Dozen superannuation trustees fail to meet valuation and liquidity risk governance, APRA says

The prudential regulator will take further action to enforce valuation and liquidity risk requirements after half of probed super trustees failed to pass.

The Australian Prudential Regulation Authority (APRA) has not ruled out taking further action to enforce valuation and liquidity risk governance demands after finding a dozen superannuation trustees failed to meet requirements.

The findings indicate 12 super funds require material improvements in either or both their valuation governance or liquidity risk management frameworks to meet APRA’s governance framework.

The 12-month review, which commenced in December 2023, probed 23 in-scope trustees examined, representing around 80 per cent of total assets managed by APRA-regulated superannuation entities.

It follows APRA adjusting Prudential Standard SPS 530 Investment Governance (SPS 530) in January 2023 to expand the requirements for super trustees related to valuations and liquidity management, as assets of APRA-regulated superannuation entities amounted to approximately $2.7 trillion as of 30 June 2024.

Of this, $500bn was invested in unlisted assets such as property, infrastructure, credit and equity.

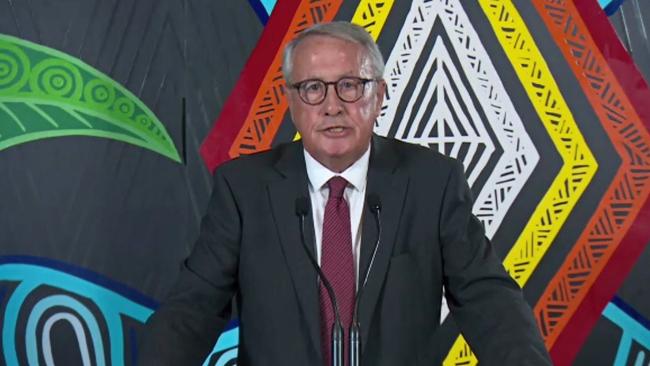

APRA deputy chair Margaret Cole said the regulator would not hesitate to take further action where necessary to enforce the provisions of SPS 530 and related regulations, including the responsibilities of relevant accountable persons under the upcoming Financial Accountability Regime.

“These latest review findings are concerning and indicative of the fact that many trustees have more work to do to lift their valuation and liquidity risk management practices. APRA expects trustees to review these findings carefully and formulate appropriate remediation plans where needed,” Ms Cole said.

“Trustees must ensure they have timely and reliable information on the value of assets when making investment decisions. They also need to have effective processes in place to manage liquidity risk.”

The review found while trustee capability and approach have generally improved since APRA’s last unlisted asset review in 2021, a significant proportion of trustees still displayed material gaps in key areas.

APRA will engage with those licensees identified as having deficiencies and will expect them to formulate appropriate and timely remediation plan.

In relation to unlisted asset valuation governance, particular weaknesses were observed in the areas of board oversight and conflict of interest management, revaluation frequency and triggers, valuation control, and fair value reporting.

For liquidity risk management there were particular weaknesses observed in the areas of liquidity stress trigger frameworks, unlisted asset liquidity risks and liquidity action plans.

Overall, APRA observed the need for greater inclusion of independent committee members with specialist knowledge concerning individual unlisted asset classes.

Superannuation funds have been in the spotlight amid a series of missteps including the Wayne Swan-led Cbus, which spent almost $400,000 on a party earlier this year, after it had allegedly mishandled $20m in insurance money and in some cases took more than a year to pay out death benefits or disability payments.

Last month, AustralianSuper said it would repay $4.2m to families of deceased members as compensation for taking too long to process their death benefit claims.

All MySuper superannuation funds passed the prudential regulator’s Your Future, Your Super performance test for the first time in the 2024 fiscal year, while backers of 37 trustee-directed products which failed will have to write to their members in the coming weeks.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout