Scott Pape’s tips for property price forecasts and interest rates

Stubborn home loan interest rates are no match for Scott Pape’s three-year-old son, writes the Barefoot investor.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Let’s take out the crystal ball and see what’s in store for property prices.

Nationally, they continue to creep higher – they’re up a very respectable 6.7 per cent this year.

Yet it’s also clear that the market is losing steam, especially in the tinsel-towns of Sydney and Melbourne, where there are currently more homes for sale than at any time in the past five years.

Why?

“Owners struggling with mortgages at the moment are thinking, ‘I’d better get out and take advantage of relatively high prices’,” AMP chief economist Shane Oliver was quoted in the news as saying.

I think that makes sense.

But hold your handbags! Another expert, Louis Christopher from SQM Research, predicted this week that prices could boom 10 per cent nationally next year if we get a rate cut (or two) early next year.

I also think that makes sense (especially in Perth and Brisbane, where there’s a lack of supply).

So the question then becomes: how likely is it that homeowners will get some ‘relief’ from high rates?

Well, in January economists were almost unanimous that we’d get a rate cut this year.

Didn’t happen.

And now they’re equally unanimous that we’ll get rate cuts next year.

Tik. Tok.

Perhaps that’s why Treasurer Dr Jim Chalmers describes current interest rates as being “stubbornly high”.

Interesting. So Jim is suggesting that interest rates are behaving much like my three-year-old does when I won’t buy him a Big M at the local Romsey IGA. He collapses on the floor and starts howling like a wolf, and then goes limp as a jellyfish when I try to pick him up.

Now that is stubborn.

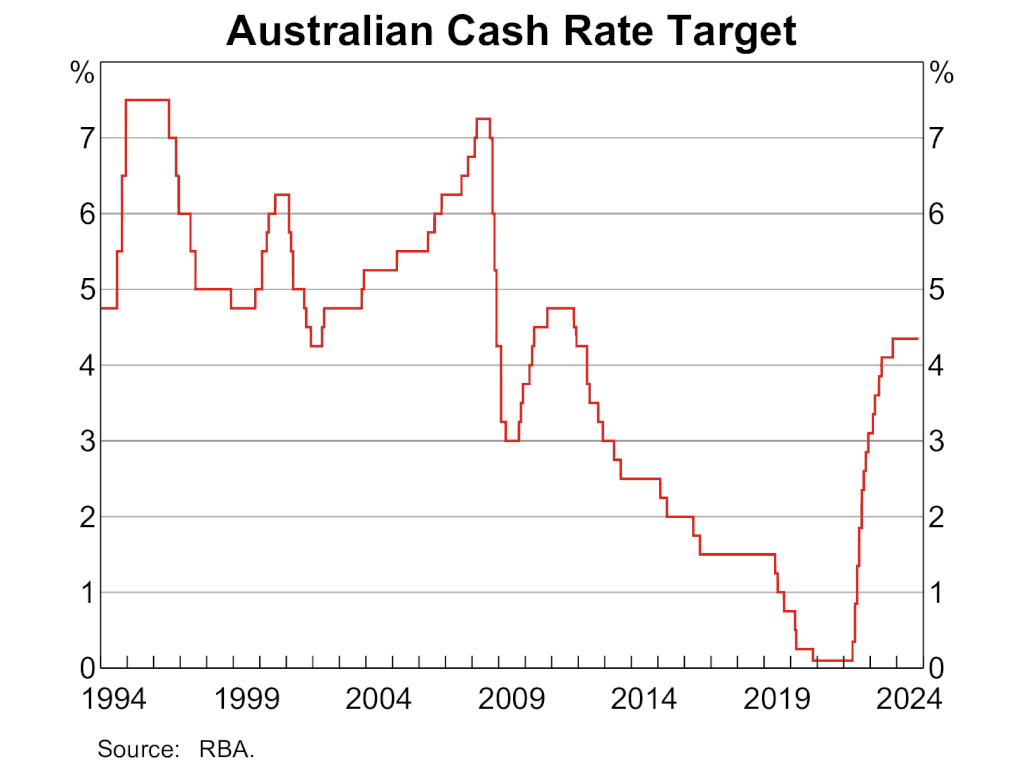

So, let’s zoom out and take a look at the historical chart.

From this perspective, current rates don’t look ‘stubborn’ – or particularly high – to me.

The truth is that interest rates movements are as unpredictable as my three-year-old. (Just ask the former Reserve Bank Governer Philip Lowe, who famously shanked his ‘lower for longer’ forecast … despite the fact that he was the one who set the rates!).

Look, despite the crazy amount of airtime we give economists and experts, history has proven that they’re actually no better at picking the longer-term movements of interest rates than a dart-throwing monkey.

So here’s my advice:

Don’t be stubborn, and don’t listen to experts (including me!). If you’re making buying or selling decisions, you need to deal with the facts in front of you.

And that goes for you too, Jim. I know you’re hanging out for a 10% pop in prices before the election in May, but you can’t count on it!

Tread Your Own Path!

I Can’t Sleep. I Can’t Eat. I’m a Walking, Shaking Mess.

Hi Scott,

I can’t sleep. I can’t eat. I’m a walking, shaking mess. We put our home up for sale in the first week of March for $1.25 million, on the advice of our agent. (At the time I thought it was on the high side, but I didn’t say anything.) It’s been eight months now and we haven’t got a single offer! Our agent has gone missing in action, and we don’t even have open-for-inspections anymore. My husband, on the other hand, is cool as a cucumber. He’s sure someone will come along and buy it. I’m climbing the walls, not just because we’re up for thousands of dollars in selling costs regardless of whether we sell or not (!), but because we’re stuck in limbo. I want to move interstate to start our new life (and my new job!) but we can’t do anything until this bloody place is sold. What should we do?

Wendy

Hi Wendy

I can feel your stress through my computer screen!

My wife says that I am too blunt, but she’s currently overseas, so I’m going to say what I damn well please:

Your asking price is too high.

If you haven’t sold your home within six weeks of listing (let alone eight months!) you have one of three options:

First, you can take it off the market and wait till prices recover.

Second, you can rent it out for a period of time.

Third, you can meet with your agent and discuss aggressively lowering the price so you can attract a number of bidders, and let them sort out what the market value is.

Which one does your head tell you is the best option?

Remember, it’s very likely you’ll be buying and selling in the same market. In other words, if you sell your home for less than you expect, chances are you’ll buy your next home for less than you expect.

The stress you’re feeling comes from a lack of control. Waiting and hoping isn’t a strategy that will work in this market. You need to take action!

Good luck!

Too Much Temu

Hi Scott,

I’ve just been clearing out my mother’s motor home and storage shed after she passed away. She had SO many (UNOPENED) packets with random labels, apparently all from Temu. Checking her Temu account, she had spent over $1000 in the last five months!

Alex

Hi Alex

As I wrote last week, Temu has turned shopping into gambling: it’s so cheap you’re willing to take a punt on whether you’ll actually use it or not (and besides, you only need to buy a few more things to qualify for free shipping, or discounts, or both).

I also think they’ve tapped into the inner six-year-old in all of us: who doesn’t love the rush of waking up on Christmas morning and seeing all the presents Temu Santa has left for us? The problem that you’ve nailed with your mum is that it’s mostly just stocking-filler rubbish that you’ll discard by New Year.

What Is Wonder

Woman Worth?

Scott,

I’m wondering what your thoughts are around the hourly rate for a stay-at-home parent? I am unable to go back to work while we have young kids at home, one of whom has a chronic illness. My wonderful partner is supporting the family on his income. Although being the main caregiver is one of life’s most important jobs, it is seriously undervalued and underpaid. If I were to get paid a wage, what would it be?

Wonder Woman (aka a mum)

Hi Wonder Woman,

My wife Liz left me last week.

She’s flown to Europe to produce a documentary for the next three weeks (“or so”). In the lead-up to her departure she sat me down and took me through what I call ‘Liz-gistics’:

It’s an actual spreadsheet that tracks the movements of our four kids. When I put all their activities into my calendar it honestly looks like a failed game of Tetris. The next few weeks are absolutely terrifying.

So, how much is a stay-at-home parent worth?

Well, I went looking and found a study by salary.com which calculated that stay-at-home mums work a whopping 96 hours a week, and therefore it says they should earn at least $230,000 a year. Yet that all sounds kinda clickbaity and not particularly useful.

Look, the home is not a workplace. If it were, I’d have taken my three-year-old to HR for verbal bullying, harassment and workplace assault after he threw his Vegemite toast at me because I mistakenly cut it into squares rather than halves.

My simple answer to your question is that you and your partner should share the money that comes into the family, based on the family money buckets you’ve set up.

However, and this is important, part of that set-up should include individual Splurge buckets: a set amount that you can enjoy without judgement or guilt from the other.

Oh, and you should also have a family Smile bucket so you can jointly save up for things that you’ll enjoy as a family. Working together is how you win.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

More Coverage

Originally published as Scott Pape’s tips for property price forecasts and interest rates