ACCC’s new report into cyclone reinsurance shows savings being blown away

A new report examining North Queensland’s insurance market has highlighted positive trends for struggling consumers, but the savings are being blown away. Read why.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Northern Australia’s cyclone reinsurance pool has begun delivering lower premiums for consumers in some regions facing a higher risk of cyclones, but the savings were being eroded by other cost increases.

That was one of the findings to come from the Australian Competition and Consumer Commission’s (ACCC) latest insurance monitoring report, which was released three months earlier to inform the federal government’s Insurance Affordability and Natural Hazards Risk Reduction Taskforce.

The reinsurance pool aims to make insurance more affordable for consumers at high risk of cyclones by reducing insurers’ costs of supplying insurance to those consumers, with the remaining small insurers required to join it before December 31.

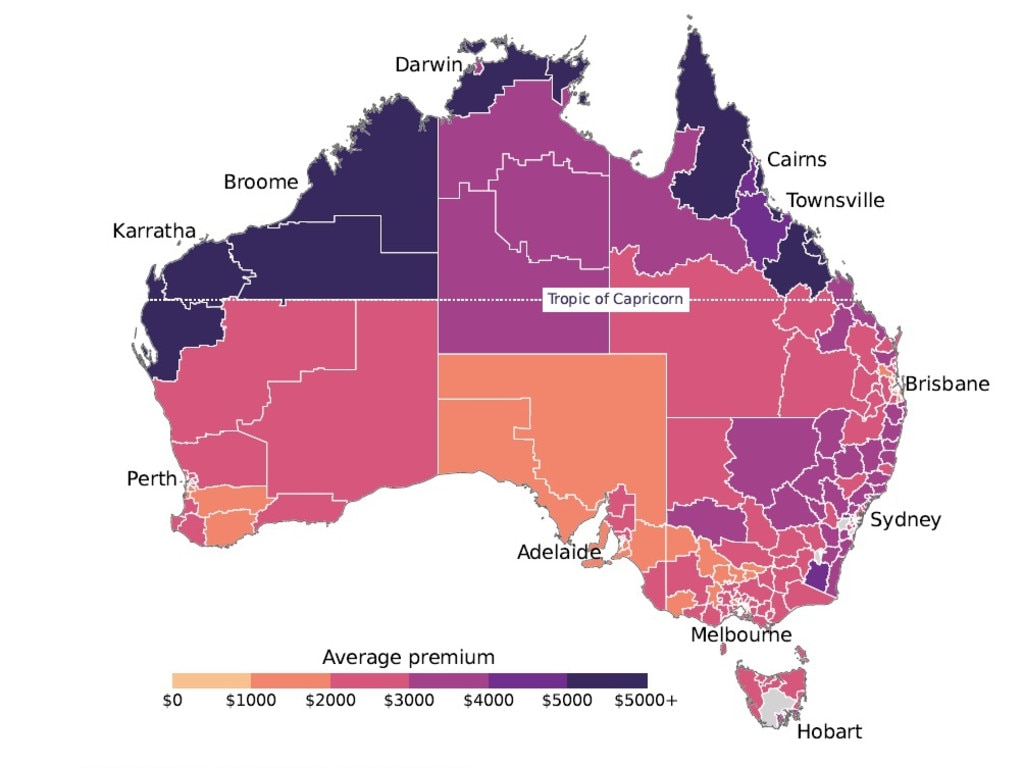

Despite experiencing some premium reductions due to the reinsurance pool, home, strata, and small business insurance premiums remain much more expensive in northern Australia, where cyclones are more prevalent.

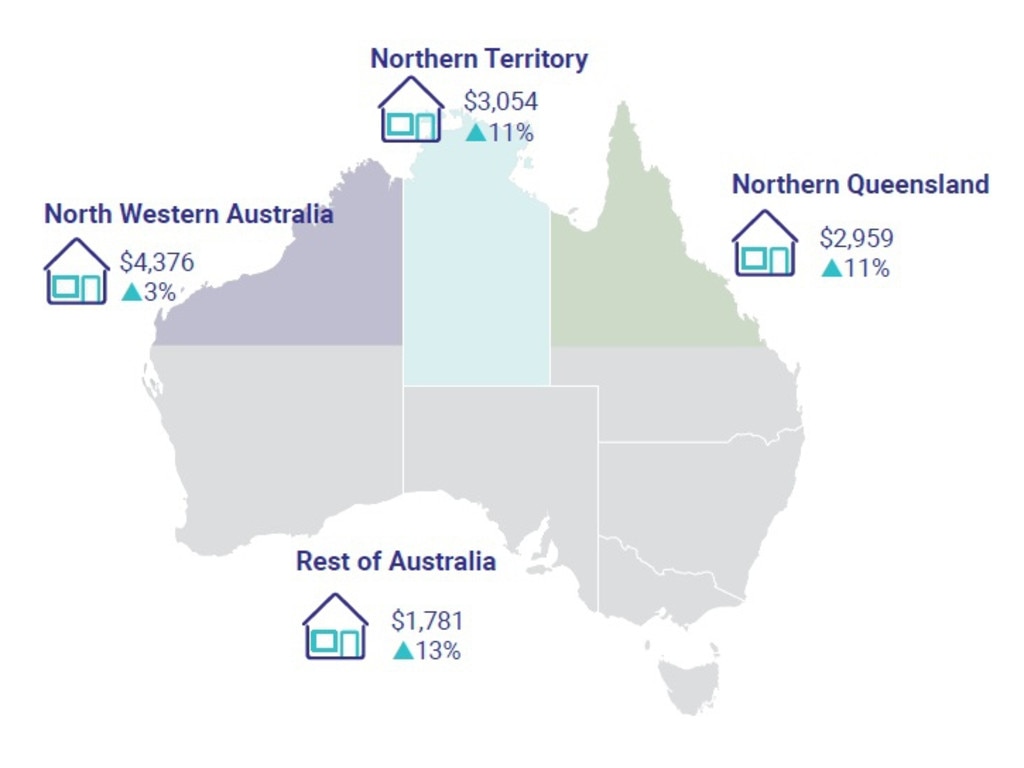

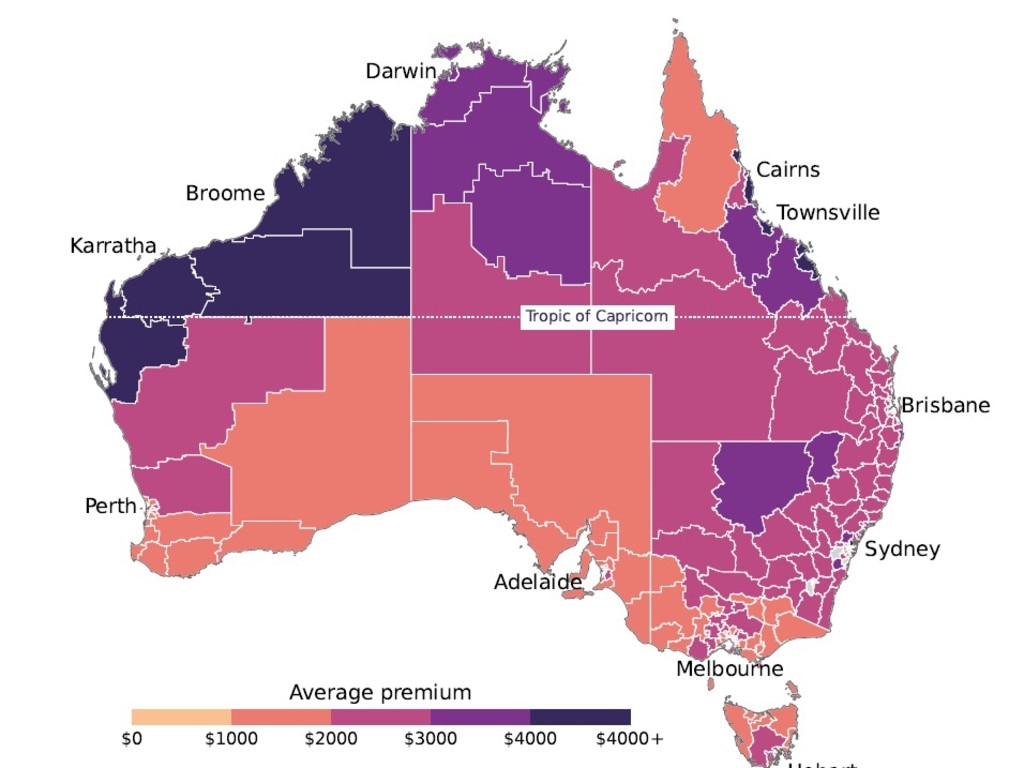

The ACCC found during 2023 that the median premium for a combined home and contents insurance policy was highest in north Western Australia, rising 3 per cent to $4,376, with 11 per cent rises recorded in Northern Territory to $3,054 and in North Queensland to $2,959, compared to $1,781 in the rest of Australia – a 13 per cent increase.

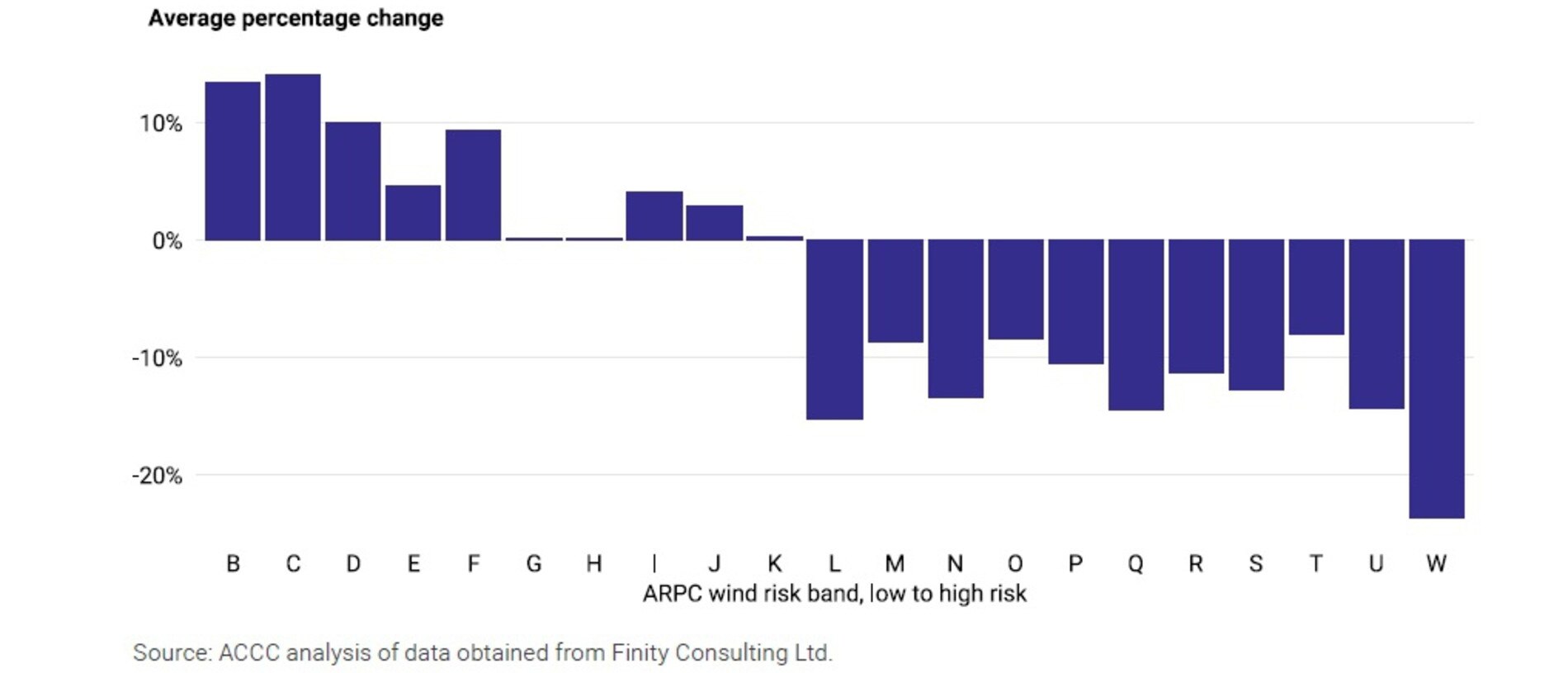

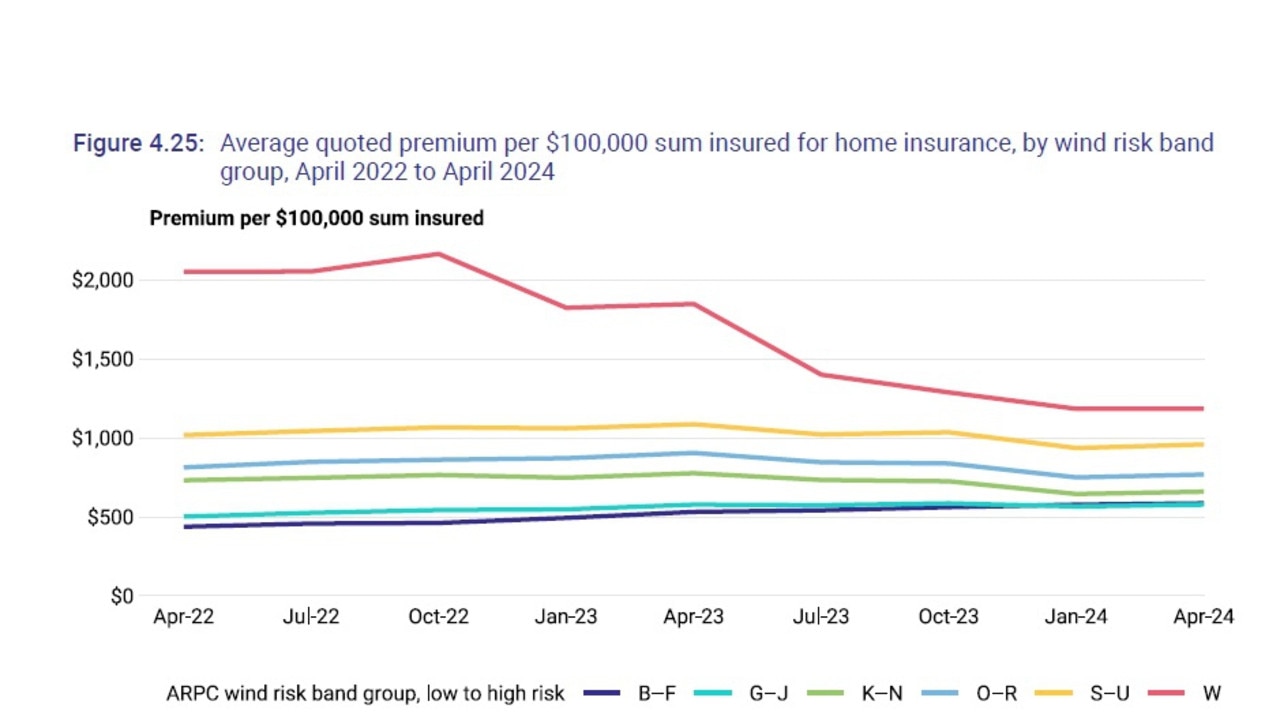

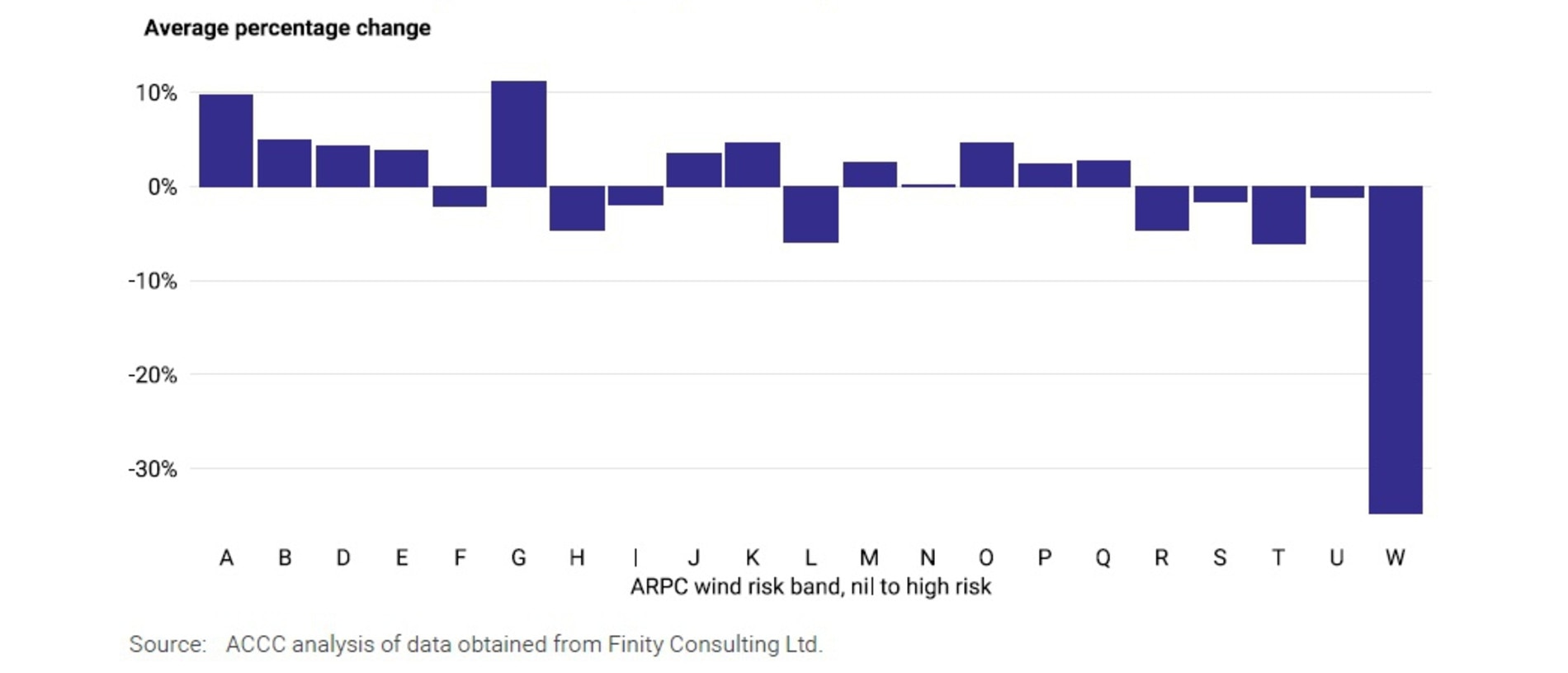

Encouragingly, the ACCC determined that home insurance premiums quoted in higher cyclone risk regions had an average decrease of 8 per cent to 15 per cent across different relative levels of wind risk, through to as high as a 24 per cent average decrease for regions with the highest risk.

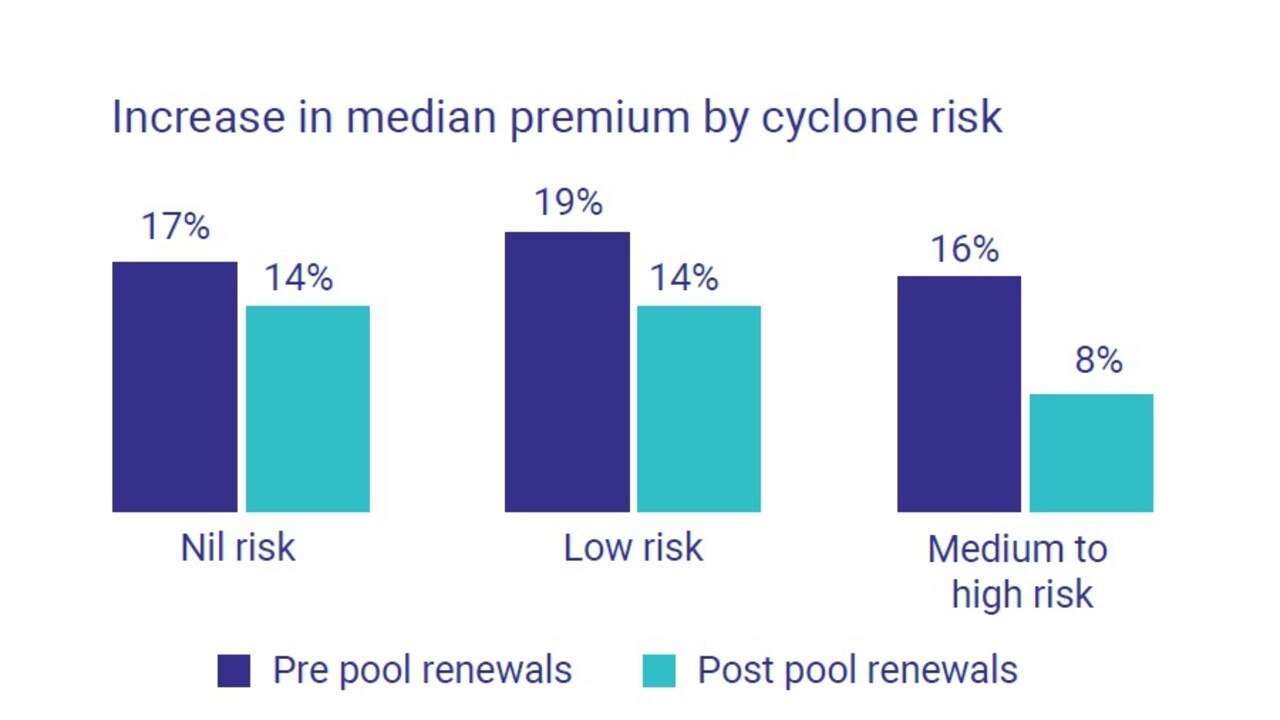

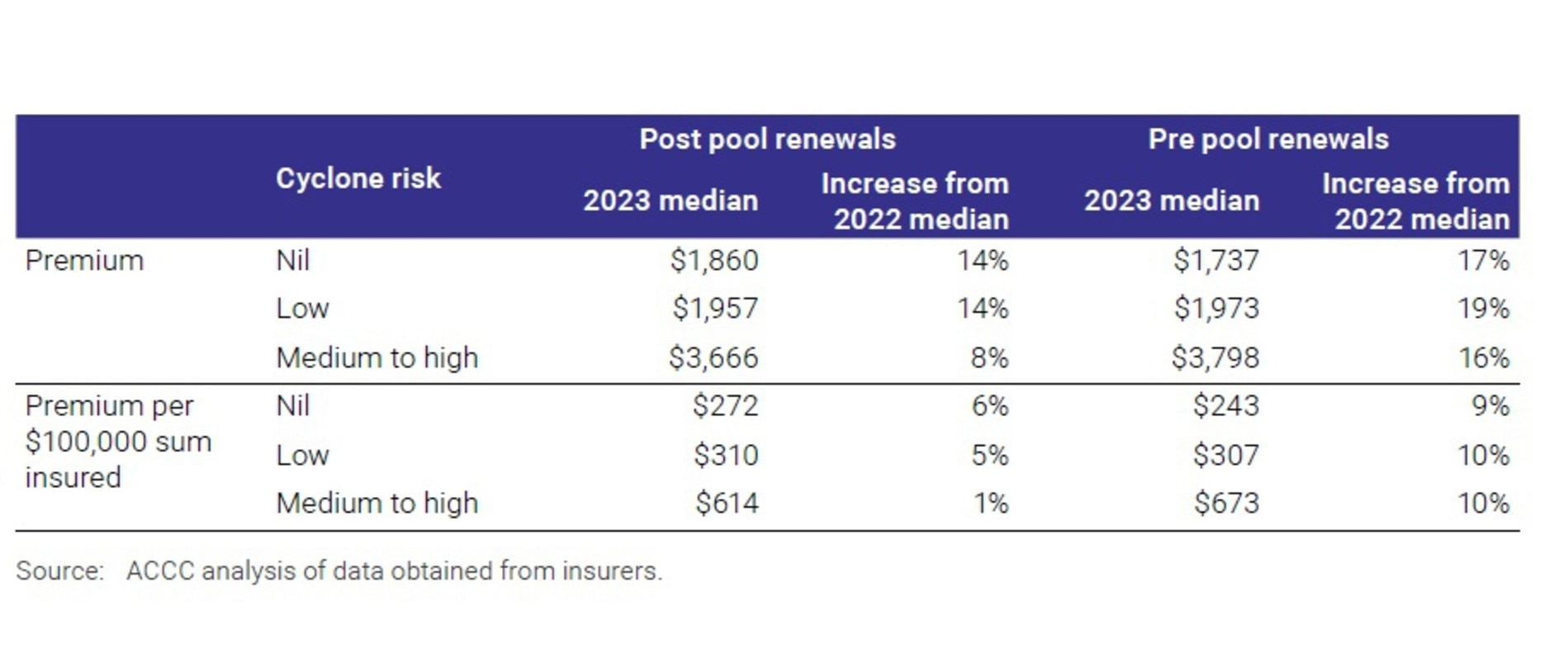

Twenty seven per cent of consumers living in areas of medium to high cyclone risk experienced a premium decrease on their combined home and contents insurance policies after their insurer joined the reinsurance pool.

By comparison, only 12 per cent of those policies experienced a premium decrease when they were renewed before their insurer joined the pool.

Additionally, 16 per cent of strata policies in areas of medium to high cyclone risk experienced a premium decrease upon renewal after the insurer had joined the pool, compared to 10 per cent for consumers who renewed before their insurer had joined the pool.

ACCC deputy chair Catriona Lowe said the savings generated by the reinsurance pool were less apparent to consumers due to the impact of a broader hardening of global reinsurance markets, extreme global weather events, and price increases of building materials and labour.

Due to different insurers entering the pool at different times, and the time needed for insurers to implement pricing changes, she said it made the transition to the pool “long and gradual”.

“For consumers anticipating the benefits of the pool, it has been a long wait, particularly as potential savings from the reinsurance pool may not be seen until they renew their policy or take out a new one,” Ms Lowe said.

“We have seen that the pool has led to some savings for insurers writing policies in higher cyclone risk regions of Australia. Insurers are making changes to pass these savings on to consumers, and also to better recognise specific mitigation measures consumers have implemented,”

“We continue to hear consumers say that the cost of insurance for their home or small business has become prohibitive, forcing them to risk underinsurance or go without insurance at all.”

She was optimistic that the pool could achieve some premium savings and benefits for consumers at higher risk of cyclones, but cautioned that “the pool on its own won’t solve acute affordability concerns”.

“Our work should allow governments to evaluate whether the pool is delivering outcomes as intended,” she said.

Local criticism flares over ACCC report’s deficiencies

After leading a campaign backed by local councils throughout northern Australia for the federal government to make changes to the Cyclone Reinsurance Pool, Townsville Chamber of Commerce chief executive Heidi Turner was not impressed by ACCC’s latest monitoring report.

“We have asked the ACCC this year to include the number of properties insured to give an indication of any rise or fall in the number of properties insured. This does not seem to be included,” Mrs Turner said.

“The research is based on quotes and not actual premiums so the data may not accurately reflect what customers are actually seeing.”

She said the report highlighted several points echoing the chamber’s longstanding concerns relating the impact of the pool, mitigation, and underinsurance.

“The continued market failure in insurance (an essential service) remains a significant inhibitor to growth and adds to the cost-of-living pressures for everyone in northern Australia.

“As premiums continue to rise, fewer people can afford adequate coverage, which should be of utmost concern to the government. As seen after TC Jasper, when the worst happens, the government ultimately becomes the insurer of last resort through grant programs if people are not insured or underinsured.

“We have been vocal in our advocacy to remove stamp duty to immediately reduce insurance costs by 9 per cent, and as the state election approaches, it’s been encouraging to see organisations join our call for its removal, now backed by prominent voices like the Insurance Council of Australia (and RACQ).”

Emphasising that no single solution would have a lasting impact, she said a comprehensive approach was essential for addressing this market failure.

A vocal advocate for strata issues, Townsville Lot Owners Group spokesman Andrew Turnour’s assessment of the ACCC’s latest monitoring report was scathing, saying “Canberra should be ashamed of this report’s intentions and quality”.

He said it had no key findings or achievements listed, “yet waffles on for 94 pages mostly about accepting the northern Australia’s insurance crisis, rather than solving it”.

“It is embarrassing that the ACCC is not monitoring how many insurance policies exist, highlighting the nation’s most important insurance affordability KPI is still missing,” Mr Turnour said.

“This confirms the ACCC still has not delivered strata insurance baselines, making the report meaningless, as the statistics cannot be trusted.

“And to complete the mess, we read the ACCC admit they continue to tolerate insurers for not making data available and or on time.”

He said the nation’s strata insured should be worried that the ACCC keeps neglecting them.

“Unlike house insurance, strata insurance cannot opt out as a Queensland government edict makes it mandatory for them to purchase three insurance products no matter what the costs,” he said.

More Coverage

Originally published as ACCC’s new report into cyclone reinsurance shows savings being blown away