Why ANZ believes it is ready for the coming financial storm

This big four bank boss knows the downturn is coming, but he has his own view about the size of the looming hit.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The way ANZ’s boss Shayne Elliott sees it, after the economic shocks from the GFC to the pandemic he is getting to know his customers pretty well.

That’s going to make all the difference as he braces for the financial storm that all bankers intuitively know is just around the corner.

The magnitude of what is about to hit is the key unknown because even as central banks have been aggressively hiking interest rates, there are so far few – if any – signs of stress or any behaviour shifts among bank customers.

“No doubt there’s uncertainty here. But if you were designing a starting point, you would pretty much want what we have now,” the ANZ boss says in an interview. Small businesses are cashed up, consumers are still sitting on high levels of savings.

“We haven’t had people behind in payments or under stress. Nobody can remember the last time it was this low,” he says after delivering the bank’s seventh annual profit.

Elliott, who is the longest serving of the big four bank bosses, says ANZ is ready for the downturn as the Reserve Bank of Australia continues to hike interest rates. Economists at his bank are tipping another 100 basis points to come by June next year, taking the cash rate to 3.6 per cent.

“It all comes down to customer selection. Have you got the right customers, who are financially better positioned. That’s what de-risking the bank over long periods of time is about. We really know our customers, we know that well. We’ve seen them through Covid and we saw through the GFC,” he says.

Even in the pre-Covid bank boom, Elliott spent much effort selling off non-core businesses from wealth to Asian ventures. He has also quit some riskier areas of commercial financing – particularly in property – while keeping his distance from new forms of consumer lending such as buy, now pay later.

The bank has run the numbers. The base case which ANZ rates at 45 per cent chance of coming to pass in the current cycle has unemployment 3.6 per cent, houses prices drop 17 per cent and GDP slows to 1.4 per cent. This is pretty much where the economy is moving into right now and Elliott has twice the level of provisions to handle this.

A “downside” scenario rated at 40 per cent chance of happening has unemployment peaking at 6.4 per cent, house prices falling 28 per cent and Australian growth is negative 0.5 per cent. Here the bank would anticipate cash needed to cover potential losses would be $3.2bn. Less likely (or 15 per cent) is unemployment at 10.8 per cent, house prices falling 41 per cent and GDP collapsing. Just as sobering, ANZ puts a zero per cent chance that things will get better from here.

In terms of impact on the bank, Elliott says a mild economic downturn would start eating away at profit. A harsher downturn would then start eating into the $3.8bn ANZ has sitting in provisioning reserves. In an extreme downturn ANZ is sitting on an additional $60bn of capital.

“That doesn’t mean that wouldn’t be painful, but banks today have never been in a better position to be able to withstand pain,” he says.

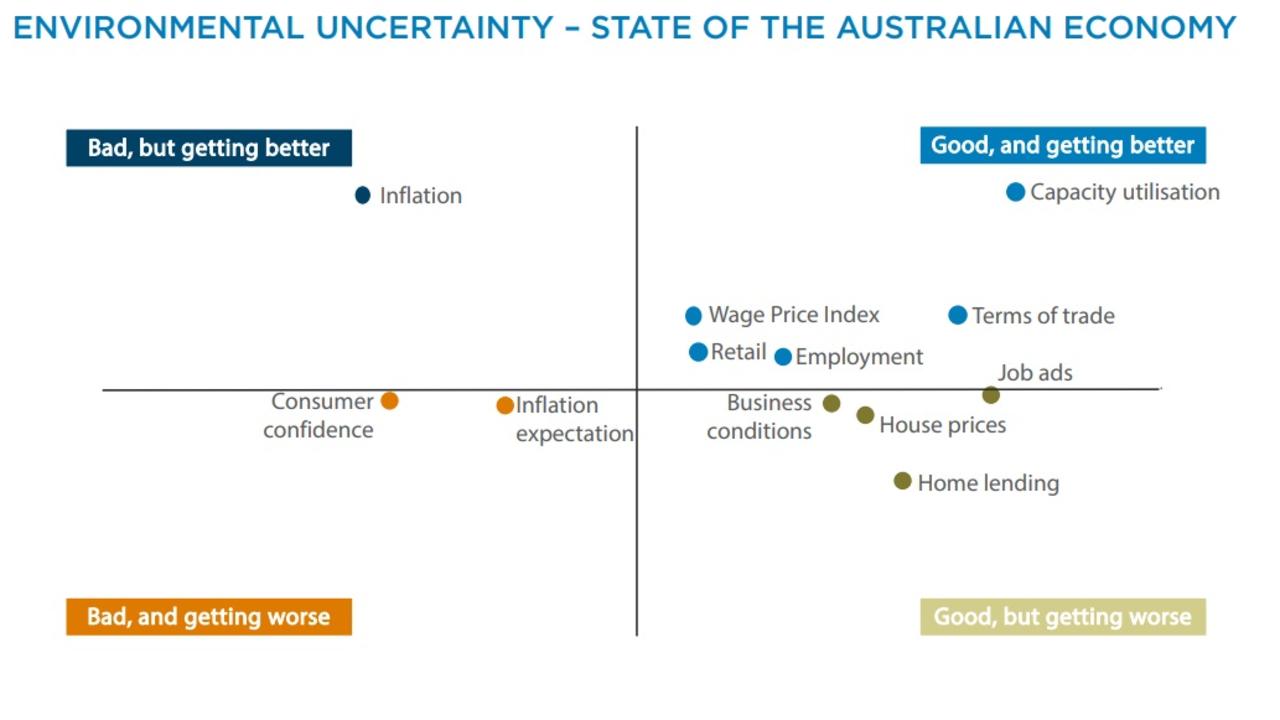

But the bank boss says it’s important not to talk ourselves into a hole. Employment remains high, household balance sheets are strong, wages growth is coming though the system and Australia’s terms of trade with the rest of the world is still booming.

“When you look at it there is actually a lot of strength still in the economy,” he says. “I think things are going to be tough, but I don’t think it’s going to be as bad as people think.”

The one bogeyman to all this is inflation. This cuts away at consumer confidence and the longer households think it’s going to be around they will start changing their behaviour, including cutting spending.

ANZ delivered a 5 per cent lift in full year cash earnings to $6.51bn. The result in the year to end-September was helped by a 10 per cent lift in revenue.

However ANZ shares were marked down 3.3 per cent with investors spooked by a warning of a higher-than-expected 5 per cent lift in costs coming through for the coming year, particularly as inflation and higher investment spending takes hold.

Rising interest rates more broadly have softened the hit by starting to widen out the bank’s net interest margin, a key lever for profit growth.

The latest earnings results mark something of a turning point for ANZ, the smallest of the big four banks. The bank had come under criticism in recent years for the quality of its results and investors have been suspicious of the costs through a large investment spend. With a less diverse customer base in Australia the bank has been more vulnerable to interest margins shrinking.

However, it means ANZ is likely to sees a much quicker benefit of wider margins.

ANZ’s much-criticised technology strategy is starting to come together – although it’s taking longer than expected to get fully digitised mortgage application up and running where others such as Commonwealth Bank have already got one in place. Elliott says this will be ready to launch next year with a true digital experience from the front to the back end.

Elsewhere it has reclaimed market share on mortgages, which is now growing again after a sluggish performance during the pandemic saw the bank lose ground in the midst of the borrowing boom. With the rush of fixed rate mortgages during the Covid-19 years now starting to roll off, Elliott says ANZ is retaining around 80 per cent of these customers with most switching into variable loans.

–

Facebook loses its cool

Growing up is hard to do. Especially for Facebook, which is starting to feel a lot older than its 18 years.

In the face of competition for eyeballs coming from all directions, including younger tech sensation TikTok, Facebook-owner Meta is spending an eye-watering amount to buy back the cool.

But few are convinced of the reinvention, including investors. This sent the tech company’s shares crashing 18 per cent in after hours trade on Wall Street as it delivered a third quarter earnings update. Meta shares are so far down more than 60 per cent this year.

Founder Mark Zuckerberg is betting the house on an over-the-horizon technology of an avatar-filled virtual reality world called the metaverse, and last year renamed his company Meta to align with this.

Much of the strategy will be based around controlling both the hardware and software of virtual reality for years to come, which Facebook is hoping can transform the internet.

Meta’s total users across all its platforms is currently 2.93 billion, and growth is slowing. The big problem is many of its users include Generation Z’s parents and even their grandparents. This is at the heart of Meta’s chase for the new technology.

Currently, efforts centres on a high-end VR headset that delivers mixed reality designed to blend virtual objects with the physical world. The aim is for the new platform to change socialising, gaming, fitness and even work. But for all the hype, the early versions have so far only generated lukewarm reviews with criticism the hardware is clunky, and the visuals are uninspiring. The platform is struggling to become part of user's daily life, such as Facebook or Instagram.

All up, Meta has guided next year’s investment spend in a range of $US34bn to $US39bn – that’s the equivalent of $52bn to $60bn, with much of the growth in building artificial intelligence capacity. At most, Wall Street was expecting capex spending at $US29bn. Two years ago, before the metaverse spend really started, capex spend came in at $US20bn.

The pay-off for many of these investments is years away, nor is it guaranteed the bets on the metaverse will even deliver.

As one analyst noted, the way investors are feeling right now is that there are too many experimental bets versus proven bets on the core of the business.

Zuckerberg on Thursday says there is more to come with a number of different products and platforms being built across the metaverse.

He defended his multi-billion dollar vision of Meta, saying the work they are doing will be of “historic importance” and create the foundation for an entirely new way that we will interact with each other and blend technology into our lives.

Other areas of investment spend include introducing artificial intelligence being developed for users and advertisers across its existing platforms and the company attempting to generate greater revenue from its popular secure messaging business WhatsApp.

The capex spend comes on top of a massive cost blowout following a hiring spree the company went on during the Covid-19 pandemic. It has since put in place a jobs freeze and even reduced office space in Silicon Valley.

Costs next year could now exceed $US101bn more than $US7bn ahead of estimates. Reality Labs, the business unit developing much of the Meta platforms, has so far this calendar year generated a loss of $US10bn.

The spending push comes in a backdrop of a slowing ad market for Facebook’s core social media business.

More broadly, competition is rising from the likes of TikTok, while tech giant Apple has crimped Facebook’s growth prospects by requiring users to opt in to giving their location data away.

Facebook’s September quarter profit of $US5.66bn is down from $US10.4bn this time a year ago.

“There’s still a long road ahead to build the next computing platform. But we are clearly doing leading work here,” Zuckerberg says. “This is a massive undertaking, and it’s often going to take a few versions of each product before they become mainstream”.

The bets being made today will result in technology being developed over regular intervals over the next five to ten years, he adds.

johnstone@theaustralian.com.au

Originally published as Why ANZ believes it is ready for the coming financial storm