Reserve Bank of Australia warns more insolvencies likely in building industry

The Reserve Bank of Australia has warned more insolvencies are likely in the building industry due to one major problem.

NewsWire

Don't miss out on the headlines from NewsWire. Followed categories will be added to My News.

More insolvencies are likely in the residential construction industry as builders struggle with rising costs, the Reserve Bank of Australia has warned.

The industry is facing major problems from a steep rise in costs, as well as labour and material shortages that have slashed profits on existing fixed-price contracts.

Some large firms have already entered into insolvency over the past year including Probuild, Condev Construction, Pivotal Homes, Waterford Homes, New Sensation Homes, Privium, Home Innovation Builders and Pindan Group.

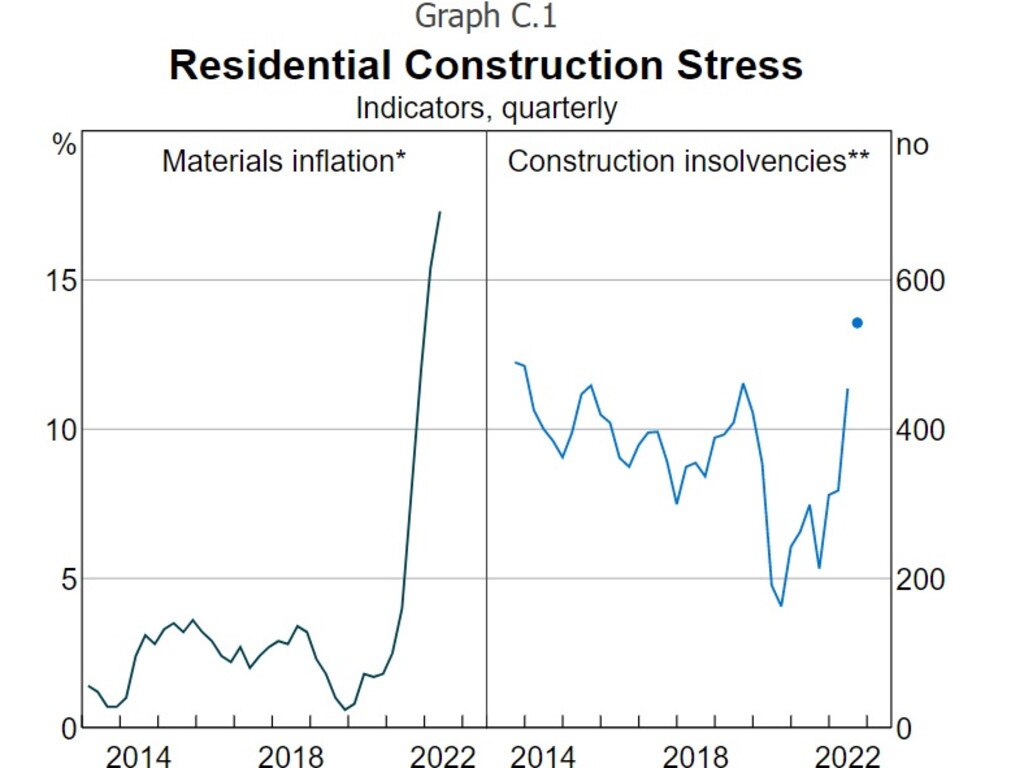

“Overall, construction company insolvencies have increased sharply, exceeding their pre-pandemic levels and accounting for close to 30 per cent of all company insolvencies,” the RBA said in its twice-yearly financial stability review on Friday.

“More recently, the increase in interest rates has begun to raise debt-servicing costs for many firms, adding to financial pressures.”

The RBA warned further increases in insolvencies were likely.

“While the direct implications for the financial system are limited because banks have very small exposures to builders, there is potential for financial stress to spread to other businesses within the broader construction industry and to some households,” the RBA said.

Builders usually offer housing contracts at a fixed price with plenty of lead time, but since the start of last year the cost of materials has gone up more than 20 per cent.

“As such, profit margins for existing fixed-price contracts have compressed substantially, and builders are now making losses on some contracts,” the RBA noted.

“Ongoing delays as a result of supply-chain disruptions, inclement weather and illness-related workers’ absences have resulted in further increases in costs and have delayed when payment milestones are reached.

“According to industry contacts in the Bank’s liaison program, construction delays for detached homes are currently around 12 weeks on average – and much longer than this in some instances.”

It has led to builders increasing the price on new contracts, slashing the period before a quote must be accepted and renegotiating some existing contracts.

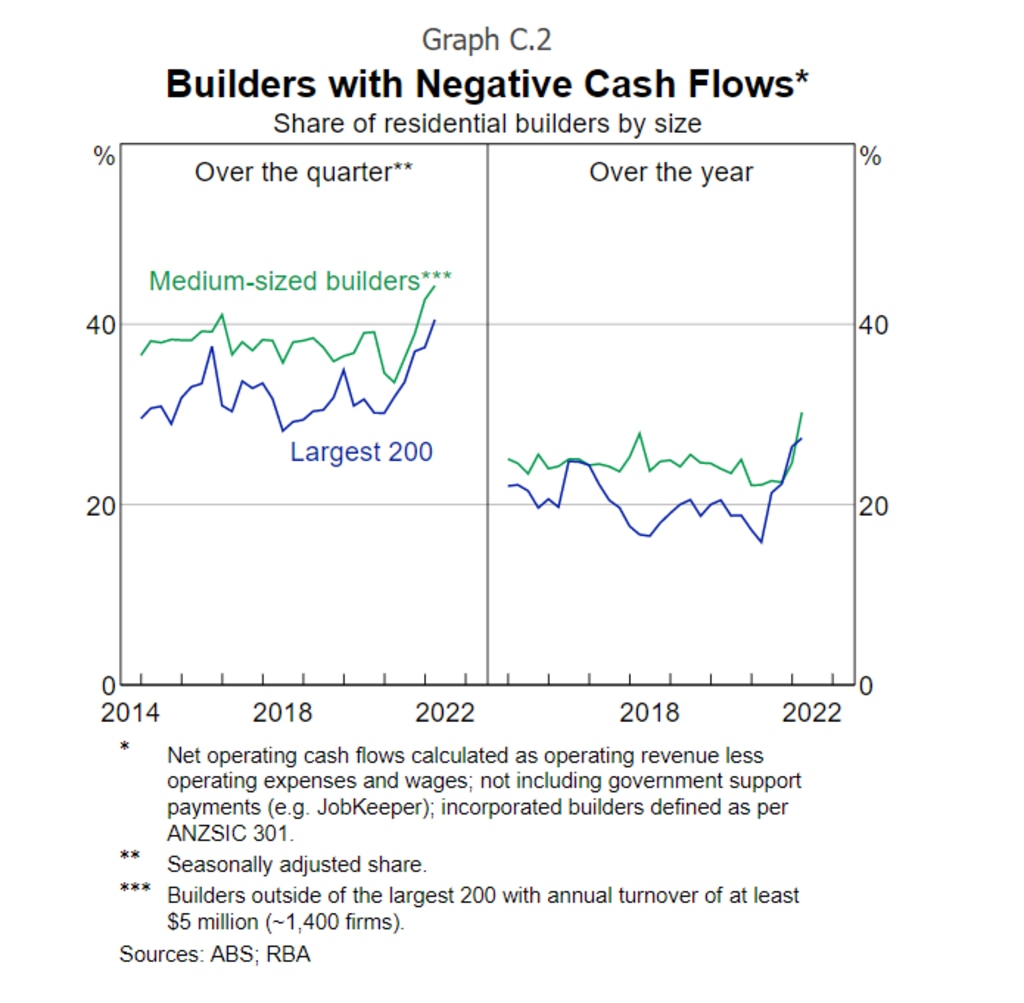

But the RBA noted the number of builders recording negative net operating cash flows had risen sharply since the start of 2021.

“Over 25 per cent of the largest 200 builders recorded an operating loss in the year to March 2022, up from a little over 15 per cent a year prior,” the RBA said.

“Recurring operating losses due to rising costs and delays have led some builders to run down their cash reserves, which were built up through the Covid-19 pandemic aided by the receipt of government support payments.

“Running down reserves can quickly become problematic for builders because they tend to have lower liquidity buffers – that is, cash and other short-term assets.”

The RBA further warned that while subcontractors had so far absorbed builders’ financial stress, the risks were high.

“The most vulnerable subcontractors are those that are unable to diversify their revenues and primarily work with one builder at a time,” the RBA said.

“Should that builder default on outstanding invoices, the subcontractor could quickly struggle to meet its own payment obligations.”

Originally published as Reserve Bank of Australia warns more insolvencies likely in building industry