Closing Bell: ASX climbs on banks and tech strength; world waits for US-China trade chat

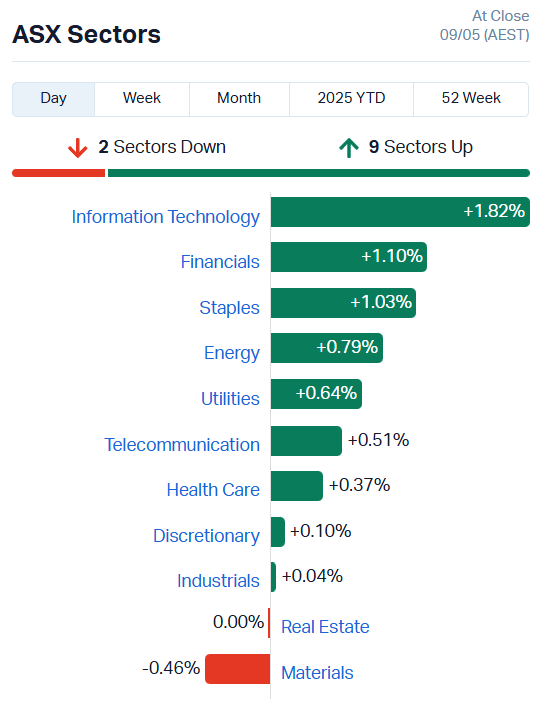

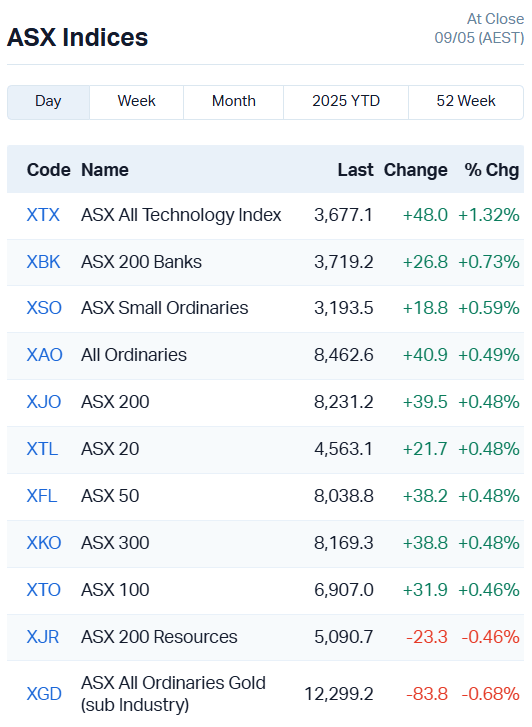

The ASX has posted a 0.48pc gain on the back of tech and banking stocks, while all attention turns to upcoming US-China trade discussions.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX lifts 0.48pc as attention turns to US-China trade talks

Info Tech leads gains, up 1.83pc with All Tech Index climbing 1.36pc

Materials lags behind, slipping 0.46pc

The ASX was significantly less squirrely today, seeming to gain confidence as it extended its upward trajectory at midday to finish up 0.48% overall.

Most of that momentum came from Info Tech (+1.83%) and Financials stocks (+1.10%) with much of the latter supported by upward movements from the banks.

Westpac (ASX:WBC) lifted 2.33%, Macquarie Group (ASX:MQG) 3.79% and QBE Insurance (ASX:QBE) 3.48%.

As for tech, there were some strong movements in the midcaps. Megaport (ASX:MP1) jumped 3.91%, Objective Corporation (ASX:OCL) 2.79% and Data#3 (ASX:DTL) 2.5%.

The Tech Index climbed 1.32%, while the ASX200 Banks nudged up 0.73%.

With trade talks between the US and China scheduled for this weekend, we may wake up on Monday to a very different market sentiment.

World awaits result of US-China trade talks

It feels a bit like we’ve all been forced to witness a giant game of chicken, one with a hell of a lot on the line.

The US Treasury Secretary Scott Bessent is set to meet with Chinese officials in Geneva tomorrow, with the goal of normalising trade between the two nations.

“I look forward to productive talks as we work towards rebalancing the international economic system towards better serving the interests of the United States,” Bessent said in a statement announcing the upcoming dialogue.

At present, the US and China are essentially in a trade embargo, with respective +125% tariffs making bilateral trade far too expensive to countenance for most businesses.

Analysts say it’s going to have a dampening effect on global growth. As expenses for US businesses grow, they’ll have less money to splash around in the rest of the world.

Neither party have shown any signs of backing down, with Trump shooting down rumours the US was considering reducing tariffs by half and Chinese Vice Foreign Minister Hua Chunying stating simply, “We have no fear”.

While there’s very little guarantee any real progress will be made in Switzerland tomorrow, many markets are betting there will be some kind of easing in tensions – or perhaps they think Trump will back down again.

Given how mercurial his moods – and therefore his policy – can be, it’s probably not the worst bet you could make.

The first signs of strain in the global economy are beginning to show, although the worst is certainly yet to come as inventories empty and stockpiles deplete in time.

The US is staring down the barrel of a serious stagflation threat, while China’s Politburo, its second-most powerful political body, has cautioned officials to prepare for “worst-case scenarios” due to the impact of “external shocks”.

What’s increasingly clear, is that while Trump and China play their zero-sum game, the rest of us are all losing.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GGE | Grand Gulf Energy | 0.004 | 100% | 12430706 | $5,600,774 |

| WEL | Winchester Energy | 0.002 | 100% | 1000000 | $1,363,019 |

| AYM | Australia United Min | 0.003 | 50% | 105099 | $3,685,155 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 2676335 | $3,253,779 |

| TMK | TMK Energy Limited | 0.003 | 50% | 16525088 | $20,444,766 |

| VPR | Voltgroupltd | 0.0015 | 50% | 667047 | $10,716,208 |

| FHS | Freehill Mining Ltd. | 0.005 | 43% | 1305474 | $11,317,347 |

| FIN | FIN Resources Ltd | 0.007 | 40% | 750767 | $3,474,442 |

| CMD | Cassius Mining Ltd | 0.022 | 38% | 1436420 | $10,840,090 |

| DDT | DataDot Technology | 0.004 | 33% | 1250000 | $3,632,858 |

| JAL | Jameson Resources | 0.04 | 33% | 49506 | $18,322,000 |

| TASDA | Tasman Resources Ltd | 0.02 | 33% | 430001 | $2,415,749 |

| PCL | Pancontinental Energ | 0.013 | 30% | 7495949 | $81,365,859 |

| ENV | Enova Mining Limited | 0.009 | 29% | 19761262 | $9,894,505 |

| KPO | Kalina Power Limited | 0.007 | 27% | 5094926 | $16,131,334 |

| VRX | VRX Silica Ltd | 0.057 | 27% | 1333575 | $33,628,648 |

| ASR | Asra Minerals Ltd | 0.0025 | 25% | 207082 | $5,412,094 |

| CAV | Carnavale Resources | 0.005 | 25% | 5191227 | $16,360,874 |

| RLL | Rapid Lithium Ltd | 0.0025 | 25% | 62500 | $2,489,889 |

| TEM | Tempest Minerals | 0.005 | 25% | 703479 | $2,938,119 |

| TNC | True North Copper | 0.185 | 23% | 861843 | $18,875,852 |

| TG1 | Techgen Metals Ltd | 0.0245 | 23% | 607703 | $3,173,314 |

| FRS | Forrestaniaresources | 0.047 | 21% | 25187100 | $11,699,995 |

| CRI | Criticalim | 0.018 | 20% | 9015158 | $40,326,729 |

| CUF | Cufe Ltd | 0.006 | 20% | 13681259 | $6,732,874 |

Making news…

Jameson Resources (ASX:JAL) just gave an update on its Crown Mountain hard coking coal project, and it’s looking pretty solid. A review by top technical advisers confirmed the project’s proven and probable reserves are still good to go, even with the shake-up in costs and coal prices.

Since 2020, inflation’s pushed up capital and operating costs, but the project’s still standing strong, said Jameson. Revised coal price forecasts and adjustments boosted its pre-tax NPV from US$469m to a massive US$942m.

Aureka (ASX:AKA) has just scored a major win by bringing on Jozef Story as its new exploration manager. Story’s no rookie, he’s fresh off four years at Barrick Gold as exploration manager, with over 25 years in the field, including stints at Fosterville and Castlemaine in Victoria.

CEO James Gurry is stoked, saying Story’s experience gives Aureka the edge to tap into its gold targets at Bendigo, Stawell, and St Arnaud.

Winchester Energy (ASX:WEL) has notched a definitive legal win in its battle with Westex Resources, after the courts dismissed all orders against the company.

Westex previously alleged Winchester had failed to meet agreed farm-in work commitments and attempted to claim damages. None were awarded, and WEL’s directors expect no further action to be taken related to the dispute.

Identification and security solution firm DataDot Technology (ASX:DDT) has netted a major Tier 1 Australian insurer as a customer through its Australian subsidiary, marking the second pilot agreement for the company’s PropertyVAULT technology.

The PropertyVAULT is a service designed to enhance the identification and recovery of stolen assets, targeted at insurance and insurance recovery sectors.

Tempest Minerals (ASX:TEM) has climbed despite launching an entitlement offer at a 9.5% discount to its 5-day VWAP price, seeking to raise up to just under $1.47m.

The company wants to channel those funds into exploration on its gold assets, as well as iron ore at the Yalgoo project.

TEM recently released an inaugural resource estimate for Yalgoo, coming in at 63.5Mt at 30.6% iron ore content.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DTM | Dart Mining NL | 0.003 | -40% | 12409271 | $3,438,820 |

| BUY | Bounty Oil & Gas NL | 0.002 | -33% | 1217227 | $4,684,416 |

| CRB | Carbine Resources | 0.004 | -33% | 1271859 | $3,310,427 |

| EDE | Eden Inv Ltd | 0.001 | -33% | 469000 | $6,164,822 |

| SKN | Skin Elements Ltd | 0.002 | -33% | 17,238 | $3,225,642 |

| FNR | Far Northern Res | 0.12 | -29% | 36562 | $6,845,190 |

| WBE | Whitebark Energy | 0.005 | -29% | 1464839 | $2,799,347 |

| MDR | Medadvisor Limited | 0.096 | -26% | 3806463 | $77,703,033 |

| AUK | Aumake Limited | 0.003 | -25% | 308600 | $12,093,435 |

| BNL | Blue Star Helium Ltd | 0.006 | -25% | 1507365 | $21,559,082 |

| PHO | Phosco Ltd | 0.054 | -23% | 136773 | $22,085,581 |

| KRR | King River Resources | 0.007 | -22% | 5071874 | $13,753,987 |

| TMS | Tennant Minerals Ltd | 0.007 | -22% | 282358 | $8,603,014 |

| AMS | Atomos | 0.004 | -20% | 730870 | $6,075,092 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 391664 | $15,867,318 |

| ENT | Enterprise Metals | 0.002 | -20% | 1 | $2,945,793 |

| JLL | Jindalee Lithium Ltd | 0.38 | -18% | 434473 | $35,628,915 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 4422914 | $10,904,117 |

| IFG | Infocusgroup Hldltd | 0.005 | -17% | 4087690 | $1,574,561 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 21521064 | $18,138,447 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 2707196 | $9,597,195 |

| RDS | Redstone Resources | 0.005 | -17% | 546336 | $5,552,271 |

| MDI | Middle Island Res | 0.018 | -14% | 782231 | $5,786,248 |

| CRR | Critical Resources | 0.003 | -14% | 1723221 | $9,149,774 |

| EAT | Entertainment | 0.006 | -14% | 500001 | $9,161,502 |

Trading Halts

VHM (ASX:VHM) – cap raise

Raptis Group (ASX: RPG) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX climbs on banks and tech strength; world waits for US-China trade chat