Super funds eye double-digit returns in bumper year

Super funds are on track for strong returns for the year but some of the best long-term outperformers have been overshadowed by more aggressive growth funds.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Super funds are on track to deliver double-digit returns for 2024 but some of the best long-term outperformers – including the nation’s biggest fund, AustralianSuper, and peer Hostplus – have been overshadowed by more aggressive growth funds as high-risk strategies paid off in a bumper year for members.

Balanced funds are now eyeing returns of around 12 per cent for the year, while the median growth fund, with 77 to 90 per cent in growth assets, should do even better: SuperRatings estimates this cohort will deliver returns of 14.4 per cent. “It’s been a good year, particularly for international shares. It’s been a stronger year for members than anticipated,” SuperRatings chief executive Kirby Rappell told The Australian.

However, default balanced options at AustralianSuper and Hostplus, which rank first and third on ChantWest’s 10-year investment return performance, look like they could fall short and come in below the median this year.

AustralianSuper’s MySuper balanced option returned an estimated 11 per cent for the first 11 months of the year, while Hostplus’s default strategy returned about 10 per cent.

Top performer Colonial First State, meanwhile, delivered returns of 21 per cent for members under the age of 55 in its First Choice and Essential Super options over the same period.

The median balanced option, which typically has 60 to 76 per cent invested in growth assets, returned 2.4 per cent in November, pushing returns to 11.4 per cent for the first 11 months of the year, according to research house SuperRatings.

For older members, the CFS funds delivered returns of 18 per cent over the first 11 months of the year. These strategies were also the top performers for fiscal 2024.

Lifecycle strategies from funds Russell Investments, Australian Retirement Trust and Aware Super also fared well through the year, with returns to the end of November in the mid teens. These lifecycle options are overwhelmingly invested in growth assets for younger members and then derisk members as they get older, typically from the ages of 50 to 55.

“Total superannuation balances have now topped $4 trillion as at the end of September and, so far, April is the only month where funds haven’t provided a positive return,” Mr Rappell said.

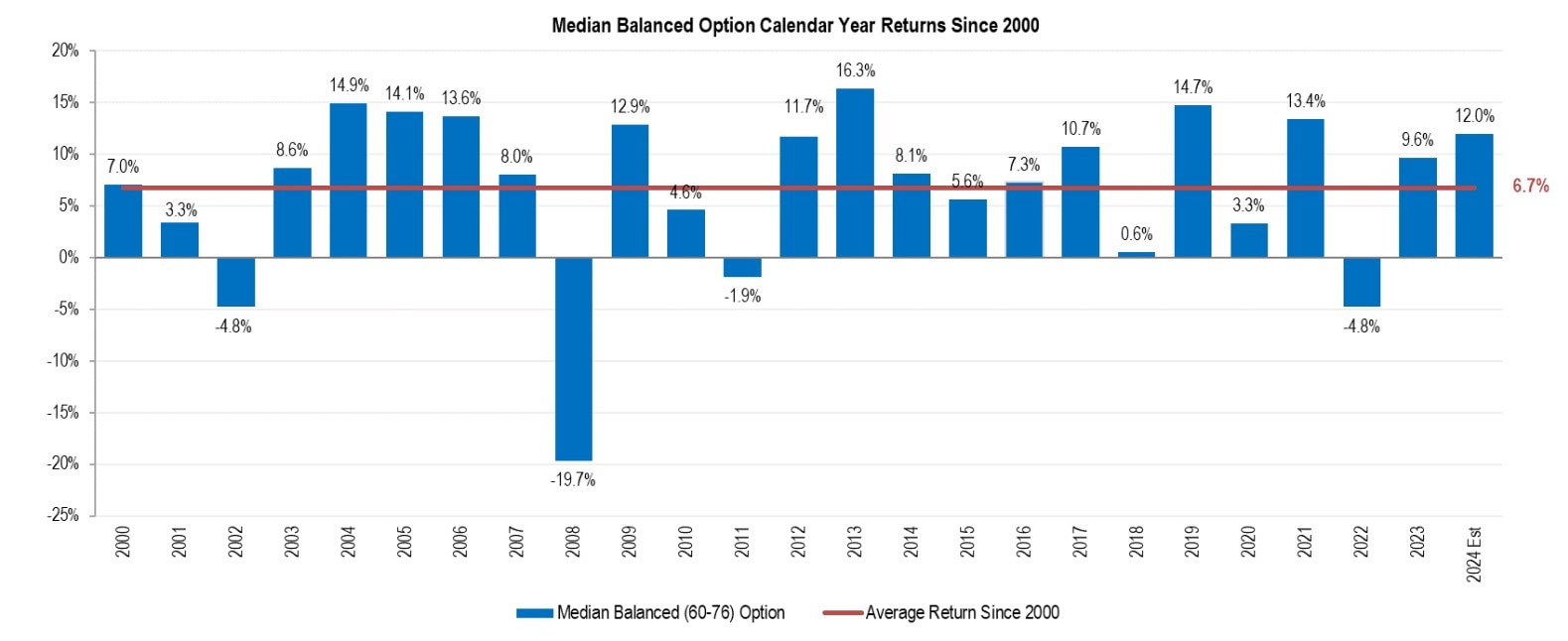

With just one negative month in the year, the expected return of 12 per cent for balanced funds is nearly double the long-term average of 6.7 per cent, putting 2024 in the top 10 for yearly returns since 2000.

ChantWest senior investment research manager Mano Mohankumar said 2024 was a “tremendous” year for super returns, as he pointed to the long-term strength of the sector’s performance. “This year’s (likely return) comes on the back of last year’s better-than-expected median of 9.9 per cent, so that negative calendar year of 2022 seems like a distant memory now,” Mr Mohankumar told The Australian. “This year also represents the 12th positive year out of a possible 13,” he added.

ChantWest’s estimates for super fund returns to the end of November sit at 11 per cent, slightly below SuperRatings’ figures.

Strong sharemarkets had driven much of the year’s returns, Mr Mohankumar said.

“International shares account for about 30 per cent of the typical (balanced) option, and Aussie shares account for about 25 per cent … Those are tremendous returns; it’s a really good story for super funds,” he said.

Returns have been driven by after a standout year for US equities in particular, with the tech-heavy Nasdaq up 28 per cent for the year to date, the S&P 500 climbing 25 per cent and the Dow Jones Industrial Average adding 14 per cent.

Over the same period the S&P/ASX200 Accumulation index gained about 13 per cent.

While equities were the standout contributor, all asset classes bar unlisted property will finish the year in positive territory. But after the standout year, Mr Mohankumar cautioned super savers not to expect the same every year.

“This year is not normal in terms of returns. It’s not what typical growth options are designed to achieve. The long-term objective for these funds is to beat inflation by 3.5 per cent. So around 6 per cent per annum over the long term, after investment fees and tax.”

Meanwhile, the federal government has pledged to push ahead with reforms to super tax breaks in the year ahead.

The government’s proposal to hike the tax rate on high-balance superannuation accounts – one of its few planned revenue-raising measures – remains stalled in the Senate and is unlikely to pass the parliament before the election.

If passed, the changes would double the tax rate on earnings of super accounts worth more than $3m from 15 to 30 per cent.

The measure is slated to take effect from July 2025 and is projected to raise $2.3bn in 2027-28 once it fully takes effect.

Concessions on super earnings and contributions are forecast to cost the federal budget $55.2bn in 2024-25, according to MYEFO documents.

More Coverage

Originally published as Super funds eye double-digit returns in bumper year