Market wrap: seven ASX200 stocks smash 52-week highs

It’s been a somewhat rocky but mostly positive day of trading on the ASX, as seven stocks hit their highest levels in a year.

Breaking News

Don't miss out on the headlines from Breaking News. Followed categories will be added to My News.

At least seven companies are grinning after a mostly positive day of trade on the Australian Stock Exchange.

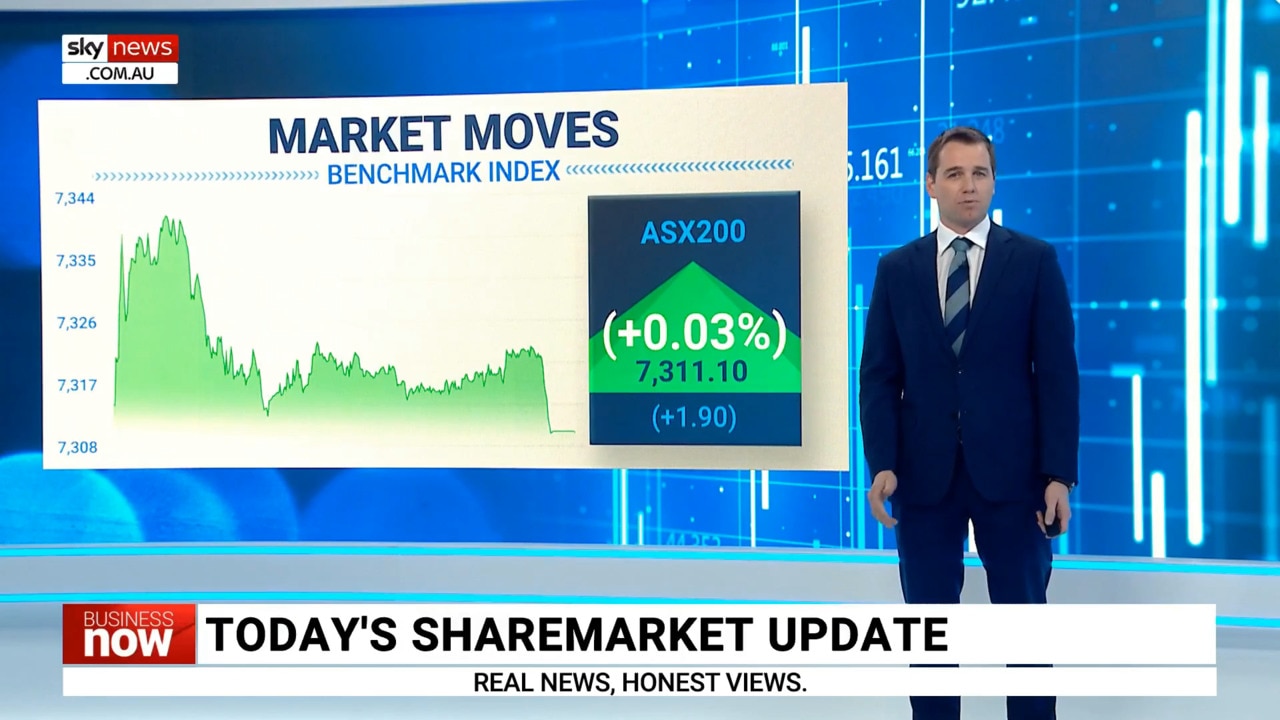

Tuesday saw the markets have some modest gains at the open, climbing 0.4 per cent to 7,342 points early on in the session.

But a late fade saw the market close up just 1.9 points at 7311.10, or about 0.03 per cent.

“The index has lost 1.87 per cent for the last five days, but sits 3.39 per cent below its 52-week high,” reported the ASX at the close.

Standouts of the day were seven companies whose shares shot up to 52-week highs.

They include:

- Plumbing supply company Reece Ltd, which reached $19.96 a share, putting their gains for 2023 at about 44 per cent.

- Packaging and visual communications company Orora Ltd finished down, but earlier in the day hit a peak of $3.64 a share – up 27 per cent this year to date.

- Fibre cement manufacturer James Hardie Industries delivered a positive earnings report on Tuesday morning, rocketing their share price to $47.45 a share – its highest since March 2022.

- Gambling technology company Aristocrat Leisure Limited recorded a new 52-week high of $41.30 a share.

- WiseTech Global Ltd topped out at $88.69 – an all-time high for the logistics software provider.

- News Corporation reached $31.43 during Tuesday’s trade, a 12 month high, putting the media giant up 16 per cent for the year to date.

Conversely, lithium supplier Sayona Mining was one of the worst performers of the day, hitting a 52-week low of 13c, or down 11.6 per cent.

Sluggish trade out of China also weighed on mining stocks, while healthcare saw a minor rise of 0.6 per cent.

Woodside Energy saw a rise of 0.6 per cent in its share price after announcing it plans to sell 10 per cent of its flagship Scarborough offshore gas project to LNG Japan for $US500m ($763m).

Energy market analyst with RBC Capital Markets Gordon Ramsay has told The Australian the deal could see a potential LNG offtake and collaboration on opportunities in new energy.

“We also like the fact this helps to de-risk Woodside‘s exposure to its high level of equity in Scarborough by reducing future development expenditure and technical risk,” Mr Ramsay says.

China's exports fell by 14.5% in July year-on-year, while imports contracted 12.4%, in the worst showing for outbound shipments since February 2020. A Reuters poll of economists had forecast a 12.5% fall in exports and a 5% drop in imports. #ausecon#ausepol@CommSec

— CommSec (@CommSec) August 8, 2023

Foreign markets also had some mild trading activity overnight, with the Dow Jones finishing up 1.2 per cent, the S & P 500 up 0.9 per cent, and the Nasdaq up by about 0.6 per cent.

CommSec economist Tom Piotrowski says stoic trade is a good thing, especially out of the US, as investors await Wednesday’s inflation data.

“We’ve got a lot of bond supply coming online, that means the US Treasury will be selling government bonds to fund itself,” Mr Piotrowski said.

“That raises the possibility of a rise in interest rates, so to see a stoic performance on the part of the markets last night was quite encouraging.”

Originally published as Market wrap: seven ASX200 stocks smash 52-week highs