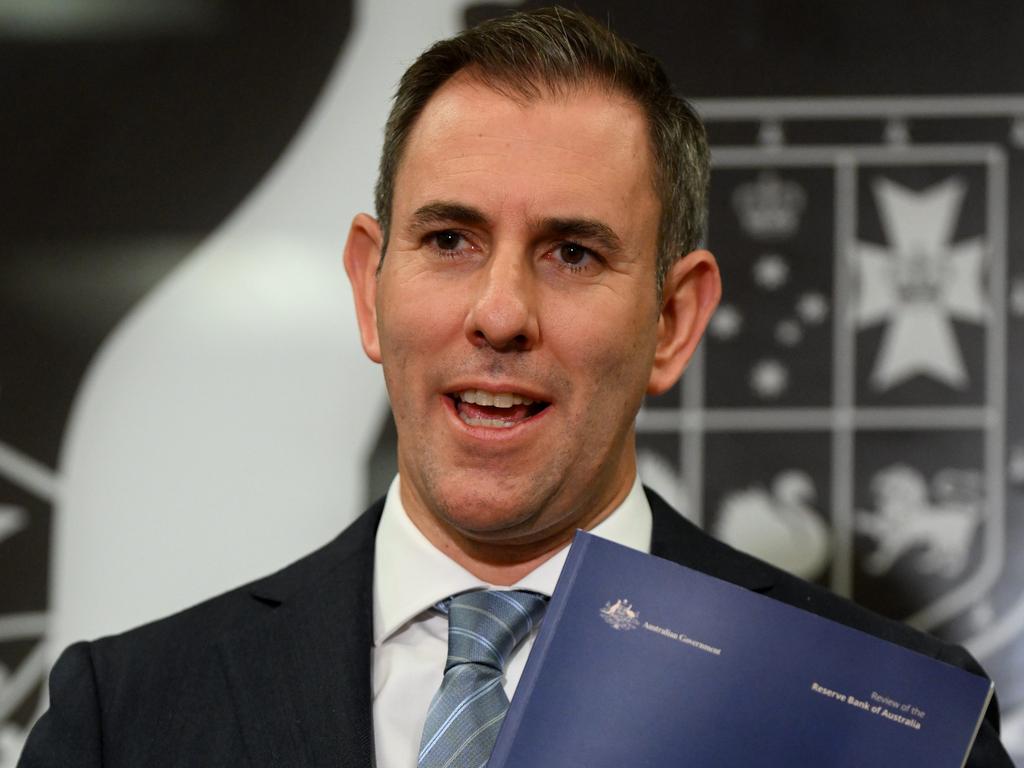

RBA delivers shock interest rate hike

Interest rates rise 25 basis points, the 11th hike in 12 months, as the Reserve Bank warns more must be done to control inflation.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The Reserve Bank of Australia has raised interest rates by 25 basis points in a shock move few financial experts predicted.

At its meeting on Tuesday, the board decided to increase the cash rate target by 25 basis points to 3.85 per cent – the 11th rise in 12 months.

The decision will heap more pain on households already struggling with cost of living pressures, however the RBA said the move was critical in bringing persistently high inflation under control.

“Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range,” the RBA noted.

“Given the importance of returning inflation to target within a reasonable timeframe, the Board judged that a further increase in interest rates was warranted today.”

The RBA said it would work to “keep the economy on an even keel as inflation returns to the 2–3 per cent target range, but the path to achieving a soft landing remains a narrow one”.

It acknowledged while some households had savings buffers, others were “experiencing a painful squeeze on their finances”.

“High inflation makes life difficult for people and damages the functioning of the economy,” the RBA said.

“If high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment.”

A record run of 10 consecutive rate rises ended in April when the central bank gave under-pressure households a short reprieve by keeping the cash rate unchanged at 3.6 per cent, but warned it would “reassess the need for further tightening at future meetings”.

The RBA on Tuesday reiterated more pain could come.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve,” it noted.

Deloitte Access Economics head Pradeep Philip said the RBA was playing “recession roulette”.

“The decision to lift the cash rate by 25 basis points to 3.85 per cent is unnecessary given 10 previous rate hikes are still working their way through the economy,” he said.

“Meanwhile, hundreds of thousands of mortgage holders are still to see their repayments surge as pandemic-era low fixed rates revert to variable, while businesses continue to be squeezed.

“With the recent independent review into the RBA reminding Australians that full employment sits alongside price stability in the bank’s mandate, it is important that the RBA exercises caution on rate rises until it has seen the impact of the last 10 fully pass through the economy.”

Compare the Market Money general manager Stephen Zeller said the RBA’s decision to raise the cash rate was a “necessary evil”.

“Even though we can see these aggressive rate increases have had some effect on inflation, we’re still nowhere near the target range of 2-3 per cent,” he said.

“A person with a $600,000 mortgage could be paying $1351 more each month than they were at the start of May 2022, so it really does pay to do your research and be prepared for that fixed rate cliff.”

Prior to the meeting market pricing suggested only a 12 per cent chance of a 25-basis-point rate hike at 2.30pm – while 18 of 25 economists surveyed by Bloomberg thought the central bank would keep rates unchanged.

Westpac chief economist Bill Evans expected the RBA to keep the cash rate at 3.6 per cent after scrapping his previous forecast of another 25-basis-point hike in May.

However, Commonwealth Bank tipped the central bank would deliver one final 25-basis-point rate hike, but noted “it looks a line ball call”.

The case for the RBA to leave interest rates on hold was strengthened last week when new data revealed inflation slowed over the March quarter, driven by a fall in the prices of fuel and goods.

The Consumer Price Index indicator rose 7 per cent annually in the first quarter, according to the Australian Bureau of Statistics.

Financial markets had expected the CPI to decrease from 7.8 per cent in December to 6.9 per cent in March, according to Bloomberg.

However, minutes from its April meeting reveal RBA board members remain concerned a surge in immigrants coming to Australia could make the challenge of reducing inflation more difficult.

Minutes from the meeting, when it opted to leave the official cash rate on hold at 3.6 per cent for the first time since May 2022, show that the central bank is worried about the headwinds strong population growth could have on its bid to return inflation to its target band of 2-3 per cent.

“Members noted that this could put significant pressure on Australia’s existing capital stock, especially housing, which would in turn manifest in higher consumer prices,” the RBA said.

“They observed that there were already signs that the recent fall in housing prices might be smaller and more short-lived than expected.”

Originally published as RBA delivers shock interest rate hike