Health Check: FDA casualties mount as Trump’s ‘revolution’ takes place

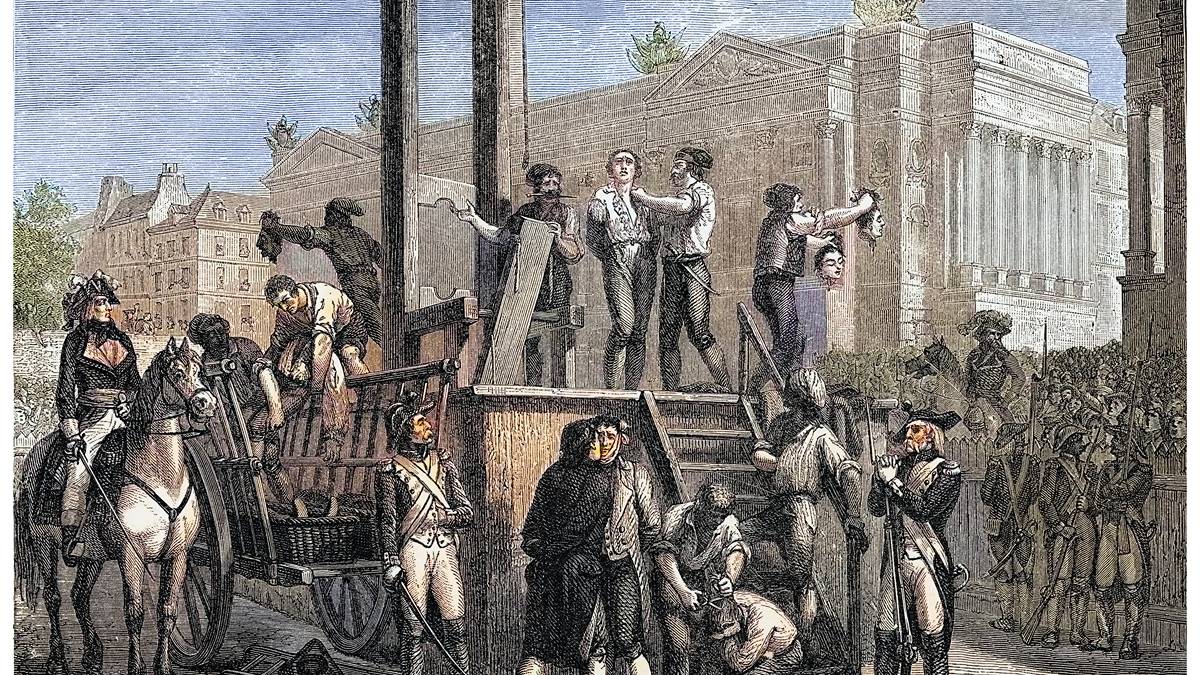

A reported 3500 US Food & Drug Administration staff are headed for the guillotine, as part of the Trump administration’s broader purge of the health bureaucracy.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

The guillotines are swooshing at the FDA as a reported 3500 staff get the chop

French to say ‘oui’ to fully legal medicinal cannabis

Bell Potter values Opthea at 5 cents per share

Grisly tales are emerging from the corridors of the US Food & Drug Administration (FDA) as mass sackings take effect.

The purge reportedly affects 3500 staff, 19% of the agency's workforce.

“The revolution begins today” posted new health secretary Robert F Kennedy Junior on X.

As with the French revolution, the tumbrils are rapidly filling.

Endpoints News reports employees turned up at the FDA’s main Maryland campus, only to find their badges – and jobs – were gone.

Center for Biologics Evaluation and Research (CBER) chief Peter Marks is departing, citing an “unprecedented assault on scientific truth”.

(Marks was responsible for vaccine evaluation and was a likely target for vaccine sceptic RFK Jr).

CBER Office of New Drugs director Peter Stein said he was offered “inappropriate” reassignment choices and quit.

Other departees include FDA chief medical officer Hilary Marston and tobacco director Brian King.

Across the broader Health and Human Services (HHS) department, the toe cutters have given some senior leaders the choice to relocate to places such as … Alaska.

Posting on Linkedin, Robert Califf – the FDA’s commissioner under the Biden administration – says with so many experienced staff shown the door, “the FDA as we know it is finished”.

He says: "it will be interesting to hear from the new leadership how they plan to put Humpty Dumpty back together again.”

Posting on X, Scott Gottlieb says the “cumulative barrage” of changes threatens to bring back “frustrating delays for American consumers".

This is particularly the case for rare diseases and other significant unmet medical needs.

Gottlieb was the FDA’s head during Trump’s first term and is currently a board member of Pfizer and Illumina.

RFK Jr maintains the cuts aim to “streamline HHS to make our agency more efficient and more effective.”

Federal health employees are expected to reduce from 82,000 to 62,000 but RFK Jr says it will be a case of doing more with less.

Nervous times for FDA-exposed Aussie biotechs

For Australian biotechs, the repercussions are unclear.

Echo IQ (ASX:EIQ) last month won FDA approval for its coronary plaque detection device, while the agency also gave the nod to Nanosonics' (ASX:NAN) next-gen probe steriliser.

Both companies report the process was ‘business as usual’.

EBR Systems (ASX:EBR) expects approval for its wireless pacemaker on or before April 13, as per the FDA’s approval timetable.

Our best guess is that those in advance stages of approval will be fine – and the process might even be expedited.

But for those in the more preliminary or exploratory stages, it’s nervous times.

French to say ‘oui’ to fully legal medicinal cannabis

Speaking of French revolutions, the Gallic nation is poised to make medical pot fully legal, which is good news for the European-focused Little Green Pharma (ASX:LGP).

Under a transitional arrangement, Little Green is one of only two suppliers authorised to provide product at full price.

France is a key market in a European sector already valued at $9.7 billion.

One would think fully legal status would open the floodgates to other suppliers.

But Little Green says this won’t happen because of the “significant information and data” suppliers need to offer.

Little Green generated December quarter revenue of $9.5 million, up 75%, with about 80% attributable to European geographies including Germany, Italy and the UK.

Biome is on a roll

Probiotics supplier Biome Australia (ASX:BIO) has got in early with a March quarter update, reporting a record 41% year-on-year sales boost to $4.5 million.

Financial year revenue to date was $13.4 million, 46% higher.

The company expects another record performance this quarter, in line with its target of achieving $75-85 million of revenue by the 2026-27 year.

Biome’s “clinically proven and condition specific” product range covers maladies including bone health, cholesterol, acne, eczema and iron deficiency.

Probiotics promoters claim the live microorganisms – primarily bacteria and yeasts – confer health benefits including gut health and improved immunity.

Broker gives Opthea a 92% price haircut – and even that might be generous

Given investors' hithero enthusiastic backing of Opthea (ASX:OPT), the eye disease developer’s fate has been a case of ‘don’t mention the war’.

With Opthea stock suspended since the March 24 news of its first phase III trial failure, Bell Potter has taken a stab at the stock’s real worth.

The answer? Five cents per share, compared with the ‘frozen’ value of 60 cents.

This reflects the company’s $125 million cash balance, less vendor obligations.

As previously reported, investors that are part of a development funding agreement may have dibs on the cash.

“It would not be unreasonable for the directors to appoint administrators,” Bell Potter says.

The firm says termination of both Opthea’s phase III trials “is a tough hit and a stark reminder of the high-risk nature of drug development.”

Quite.

Medadvisor raises funds and cuts costs

Exposed to US vaccine usage trends, medical communications house MedAdvisor (ASX:MDR) is raising up to $7 million of equity and plans to slash its US workforce by 44%.

The capital raising consists of a $5 million placement at 10 cents per share, plus a share purchase plan to raise up to $2 million.

The raising is at 10 cents per share, a 9% discount to the last closing price.

Medadvisor doesn’t make vaccines, but it runs drug awareness campaigns on behalf of big pharma, via pharmacies.

US vaccination rates have been running below historical trends – and that’s been the case well before RFK Jr’s ascendancy.

For instance, less than half of American adults are vaccinated for ’flu and that number should be closer to three-quarters.

Vaccine hesitancy aside, Ratliff cites vaccine fatigue as so many new vaccines have come on to the market.

These include prophylactics for shingles, pneumococcal bacteria and respiratory syncytial virus.

Medadvisor derives about 30-50% of its US revenue - or 30% of total revenue at the midpoint - from vaccine campaigns.

Medadvisor now expects revenue for the year to June 2025 to be down around 19% to 24%, to $93-99 million.

Gross profit is expected tumble to $$57-60 million, from last year’s $74.2 million.

Medadvisor is undertaking a strategic review to narrow the gap between the board’s perceived worth of the company and what the market thinks.

The company has attracted non-binding proposals from buyers of Medadvisor’s Australian business, which operates separately to the bigger US operation.

Originally published as Health Check: FDA casualties mount as Trump’s ‘revolution’ takes place