Time for mining investors to face the future and meet the CLANCs

Mining stocks are riding a wave but the real action will be with the future-facing metals: copper, lithium, aluminium, nickel and cobalt.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Mining stocks look set to shine in the year ahead: rebounding global growth, limited supply and the rush to go “green’’ should combine to offer some exceptional opportunities.

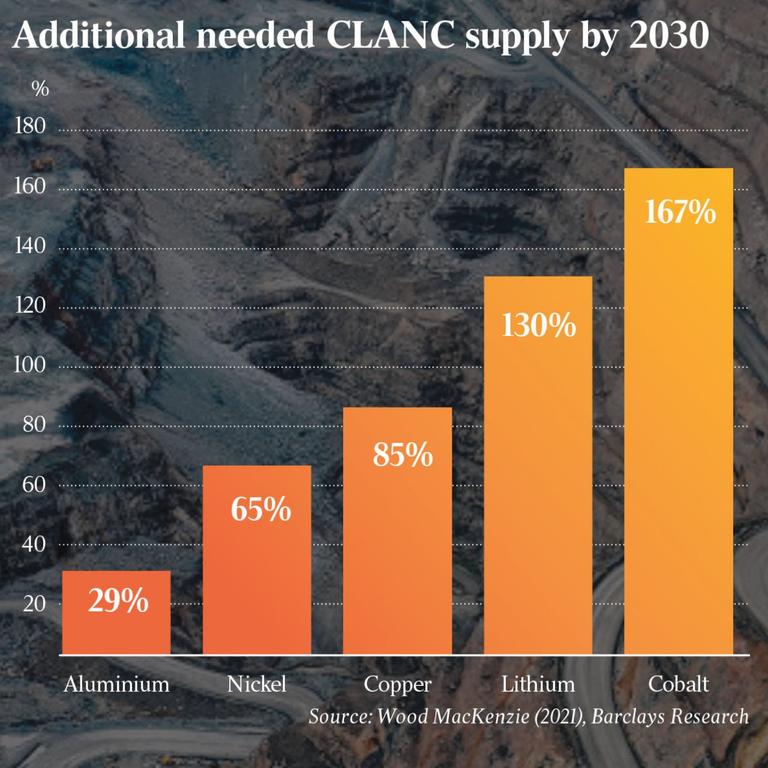

If you’re still grappling with just what the switch from coal and oil toward environmentally friendly minerals will mean for mining investors, the market has created another of those useful collective acronyms. It’s the CLANCs — Copper, Lithium, Aluminium, Nickel and Cobalt.

These CLANCs will power renewable energy systems and electric vehicles in 2022 and the stocks that have them on-board should shine brighter still.

Meanwhile, iron ore, the king of metals, is also due to have another strong year with its China-driven price outlook improving in recent months.

As Nick Harridge, KPMG national mining leader suggests: “We expect future facing minerals including copper, nickel and critical minerals demand to continue to be strong in 2022, because of their use in renewable energy infrastructure and batteries. I’d call out lithium in particular.”

You might think this sector — typified by the lithium boom last year — has already had a strong run. But the outlook for metal miners is being upgraded continually as the world’s biggest investment banks weigh up resurgent post-Covid demand.

Take your pick: Morgan Stanley, Goldman Sachs, RBC Capital Markets — the major players — keep issuing bullish reports upgrading virtually all metals for 2022.

As Canada’s RBC put it a few weeks ago: “High commodity prices, subdued capital expenditure and healthy balance sheets are likely to translate into strong free cash flow and dividends across the sector (despite cost pressures) … All of these factors should continue to support near-term multiples and equity valuations.”

In many ways the wider opportunities in the resources sector are captured inside our biggest mining stock, BHP, which is now set to represent more than one dollar in every 10 invested in the local market after its “unification” deal.

BHP is positioning to become more reliant on CLANCs, such as copper, and preparing for the day when iron ore no longer represents 70 per cent of profits.

As the shift in emphasis away from iron ore extends, BHP and top tier rivals are now very close to presenting as future facing mining stocks that have “divested” almost all mining and coal assets.

Indeed, the main threat to this promising picture for mining stocks — beyond the conventional pressures of the commodity price cycle — is overcoming supply challenges.

Inside the local market there is the particular problem of the WA state borders; many of the big miners face logistic pressures as the state remains closed. At the same time, they may face temporary setbacks once WA opens its doors and its Covid case numbers fall into line with the rest of the world.

On a global scale miners may also be among the first to face serious inflation pressure: Already one of our biggest miners, the iron ore specialist Fortescue, has reported a 20 per cent increase in quarterly costs.

Even if a mining stock is trading against a strong backdrop in terms of supply and demand, the realities of mine management can also offer setbacks at any time. Just because the market is moving the right way never guarantees an individual mining stock can deliver on its promises.

Digging for something to buy

For investors the key issue in selecting mining stocks might well be overload. There is simply too much to choose from, with hundreds of ASX listings and a never-ending stream of “buy” calls that stream out from the brokers and advisers.

One way to sidestep the problem might be to opt for an Exchange Traded Fund that buys the entire mining sector. On the ASX there are traditional funds that do just that, such as the VanEck Australian Resources ETF or SPDR S&P/ASX 200 Resources Fund or BetaShares Resources ETF.

Look inside these ETFs and you will find they are like-for-like reproductions of the mining index. At VanEck Australian Resources ETF, for example, 20 per cent of the fund is in our top three mining stocks — BHP, Rio and Fortescue.

Similarly, an investor can aim to capture key trends such as the move towards battery metals. The ETFS Battery Metals fund is a leader here — up 14 per cent over the last year — and Mineral Resources and Pilbara Minerals are top stocks in this fund along with global leaders in battery tech such as Nissan and BMW.

Of course in an ETF you get both the best and the worst companies and most investors believe value in the mining sector is all about selection. Last year while the broad ASX 200 ETFs managed a total return of near 17 per cent, the ETFs based on the mining index returned closer to 10 per cent. Those knockout returns you may have read about come from the best stocks not the wider index.

At the top of the market there is BHP and Rio — with Fortescue very much a third placed favourite. All three of big cap miners are moving fast to make sure they have a portfolio which will reflect the new realities of the market. BHP and Rio are well down the road, Fortescue is rushing to catch up — it just shelled out a sizeable $310m to buy the battery division of Williams Engineering.

Analysts reports reflect this pecking order: the diversified miners BHP and Rio are consistently more favoured. Fortescue is seen as a riskier, if potentially more lucrative, proposition — due to turbocharged ambitions of founder Andrew Forrest.

Max Cappetta, CEO at the Redpoint Investment Management group, echoes many professional investors in suggesting a two-pronged approach where the mining stocks are divided into the cashflow kings such as BHP and Rio which are set to offer 10 per cent dividend yields, alongside individual star stocks that can bound ahead in price.

“You just have to keep in mind this is a sector in a very strong position now, and the best stocks have a very good chance of achieving their objectives especially when it comes to raising capital,” says Cappetta. We see this sector having a string of drivers in its favour and the broader picture has the decarbonisation story which is going to run for years.”

The challenge for any professional or private investor is not to pay too much for a slice of the action when it is clear the commodity prices are at an elevated point in their cycle.

To put that another way, it is always going to be difficult for anyone with an eye towards value to purchase a stock that has perhaps doubled in price the previous year — yet this is the position of several leading stocks in the battery metals sector, especially in the lithium category.

Beyond the big three stocks, there is a wide variation of recommendations among locally-listed CLANC stocks. Here’s a stock from each CLANC category worth a closer look.

Copper — Sandfire Resources

The $2.6bn stock is a rare example of a one-time small cap that has grown from local minnow status to a global force in copper.

Lithium — Pilbara Minerals

The $10 billion stock is an institutional favourite currently off its record highs of last year but sitting on one of the biggest lithium deposits in the world.

Aluminium — South 32

The $17 billion one-time BHP spin off is a diversified miner but it has reset its sails with a well-timed new commitment to hydro-powered aluminium.

Nickel — Chalice Mining

Soaring to $2.5bn after the share price rose from $1 in 2020 to near $7.20 now, the stock is still heavily backed thanks to the promise of the biggest nickel-related discovery in two decades at its WA mine.

Cobalt — Jervois Mining

A key battery metal largely missing from the Australian landscape, but the overseas based $941m Jervois group has emerged as one of the most promising ASX stocks.

More Coverage

Originally published as Time for mining investors to face the future and meet the CLANCs