Returned Labor government could be a win for Queensland gas

With the Albanese Labor Government winning a clear majority, the way could be clear for Queensland gas to support east coast demand.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Labor has secured a clear majority in the Lower House following a landslide electoral victory

Government has reiterated the importance of gas in the energy mix to back up renewables

Natural gas is also important in the manufacturing and industrial sectors

The Australian Federal Election is now in the rear view and the question that’s likely on the minds of those in the oil and gas industry will undoubtedly now be what impact the returned Labor government will have.

What is clear though is there’s some relief that the result did not result in a Labor minority reliant on support from the Greens, a party outright hostile to anything to do with petroleum, and/or independents to form government and pass legislation.

Though the results might not be the preferred result of some parties – the Coalition is perceived as more business friendly – a far stronger Labor Government isn’t unwelcome either.

With an overwhelming majority in the House of Representatives, the Albanese government will have little trouble ramming through legislation to the Senate where it need to secure support from either the Coalition or Greens to pass laws.

With both Labor and the Coalition acknowledging that gas plays an important role in the country’s energy mix, that might not be all that bad for the oil and gas industry.

Labor, for instance, might have mis-stepped with its controversial $12/GJ gas cap, but did eventually realise its error and started handing out exemptions.

Further highlighting this, Resources Minister Madeline King reiterated in an interview with ABC Radio on May 15 that the government was committed to the Future Gas Strategy, saying that it is an important roadmap for where gas sits and that it will backup renewables.

She also noted that Australia’s customers in Japan and in Korea still needed access to natural gas and would probably need supplies to support their renewables push longer than Australia would.

Not just for energy

But energy generation is just one facet of the natural gas story.

Natural gas is also used in brickmaking, as feedstock for industrial processes and for producing ammonia fertiliser.

Comet Ridge (ASX:COI) managing director Tor McCaul told Stockhead that most people in Australia only saw natural gas as being used for generating power and did not fully understand its importance in manufacturing.

“There’s an ignorance about how useful gas is. It is used to manufacture glass, bricks and aluminium. You can’t build a house without it,” he said.

“From an East Coast perspective, 70% or more of the gas consumed is actually about manufacturing, it's not about power.

“If you want a Made in Australia (policy), then really natural gas has to underpin that.

“To some degree, I think we've got a bit of a mandate here now to push forward with gas to support renewables and support manufacturing.”

Importance to manufacturing aside, McCaul warned that demand for power will only go up due to incremental increases from data centres powering the artificial intelligence revolution.

He also drew on his personal experience about the big risk in the southern states around power supply.

“I spent three and a half years in Pakistan and I kind of know what it's like when the government cycles half the suburbs on and the other half off every couple of hours. It’s not a lot of fun.”

Looking ahead, McCaul said that Australia had to ensure it did not renege on its LNG export contracts or damage our international standing.

“You take decades to build a reputation as a reliable, dependable producer, and you can literally destroy that in a matter of a month or two,” he added.

“Not only do these international customers sign up for long term take or pay contracts, but some of them actually put in billions of dollars to the owners of the project and actually own some of the infrastructure.

“To take those cargoes off them and send them south because Victorians have an ideological hatred of gas is really quite unfair.

“I think in the longer term Australia will suffer for that, and it will hurt investment, not only in the gas sector but also other sectors.

“The thing going forward is developing more indigenous supply. We need to develop gas that's under our own feet as there will never be a cheaper molecule.

“Stop reducing our own supply as paying for overseas gas to come in actually generate more emissions.”

Queensland gas supply

While the southern states – Victoria and New South Wales – are still shying away, Queensland has no such issues and has the gas reserves to meet that demand.

“We actually have the capacity here (in Queensland) to give to Victoria. The problem the southern states have in relying on is that we can’t get it there because the pipelines are full,” McCaul said.

“APA is now investing to increase the capacity going south and I understand it could be as much as 25%, but that'll take two or three or four years to implement.

“So there's still a risk for the next few years, and even then it is really incumbent on New South Wales and Victoria to develop their own gas.

“Victoria needs gas for manufacturing. Sorbent has moved the manufacturing of certain products to Asia.

“Not having enough gas just shifts business offshore, shifts jobs offshore and maybe the planet is worse off for it.”

Even if the two southern states get on the bandwagon, there will still be a need for new gas supplies.

Building new supplies

McCaul’s Comet Ridge is one of several ASX-listed juniors that are exploring and/or developing new reserves of gas in Queensland.

The company has a 57.14% interest in the Mahalo Gas Project joint venture with Santos (ASX:STO), which has proved and probable (2P) gas reserves of 266 petajoules and a further 315PJ in best estimate (2C) contingent gas resources.

“The big news for us this year is we've now got two FEED studies running concurrently at Mahalo in the joint venture block with Santos,” McCaul said.

“We've got Santos doing the front end engineering design on the compression and the wells and the gathering system and we've got Jemena now pushing very hard through the pipeline FEED.

“Jemena are looking at a 10 inch pipeline over about 80 kilometres and it'll have dual connection. It will go initially into the Jemena line and then it'll go also across the paddock into the Santos GLNG line.

“Mahalo Hub will be able to supply domestic and export, and ... I think that balance is really important. We've also got a pilot running at Mahalo East and we expect to have our reserves package off to our auditor in the next week or two.

“And that's been helped by a $5 million Queensland State Government grant that we competitively bid for and won.”

Comet Ridge also has a 100% interest in Mahalo North and East projects, which are expected to be developed through the central Mahalo JV system.

Mahalo North has 2P reserves of 43PJ and proven gas production with the Mahalo North-1 pilot having produced 1.75 million cubic feet per day of gas during testing.

Flow testing of the Mahalo East pilot is currently underway with success expected to allow the company to convert most if not all of Mahalo East’s existing (2C) contingent resource of 31 petajoules into 2P reserves.

“We see Mahalo Hub through two lenses,” McCaul added.

“We see it through the Santos joint venture lens where we're a 57% equity holder and we've got a good partnership and team there with Santos and Jemena.

“And then we've got almost the same area across the northern blocks. And three of those four northern blocks have got a domestic market obligation. So we're talking to a range of customers about gas sales aggregators and power generators.”

He added the company still its permits in the Galilee Basin that significant gas potential and would turn its attention there after getting Mahalo up and running, a process that it will focus on for the next couple of years.

FID for Mahalo is expected to be in Q1 2026 with gas production starting in the second half of 2027, though McCaul said the joint venture was working hard to make it happen a little earlier.

Terrific Taroom

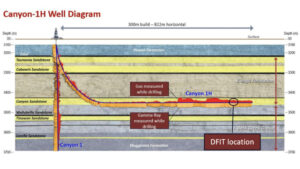

Over in the Taroom Trough, Omega Oil & Gas (ASX:OMA) encountered a little bit of a surprise after finding that its Canyon project might be more of an oil and gas play rather than a condensate-rich gas resource.

During the flow-testing period, the well flowed at a peak rate of 452 barrels of oil and 600,000 standard cubic feet of gas per day and a sustained rate of 321bpd of oil and 472,000scfd gas from a 650m interval in the target Canyon sandstone.

For future development wells, this is equivalent to a sustained rate of 987bpd of oil and 1.45 million (MM) scfd of gas from a 2000m lateral, which the company said in late March demonstrated the Canyon project area hosted material oil and gas plays.

For comparison’s sake, it also translates to a gas equivalent flow rate of ~7.4MMscfd, significantly higher than the peak flow rate of 2.6MMscfd achieved at fellow Taroom Trough operator Elixir Energy's (ASX:EXR) Daydream-2 vertical appraisal well.

Adding further interest, the flow of oil and gas comes from just one of several pay zones, some of which might have more gas than oil.

The fluid system and production profile are similar to benchmarks like the Bakken, the Permian, Wolf Camp A and also certain areas of the Scoop and Stack formations in Oklahoma.

There is also plenty of opportunity to optimise the drilling process.

Fellow Taroom player Elixir recently launched a three-phase strategic plan that seeks to firstly secure the long-term retention of its acreage before focusing on targeted investment to deliver its first 2P reserves.

The company hopes to produce by late 2027.

Its strategic plan is built around a fast-follower approach in the Taroom Trough, by leveraging surrounding development activity and investment to drive rapid advancement.

Meanwhile, QPM Energy (ASX:QPM) supplies gas from its Moranbah project to industrial customers and the Townsville Power Station, a peaking gas plant that operates for three to seven hours per day during peak morning and evening periods when electricity prices are at their highest.

In late April 2025, the company increased 2P reserves by 33% to 435 petajoules with more than 300PJ remaining uncontracted.

It also represents a 166PJ increase in 2P reserves since it acquired the project in August 2023, a noteworthy achievement given that Moranbah is a producing project.

A major reassessment, which included validation of the project’s geological dataset and integration of historical production data, found that a larger volume of gas is contained within its petroleum leases than previously estimated, which in turn has the potential to underpin further reserve upgrades.

The project currently produces 22-24 terajoules of gas per day from more than 125 wells.

Existing infrastructure includes over 500km of gas-gathering and water pipelines, a 150km electricity distribution network, 64TJ/d of compression capacity, the 160 megawatt Townsville power station and the 12.8MW Moranbah power station.

At Stockhead, we tell it like it is. While Comet Ridge, Omega Oil & Gas and QPM Energy are Stockhead advertisers, they did not sponsor this article.

Originally published as Returned Labor government could be a win for Queensland gas