Ten ways to save our super system

The reputation of big super funds hit the rocks in 2024. Here is what needs to happen this year if we want the system to improve.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

This year will be one of reckoning for the $4 trillion super sector. Too big to fail, major funds have also become too big to be run like local football clubs and demands for a complete overhaul of the industry fund system are gathering pace.

As a string of investigations, involving leading funds such as Cbus, highlight failures, an exceptional opportunity to sort out the wider super system looms in the months ahead.

With compulsory super driving the sector to ever greater influence and bull markets underpinning funds under management, 2024 should have been a year of celebration for super. Instead, it was a year of revelation, when the failings of big funds became all too obvious.

Meanwhile, the number of individuals trying to build their own super savings through self-managed super funds continued to increase, despite little government encouragement.

Here are 10 key moves which would sort out super in 2025, making a sustainable and successful system better for everyone — especially individual investors.

Big picture

1. Remove the bias against younger Australians

Perhaps the architects of super never meant it to happen, but today’s super system is biased against younger Australians. The tax advantages inside super favour older, retired Australians and block earnest efforts by younger workers to build their own super.

A key Actuaries Institute paper has suggested a flat 10 per cent tax at all life stages, except retirees would face a special tax when they withdrew high amounts from the funds.

In other words, older Australians would pay for the reshaping of the system. It’s an idea which is not going to go away.

2. Create a single regulator

Big super is regulated by two bodies; consumer regulator ASIC and prudential regulator APRA. This arrangement must be ideal for any operator inside the big funds who wants to arbitrage between the two.

But, no single force has comprehensive oversight of the system — a recipe for failure in any area of activity.

3. Allow super to be used in home purchases

The wider tax system is expressly designed to favour the homeowner. Capital gains tax relief on the primary residence is — obviously — only accessible if you own your own home. Similarly, the pension system is weighted heavily against those who don’t own their own home (because those which do effectively enjoy an exemption on the pension assets test).

This is before we even consider the security of owning, rather than renting, in an economy where renting remains unstable for most people most of the time.

The wider tax system is not going to be changed anytime soon (whatever the super settings). Because of this, Australians should be allowed to use their super to buy their home.

4. Simplify the caps

The regulations around super have strong similarities with a pot of spaghetti. But, there is one clean way to make it a lot easier for investors: harmonise the caps (the individual limits and thresholds which dictate the inflows and outflows in the system).

There are now so many ‘‘caps’’ inside the system in terms of contributions and other issues it is exceptionally difficult for the everyday investor to understand the specific attractions of super savings. Worse still, caps are often based on different underlying indicators.

At the same time, some are indexed to inflation and some are not. This is the low-hanging fruit for super reform.

5. Establish a comprehensive independent inquiry into Big Super

As one of the biggest industry super funds, Cbus has been an embarrassment to the sector, but also an outstanding example of what can happen if you let a $93bn fund run its own show without proper policing.

The fund is being taken to court by ASIC over allegations concerning delayed payments on death benefits and disability.

The case involves more than 10,000 Cbus members, including a grieving father who was given the run-around for a year before the fund paid out.

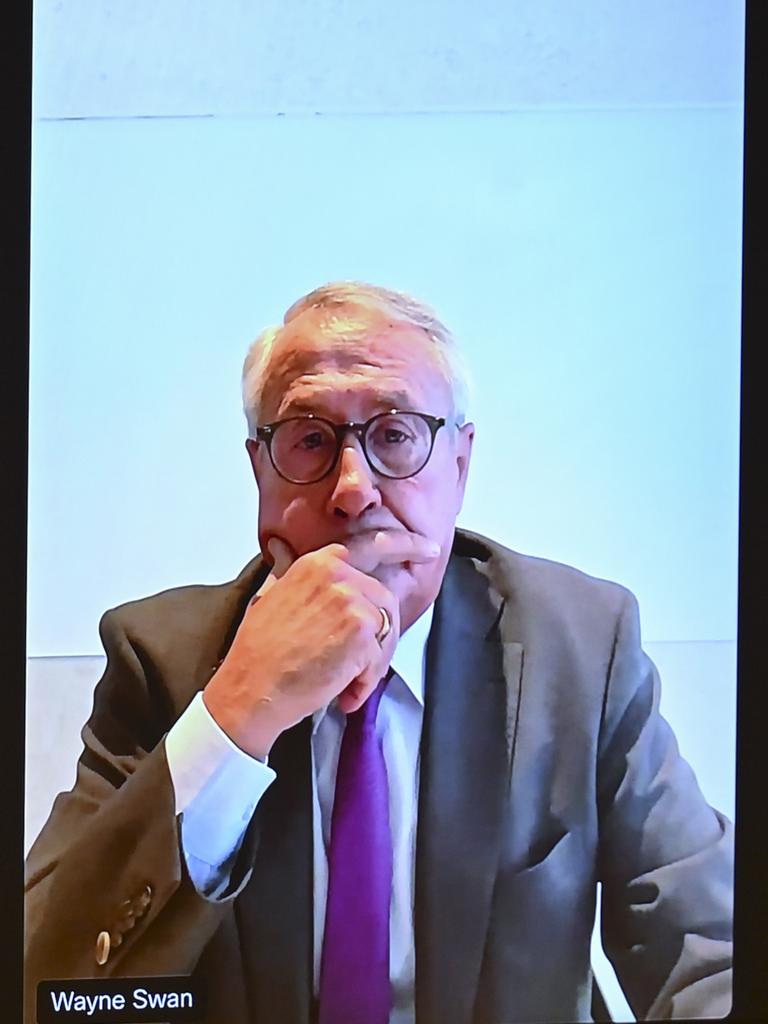

Separately, the fund has become synonymous with union-linked problems since its chair Wayne Swan is also national president of the ALP. The Australian recently reported on the Cbus AGM, but media were not allowed into the meeting; this would be inconceivable for a publicly listed company of even half the size.

Cbus is not alone in its cock-ups. There have been a range of failings at big funds.

6. Make funds invest strictly for investment reasons

The politicisation of industry funds is inevitable when there is so much money involved — AustralianSuper alone has $341bn under management.

On one side we have ‘‘top down’’ pressure from the government to get the funds to invest in housing, though fund managers consistently suggest it does not offer the returns they require. On the other side there is “bottom up” pressure to invest in sectors linked to a fund’s core membership.

Big funds must invest for the sole purpose of optimising the investment returns of members.

7. Tell us how much the fund is really worth

One of the reasons major industry funds pole-vaulted the competition in recent years was the larger focus these funds put on unlisted assets. As an investment strategy it has been undoubtedly successful, and it is worth noting most of the biggest funds have managed consistent strong returns.

But, the price of this success has been that asset valuations are unclear and there is fading confidence on transparency in the sector.

In a sharply worded report from APRA, it was found the majority of big funds have been falling short of their legal obligations on valuation governance.

Super funds are too important to have any mystery surrounding how much they are worth — it’s time for a clean-up.

8. Clean out boards of Big Super

When we look at the board of a $100bn operation we expect to see top-level executives with top-level credibility, credentials, and experience. This is not the case at super funds, and Cbus again stands out as a strong case study, with endless controversy over the credentials and capacity of its latest board appointments.

Behind the scenes, powerful lobby groups are pushing the funds to overhaul the current model and replace it with procedures which will satisfy both the everyday investor “pub test’’ and evolving regulations from APRA.

Super funds are no longer cottage operations with a few million dollars to manage — they are multibillion-dollar organisations and need to reflect this power.

Self-managed funds

9. Confirm SMSFs can borrow for property

Some voices in super have persistently questioned whether SMSFs should be allowed to take out mortgages to buy property — oddly, they never questioned the right to buy highly-geared hedge funds or digital assets such as bitcoin.

Yet, for some reason “bricks and mortar” is seen as unsuitable for SMSF borrowing. This is silly.

Independent investors can make their own decisions on what they buy for their super fund.

Every single year there is a threat this basic feature of SMSFs will be removed. With no regulatory certainty, the major banks have exited the market, leaving this important business to less well-known players. Clarify this area with a permanent tick of approval.

10. Quit creating new taxes aimed at active, independent investors

In the first suggestion we covered earlier in this article ‘‘remove the bias against younger Australians’’ I said the price of harmonisation inside the system (if it is to be cost-neutral) would be to reduce the benefits for older Australians.

But, a comprehensive reform of the system would have the powerful benefit of sorting out super taxes on a permanent basis.

There would be no more surprises, no more hazy, crazy efforts such as the ongoing attempt to introduce a new super tax on unrealised gains.

Investors need certainty, let’s give it to them.

James Kirby hosts the twice weekly Money Puzzle podcast.

Originally published as Ten ways to save our super system