Reserve Bank to get new rates decision charter in major shake-up

The RBA must give ‘equal consideration’ to achieving full employment and controlling inflation when making interest rate calls under a landmark plan embraced by Labor.

The Reserve Bank must give “equal consideration” to achieving full employment and controlling inflation when making future interest rate calls, under a landmark plan embraced by Labor that would ensure the governor is subject to greater oversight by independent experts.

Jim Chalmers announced on Thursday the government had accepted all of the 51 recommendations made by his hand-picked RBA review panel, in the largest shake-up of the central bank since the early 1990s when it adopted its modern inflation-targeting mandate.

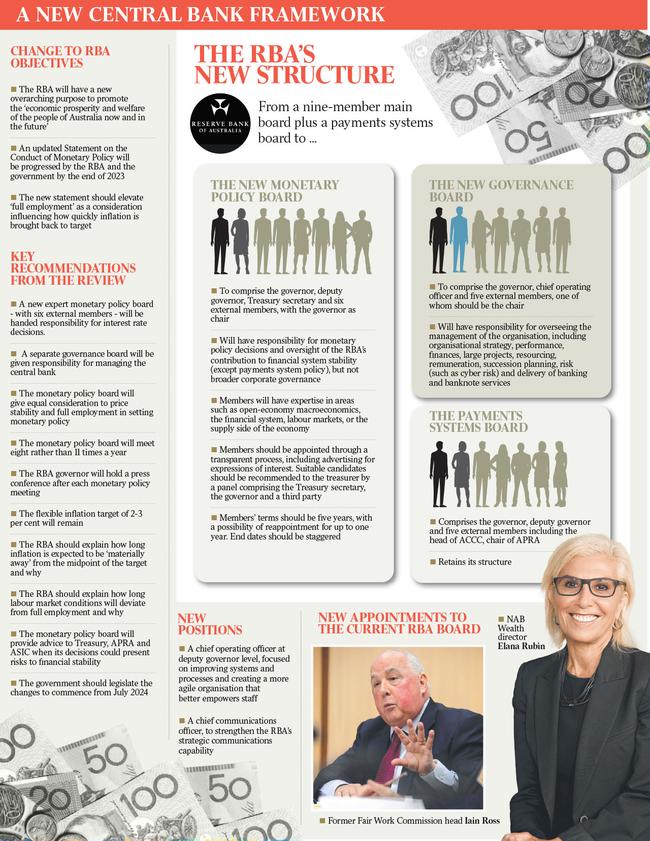

Under the overhaul, responsibility for interest rates would be handed to a new monetary policy board of nine experts, including six external members, with a separate governance board to take over the day-to-day management of the central bank.

The changes are aimed at increasing the role of external monetary policy experts, tempering the influence of the Reserve Bank governor – who would still serve as chair of the proposed monetary policy board – and providing better support for interest rate decisions.

The new board would meet eight times, instead of 11, each year, starting from mid-2024, to allow “more time to consider the issues and engage with RBA staff within each meeting cycle”, and a press conference would be called following each meeting.

The bank would also face new transparency requirements to provide details and data about its decisions and monetary policy strategy, with the creation of a new chief communications officer position.

The Fit for the Future report released by the Treasurer will drive an overhaul of the central bank, which has seen its credibility suffer over the past 18 months, most notably as a result of its botched guidance that rates would stay at virtually zero until 2024.

Dr Chalmers said the government would introduce legislation to make the required changes to the Reserve Bank act by the end of the year. He also announced two new appointments to the Reserve Bank board – former Fair Work Commission president Iain Ross and corporate director Elana Rubin, who both started at the ACTU specialising in occupational health and safety.

The Coalition responded by offering in-principle support for the review, but Peter Dutton sounded the alarm over the prospect of “union bosses with links into the Labor Party making decisions about people’s mortgage rates”.

“We need to make sure there are proper safeguards, that it is an independent process,” the Opposition Leader said.

With former ACTU secretary Bill Kelty – the last union member to sit on the central bank board – labelling some of the recent interest rate decisions as “absolutely crazy”, Dr Chalmers said the RBA was a “high-quality institution” that had made “a significant contribution to Australia’s economic performance over many decades”. “We want to make sure that Australia’s monetary policy framework delivers the right decisions and makes the right calls for the Australian economy and for the Australian people,” Dr Chalmers said.

“This review, its recommendations and our response is all about ensuring that the Reserve Bank is as strong and as effective as it can be now and into the future as well.”

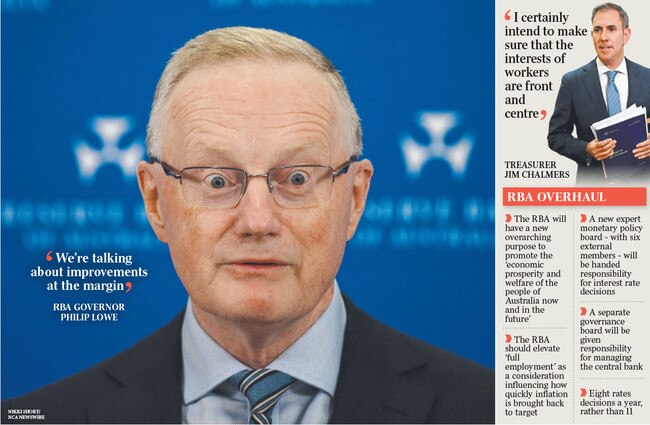

RBA governor Philip Lowe defended the existing board’s performance through a tumultuous few years, but accepted the recommendations of the panel.

“The idea that the board members sit there meekly and accept the recommendations that I put to them is very far from the reality that I have lived as the governor,” he said. “So that part of the review discussion didn’t really resonate with me. But I do hear them, and they say they would like to see more monetary policy and financial expertise on the board, and I understand why they are saying that.”

The review of the central bank found that the 2-3 per cent inflation target had “generally worked well over three decades”. However, “some modest improvements to the current framework and objectives” were needed.

Dr Chalmers said: “I certainly intend to make sure that the interests of workers are front and centre” in the central bank’s deliberations.

“I think that workers do deserve a voice around the Reserve Bank table, and I think that Iain Ross’s appointment today satisfies an important objective, which is to make sure that the wages and living standards of ordinary working Australians are considered and contemplated as the Reserve Bank takes its decisions.”

ACTU president Sally McManus said the central bank had not placed the same focus on employment outcomes as it had on inflation, and that the appointment of Dr Ross would bring to the board a much better understanding of the labour market. The RBA didn’t “really actually understand how wages work”, Ms McManus told Sky News.

Judo Bank economic adviser Warren Hogan and AMP Capital chief economist Shane Oliver said the RBA under Dr Lowe had demonstrated more concern over its full-employment objective than other central banks, and was prepared to hike less aggressively and take longer to return inflation to target.

Both economists argued the RBA review effectively endorsed this approach, with Dr Lowe himself arguing its recommendations would not “fundamentally change how the economy works” and only achieve “improvements at the margin”.

The greatest source of anger at the bank and its governor was Dr Lowe’s repeated guidance though most of 2021 that the cash rate would stay at the pandemic-emergency level of 0.1 per cent until 2024.

Instead, an unexpected surge in inflation in early 2022 triggered the first of 10 straight rate hikes in May.

The expert panel who conducted the review – Secretary for Public Sector Reform Gordon de Brouwer, former Bank of Canada deputy governor Carolyn Wilkins and ANU professor Renee Fry-McKibbin – made clear that the review was “not a judgment on the past six months”.

Dr Lowe also said he did not take the review process “personally”, despite the report’s focus on the period since his appointment in 2016, and the heavy criticism directed at him over the past year.

Dr Chalmers said he would make a decision by the middle of year on who would lead the RBA beyond September when the governor’s seven-year term expires. Most expect him to be replaced. In response to a question on his future, Dr Lowe said: “It’s entirely up to the government whether I continue to serve in this role after September. If asked to continue, I would.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout