$4 billion blow facing tradies and small business after Labor’s budget

The slashing of a popular tax offset for small businesses and tradespeople in Labor’s budget has been met with anger, setting up an election flashpoint with the Coalition.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Tradies and other small businesses could miss out on more than $4 billion in hip-pocket help next year, with Labor’s decision to axe the instant asset write-off setting up an election flashpoint with the Coalition.

Tuesday’s budget revealed no funding beyond June for the scheme, which allows firms with a turnover of up to $10m to deduct the cost of new assets worth up to $20,000.

Meanwhile, Labor’s pledge in last year’s budget to continue the scheme for the current financial year was yet to be passed into law by Wednesday evening.

Labor on Wednesday afternoon was nearing a deal with crossbenchers to pass the legislation through the Senate overnight, which will allow businesses to lodge their claims until the end of June.

In the wake of the budget, industry bodies said dumping the measure for the upcoming financial year would be a devastating blow to small businesses.

“We’re in a fork at the road here for small business – the government needs to act swiftly to confirm there’ll be funding for it down the track,” Council Of Small Business Organisations Australia CEO Luke Achterstraat said.

Master Plumbers Association of NSW CEO Nathaniel Smith said losing the ability to write-off $20,000 instantly from new assets would cruel tradies’ companies.

“Businesses … rely heavily on it to upgrade equipment, tools, or to reinvest in their organisation to take on more apprentices and employees,” he said.

“It’ll cause massive damage to small businesses … it’s something they rely on.”

Prime Minister Anthony Albanese, when quizzed on Wednesday on what his message was to tradies facing the write-off not being extended, hinted at future announcements on the scheme.

“We’ll have more to say … about blue collar workers and tradies as we go forward,” he said.

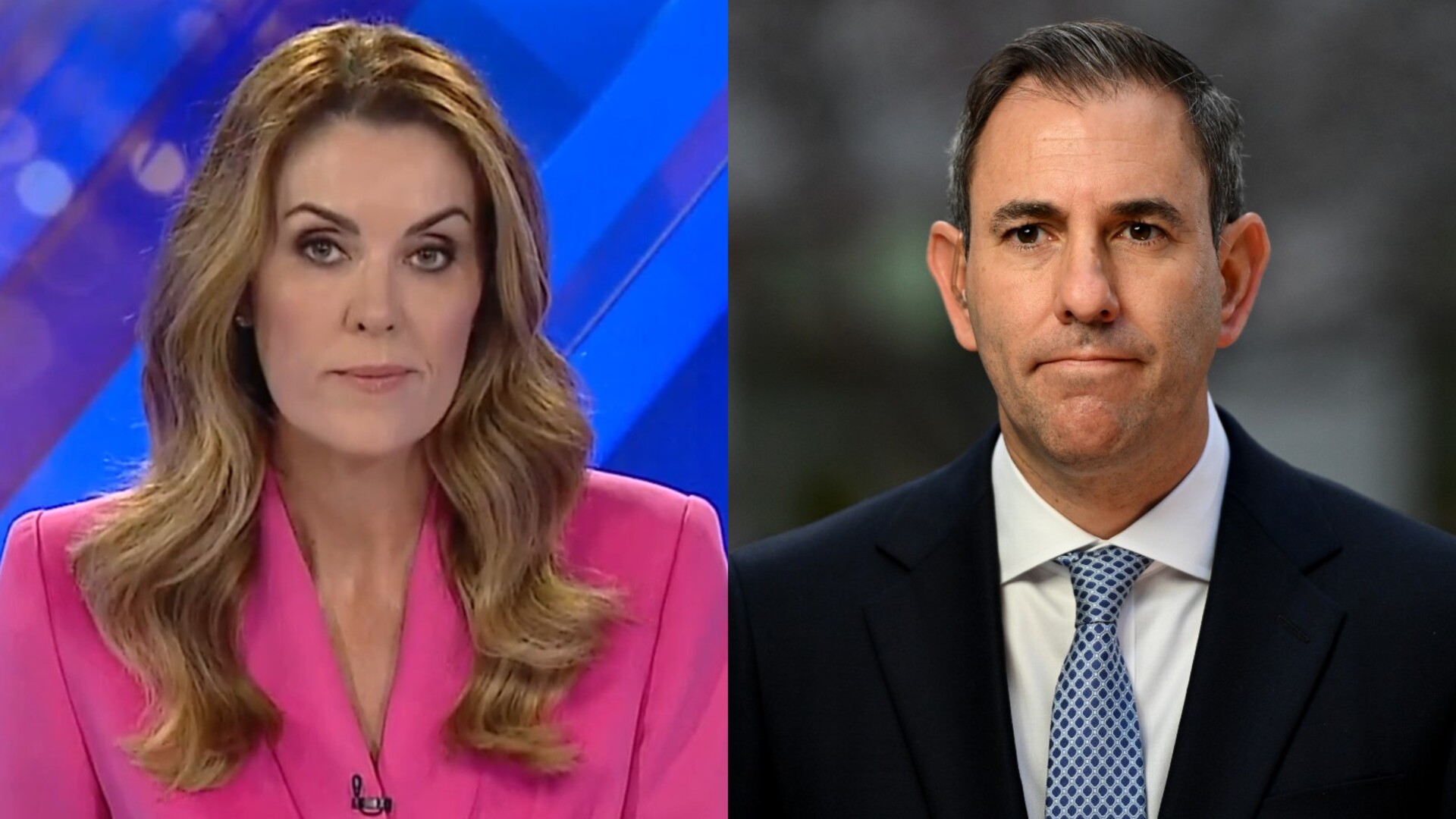

Treasurer Jim Chalmers blamed the holdup on the 2024-2025 write-off scheme on the Coalition.

“The extension for the instant asset write-off that we’ve already budgeted for has been held up in the parliament. I think that’s, frankly, shameful that it’s been held … hostage to some Senate shenanigans,“ he said.

“We want to see that passed and as the Prime Minister indicated earlier today we’ll have more to say about the future of the instant asset write-off in addition to that.”

Government tax documents, published late last year, show small businesses claimed $4.1b under the scheme in 2023-2024, when the cap was at $20,000.

The Coalition has pledged to lift the scheme to $30,000 and make it permanent if it wins the election.

20Twenty Landscape Constructions co-director Jayden Bruni said he had been holding off making any major purchases this financial year due to uncertainty over the instant asset write off.

“Six months down the track, I may have to spend that 50, 60 or $70,000 to grow my business in the future, and if I don’t have the instant asset write-off to keep more money in my pocket, it might hurt me,” he said.

The landscape boss said the biggest factor threatening many small businesses was “an ever-rising tax bill”.

“We are in a perpetual state of taxation on small and medium businesses,” he told The Daily Telegraph. “Small business is the backbone of the nation; without small business there is nothing, but we are slugged with more and more overheads and taxes whenever we try to get ahead.

“They need to help small businesses retain more money,” he said. “A $150 electricity rebate is a very small bandaid for a massive open wound.”

More Coverage

Originally published as $4 billion blow facing tradies and small business after Labor’s budget