Closing Bell: ASX tanks 1.8pc, oil barrels over as 104pc tariff on China kicks in

The funeral march continues for the global economy, as the tariff stoush and trade war continues on the global stage.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

The funeral march continues for the global economy, as the tariff stoush and trade war continues on the global stage.

- Oil hits four-year low, returning to early 2021 levels

- Energy sector leads ASX down 1.8%

- China intervenes in home markets as US trade war escalates

The newest US tariffs on all Chinese imports have now come into effect, raising the prices of huge swathes of products, especially smart phones, computers and batteries, by 104% for US consumers.

Beijing has signalled it's more than willing to intervene in the Chinese market to deal with the fallout – state-run investing company Central Hujin has moved to counter the panic induced by the US-China trade war by buying up more exchange traded fund shares.

“We’ll resolutely defend the stable operations of capital market,” a Central Hujin statement released on Monday promised.

Investment banks including Morgan Stanley and UBS predict interest rate cuts are likely in China’s very near future, forecasting a relaxation of fiscal policy and an increase in spending by the central bank.

"US and China are stuck in an unprecedented, and expensive, game of chicken, and it seems that both sides are unwilling to back down," Nomura chief China economist Ting Lu said.

A sea of red, as far as the eye can see

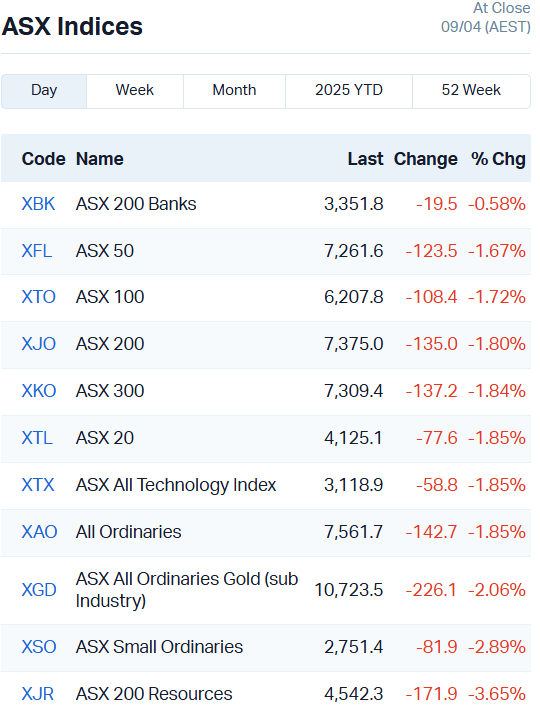

Caught between a rock (the US) and a hard place (China), the Aussie bourse took another beating today, completely reversing yesterday’s gains to fall 1.8%.

We weren’t the only ones.

While Asian markets were showing strong signs of recovery yesterday, it’s a different story today.

At time of writing, the Nikkei is down more than 3.2% and the Hang Seng 0.67% while the Shanghai Composite index has managed a 1.07% lift, probably in part due to aforementioned market intervention.

US indexes didn’t avoid the bloodletting – the Nasdaq fell 2.15% and the S&P500 1.57% overnight.

Adding to market woes, oil has fallen to levels not seen since the early months of the Covid-19 pandemic, shedding about 4% on average – West Texas Intermediate crude fell 3.96% to US$57.22 a barrel, while Brent lost 3.39% to fall to US$60.69 a barrel.

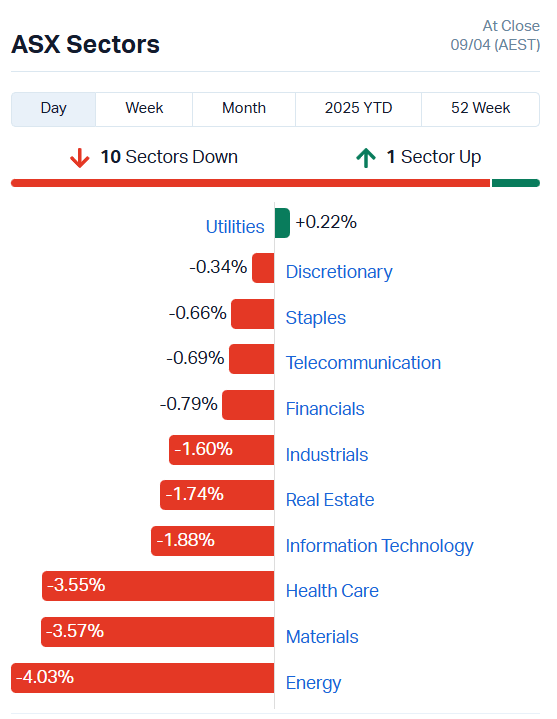

Unsurprising, then, that the Energy sector has been the hardest hit on the ASX today, falling an eye-watering 4.03%.

The bigger stocks took much of the brunt, with Woodside Energy (ASX:WDS) falling 3.72%, Santos (ASX:STO) 5.65% and Ampol (ASX:ALD) 3.08%.

There was plenty of pain to go around, though. Resources slipped 3.57% and news of pharmaceutical tariffs brought Healthcare down with a 3.55% fall.

The big caps told the story for resources – BHP (ASX:BHP) fell 3.45%, Fortescue (ASX:FMG) 4.18% and Rio Tinto (ASX:RIO) 5.01%.

As for biotech stocks, CSL (ASX:CSL) is still firmly in the red with a 4.96% drop, joined by Sonic Healthcare (ASX:SHL) down 2.86% and Cochlear (ASX:COH) down 2.57%.

Trump’s shock announcement of a new “major” tariff on pharmaceutical imports set biotech investors running for the hills, although Australia’s exposure is relatively limited, as Stockhead’s Tim Boreham explains in this breakdown.

It wasn’t all bad on the ASX today – the Utilities sector managed a 0.22% lift and some notable exceptions to the dour mood were energy utility AGL (ASX:AGL), which rallied 1.26%, healthcare company Healius (ASX:HLS), which gained 4.48%, and automotive supplier Bapcor (ASX:BAP) which lifted 3.28%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 9:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| OSX | Osteopore Limited | 0.032 | 100% | 59,759,178 | $1,933,897 |

| ZEU | Zeus Resources Ltd | 0.009 | 50% | 12,731,454 | $3,844,039 |

| AJL | AJ Lucas Group | 0.007 | 40% | 2,641,039 | $6,878,648 |

| PVT | Pivotal Metals Ltd | 0.009 | 38% | 10,872,119 | $5,896,968 |

| AOA | Ausmon Resorces | 0.002 | 33% | 450,000 | $1,966,820 |

| JAY | Jayride Group | 0.002 | 33% | 3,000,000 | $2,117,588 |

| GBE | Globe Metals &Mining | 0.032 | 28% | 148,571 | $17,366,325 |

| CCO | The Calmer Co Int | 0.005 | 25% | 1,876,010 | $10,215,485 |

| ERA | Energy Resources | 0.0025 | 25% | 2,369,570 | $810,792,482 |

| RDN | Raiden Resources Ltd | 0.005 | 25% | 16,984,013 | $13,803,566 |

| VML | Vital Metals Limited | 0.0025 | 25% | 1,338,022 | $11,790,134 |

| PLN | Pioneer Lithium | 0.12 | 24% | 15,000 | $4,128,483 |

| NNL | Nordicresourcesltd | 0.115 | 24% | 131,294 | $13,706,698 |

| STM | Sunstone Metals Ltd | 0.011 | 22% | 3,329,984 | $53,589,183 |

| KNI | Kunikolimited | 0.145 | 21% | 147,468 | $10,427,312 |

| ATG | Articore Group Ltd | 0.175 | 21% | 1,193,515 | $41,307,145 |

| GAS | State GAS Limited | 0.03 | 20% | 200,647 | $9,815,022 |

| DTR | Dateline Resources | 0.006 | 20% | 3,777,999 | $12,827,843 |

| ROG | Red Sky Energy. | 0.006 | 20% | 2,413,218 | $27,111,136 |

| TYX | Tyranna Res Ltd | 0.006 | 20% | 891,420 | $16,439,627 |

| IDT | IDT Australia Ltd | 0.105 | 17% | 169,719 | $38,671,008 |

| LM1 | Leeuwin Metals Ltd | 0.175 | 17% | 2,955,963 | $12,644,957 |

| DVL | Dorsavi Ltd | 0.007 | 17% | 100,000 | $4,387,428 |

| EE1 | Earths Energy Ltd | 0.007 | 17% | 902,602 | $3,179,785 |

| IXR | Ionic Rare Earths | 0.007 | 17% | 14,851,576 | $31,430,570 |

With a European Union Medical Device Regulation (EU MDR) approval for its custom orthopaedic and cranial implants in hand, Osteopore (ASX:OSX) shares skyrocketed. This approval allows Osteopore to offer its custom-made implants alongside its already approved off-the-shelf neurosurgical and craniofacial products.

With the European orthopaedic market set to grow at 3.3% annually and the cranial implant market at 9.4%, Osteopore said it was well-positioned to take advantage of this demand. The company’s exclusive distribution deal with Zimmer Biomet further strengthens its presence, creating an opportunity for Osteopore to broaden its reach across Europe.

Red Sky Energy (ASX:ROG) reported some solid numbers coming out of its Block 6/24 offshore Angola, with a net 5.1 million barrels of contingent resources from the Cegonha oil field. There’s also an additional 11 million barrels of potential across three other prospects in the area.

Red Sky said it’s got its sights set on rapid production and cash flow. The company’s also eyeing a promising pre-salt structure under the Ibis prospect, with plenty of room for more exploration and growth.

With China’s latest move to restrict exports of medium and heavy rare earths, the spotlight has been thrown on Ionic Rare Earths’ (ASX:IXR) Makuutu heavy rare earth project in Uganda, positioning it as a potentially strategically important source of heavy rare earths outside of China.

The project holds one of the highest heavy rare earth percentage contents identified to date, with the resource dominated by yttrium, lanthanum, praseodymium and neodymium among a basket of other medium and heavy rare earth oxides.

Owner of online marketplaces Redbubble and TeePublic, Articore Group (ASX:ATG) has secured a new investment from Jencay Capital Pty Ltd, an Australian investment fund that has purchased 5.09% or just under 14.5 million shares in ATG in total.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 9:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -50% | 23,731 | $8,219,762 |

| MOM | Moab Minerals Ltd | 0.001 | -50% | 719,849 | $3,467,332 |

| CDT | Castle Minerals | 0.002 | -33% | 771,452 | $5,783,469 |

| OLI | Oliver'S Real Food | 0.004 | -33% | 1,142,378 | $3,244,392 |

| RAS | Ragusa Minerals Ltd | 0.016 | -30% | 739,618 | $3,279,772 |

| AOK | Australian Oil. | 0.0015 | -25% | 1,000,000 | $2,003,566 |

| RMI | Resource Mining Corp | 0.003 | -25% | 7,500 | $2,661,623 |

| TAS | Tasman Resources Ltd | 0.003 | -25% | 1,438,284 | $3,220,998 |

| ABE | Ausbondexchange | 0.031 | -23% | 26,333 | $4,506,725 |

| MEG | Megado Minerals Ltd | 0.012 | -20% | 1,651,243 | $6,295,249 |

| PKD | Parkd Ltd | 0.028 | -20% | 76,688 | $3,640,486 |

| AMS | Atomos | 0.004 | -20% | 1,800 | $6,075,092 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 280,000 | $7,870,957 |

| CTN | Catalina Resources | 0.002 | -20% | 5,539,285 | $3,790,655 |

| IPB | IPB Petroleum Ltd | 0.004 | -20% | 75,000 | $3,532,015 |

| OVT | Ovanti Limited | 0.004 | -20% | 3,002,000 | $13,507,739 |

| SPQ | Superior Resources | 0.004 | -20% | 7,378,003 | $10,849,319 |

| M24 | Mamba Exploration | 0.009 | -18% | 2,204,067 | $3,246,822 |

| MTM | MTM Critical Metals | 0.135 | -18% | 4,213,874 | $75,681,858 |

| BTC | BTC Health Ltd | 0.05 | -17% | 9,092 | $19,519,398 |

| ADO | Anteotech Ltd | 0.01 | -17% | 11,784,576 | $32,463,604 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 50,000 | $3,448,673 |

| BP8 | Bph Global Ltd | 0.0025 | -17% | 203,588 | $1,824,924 |

| EMU | EMU NL | 0.02 | -17% | 458,300 | $4,646,434 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 9,065,333 | $18,138,447 |

IN CASE YOU MISSED IT

An optimised Preliminary Economic Assessment (PEA) for the Root lithium project in Canada has increased its net present value by 22% to US$668 million for Green Technology Metals (ASX:GT1), also raising EBITDA to US$234m and after-tax IRR to 53.5%.

Pure Hydrogen (ASX:PH2) has gained access to Hydrexia’s mobile hydrogen refuelling stations and installation service support after inking a commercial agreement with the hydrogen technology solutions provider. The deal follows a landmark US$28m supply deal with Mexico City-based GreenH2 LATAM for hydrogen equipment.

Leveraging petrophysics, Riversgold (ASX:RGL) has confirmed the high chargeability and low resistivity of a sulphide copper-silver sample from the Saint John project in Canada, which also graded at 10.15% copper and 65.8 g/t silver. The results give RGL a strong geophysical signature to find more mineralisation via airborne surveys.

Caprice Resources (ASX:CRS) has gained a wealth of commodity and exploration expertise in the form of incoming non-executive director Robert Waugh, who played a pivotal role in bringing Musgrave Minerals from IPO, through several gold discoveries, until it was acquired by Ramelius Resources for more than $200 million.

In one of the last steps before producing battery-grade lithium carbonate, Anson Resources (ASX:ASN) has begun “polishing” 43,500 gallons of highly purified lithium chloride eluate produced at the Green River lithium project in the US.

At Stockhead, we tell it like it is. While Green Technology Metals, Pure Hydrogen, Riversgold, Caprice Resources and Anson Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX tanks 1.8pc, oil barrels over as 104pc tariff on China kicks in