Australian companies gone bust and now insolvent has risen with more to come

More Aussie companies have unfortunately gone bust — with more to come as experts revealed what the ATO will do. Search the list and see if they are near where you live.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Almost 5500 Australian companies went broke in 2022, eclipsing last year’s result, with a full month of the year still to go.

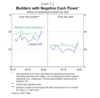

Data compiled by News Corp shows that in June the number of companies entering insolvency climbed above 600 a month for the first time in two years, and has remained consistently high.

Insolvency numbers are still below the pre-Covid average of about 8000 a year but experts warn February could see a big spike as interest rate hikes and surging inflation zip household purses shut.

“We expect them to still continue to climb,” the chief executive of credit reporting company CreditorWatch, Patrick Coghlan, said.

“Probably our current predictions are sort of 10 to 15 per cent above pre-Covid numbers.”

He said that while city streets, shops and restaurants are full of shoppers, the new year would be a challenge as higher interest rates flowed through to households.

There was also a backlog of companies that didn’t survive Covid yet to wend their way through the insolvency system, he said.

Industry is also bracing for a wave of company closures at the hands of the Australian Taxation Office.

But Mr Coghlan said that, despite tough talk from the ATO about pursuing company directors over debts, the agency was yet to return to its pre-Covid level of legal action to wind up businesses.

He said he expected the ATO’s “Team Australia” attitude to persist for at least the next 12 months.

“They may start ramping up slowly, which seems to be the narrative, but I think you’ll find that the ATO will be the last one to really get going again,” he said.

While the number of companies the ATO winds up through the courts remains at a lower level than usual, “we expect this to naturally increase as the economy normalises”, a spokesperson said.

“ATO has resumed firmer and stronger actions and focused its approach on disengaged clients.”

The ATO said it was sending about 150 notices a day to company directors, making them personally liable for the tax debts of their business, and had started reporting tax debts to credit monitoring agencies.

The number of Australian companies that went broke so far this year hit 5487 by the end of November, eclipsing last year’s result, 5138, with a full month still to go.

In June, the month after the ATO announced the crackdown, insolvencies surged from 535 a month to 629 a month.

Insolvencies were also above 600 in August (611), September (645) and November (611).

Much of the surge in the second half of the year was driven by NSW, where insolvency numbers more than doubled in three months, soaring from 112 in July to a peak of 281 in September.

NSW recorded the highest number of insolvencies for the 11 months to November, at 2231. There were 1085 in Victoria, 808 in Queensland, 325 in Western Australian, 207 in South Australia, 99 in the ACT, 36 in Tasmania and 29 in the Northern Territory. There were 667 insolvencies where no state was recorded in ASIC data.

Originally published as Australian companies gone bust and now insolvent has risen with more to come