units.

“The numbers really hit home when you realise this process now takes five years longer than it did 15 years ago in Sydney, and over four years longer in Melbourne,” he added.

Mr Mickenbecker said he was also surprised that Tasmania’s capital had become harder to buy in than Queensland’s.

“It now takes longer to save a deposit in little Hobart than it does in Brisbane, our third largest city. Hobart property prices have boomed in the last couple of years,” he said, adding that the pandemic-induced price boom had only made house hunting harder for first-time buyers.

“The runaway property prices seen since the end of the first Covid lockdown have blown the deposit-saving timeline further out, making the task all the more challenging,” he said, but warned that anyone holding out for a bursting bubble could be left waiting.

“Many commentators have speculated that reduced numbers around migration, overseas student intakes and tourism have created an unsustainable property price bubble that will inevitably correct.

“However, prices have risen so far that any correction is now going to be from a very high base. First-home buyers will be hoping for a price correction, but the easing of the release valve in a post-vaccination Australia could mean another price eruption before we see correction.”

However, Mr Mickenbecker said once on the ladder, servicing a mortgage has never been easier.

“On the plus side, once you crack the market, low home loan rates mean it may be cheaper to service a loan than in years gone by.

“Unfortunately, you only see this benefit when you are at the pointy end of house buying, not midway through the journey,” he said.

Mr Mickenbecker’s advice for determined first-home buyers looking to cut the waiting time was to look outside the box and make compromises.

MORE: Housing market problem 70 per cent of Millennials believe

First-home buyers are being saddled with $6300 in ‘hidden’ costs

“Discipline is everything. Set a plan and a budget, and lock your deposit savings away every payday. Treat the money as untouchable. There are even a couple of savings products offering interest rates for young adults that are way ahead of the market – one up to 3 per cent,” he said.

“For partners saving for their first home, there is the opportunity to squirrel away the best part of one income. Otherwise, you could consider buying with a family member to split costs,” he said.

And he said first-home buyers should also be aware that there are ways of working around the dreaded 20 per cent deposit. First-time purchasers could consider lender’s mortgage insurance to cover the difference between their actual deposit sum and the required 20 per cent, or look to government assistance.

“Government incentives like the First Home Loan Deposit Scheme can help buyers get a loan with a deposit as low as 5 per cent, compared to the usual 20 per cent. This would effectively cut the deposit-saving time frame in Sydney to a quarter of what it would otherwise take,” Mr Mickenbecker said.

Originally published as Australian property: how much harder is it to save for a house deposit now vs 15 years ago