Power prices soar as fuel costs, coal-power outages and increased demand hit home

Power prices surge two-thirds higher amid rising fuel costs, power station outages and increased demand as inflationary pressures hit the economy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Power prices surged two-thirds higher in the first quarter of 2022 amid rising fuel costs, power station outages and increased demand in the latest sign of inflationary pressures hitting Australia’s economy.

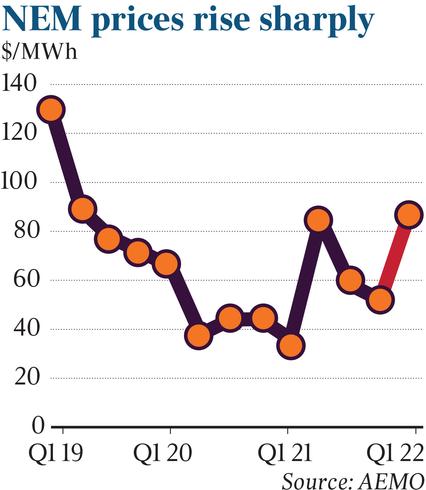

Wholesale electricity spot prices surged 67 per cent in the first three months of 2022 to average $87 per megawatt hour across the power grid, data from the Australian Energy Market Operator shows, from $52/MWh in the fourth quarter of 2021, in a trend that could filter through to higher household bills.

Prices have lifted substantially across the market since the end of March with second quarter futures lifting beyond $150/MWh across NSW, Victoria, Queensland and South Australia.

The Morrison government has a target for wholesale power prices of below $70/MWh in 2022 but a trio of market forces have dramatically lifted pressure on the market from a year ago when prices averaged just $36/MWh, marking some of the cheapest levels in several years.

Power station outages and high demand sparked high prices in coal-heavy Queensland and to a lesser extent NSW, while Victoria and South Australia were more measured.

The loss of one of AGL Energy’s Liddell coal-fired units and reduced output at Gladstone had contributed to the squeeze, along with planned outages at Eraring and Vales Point in NSW in the second quarter.

Queensland’s average price skyrocketed to $150/MWh, the second-highest level for any quarter since the national electricity market was created in 1998 and more than triple the level of a year ago.

A slump in black coal generation to its lowest first-quarter level since at least 2002 was partly to blame, although the price of coal that was traded in the system also contributed to market jitters. Black coal prices staged their biggest quarterly change in over two decades, coinciding with the surge in international coal to record levels this year, following Russia’s invasion of Ukraine.

Over 3000 megawatts of coal-fired power shifted above $60/MWh from low levels, which – combined with outages – piled pressure on prices.

“Wholesale prices in Queensland and NSW were again significantly higher than in southern states. This was due to the larger price-setting role of black coal generation and system security constraints limiting daytime electricity transfers from Victoria into NSW, despite an average energy price difference of $48/MWh,” said AEMO’s executive manager for reform delivery, Violette Mouchaileh.

Gas prices on the east coast remained high at just under $10 per gigajoule, underlining the pressure building on big industrial buyers of the fuel to keep a lid on costs. Russia’s invasion of Ukraine has seen Newcastle thermal coal prices soar to an all-time high. Along with elevated LNG prices, this has pressured the market, and given Australia’s role as a major exporter, this has a bearing on domestic gas prices.

“International energy prices remained volatile during the quarter, as the war in Ukraine and sanctions against Russia added uncertainty to markets already impacted by global supply constraints. Asian LNG prices averaged $40/GJ, $6/GJ lower than the previous quarter, while volatility and a peak price of $53/GJ in the quarter contributed to the continuation of high LNG exports,” AEMO noted.

“Thermal export coal prices averaged $367 per tonne, $116 per tonne higher than the fourth quarter of 2021 after briefly reaching a new $604/tonne record on 2 March, influenced by sanctions against Russia, a major global oil and thermal coal producer.”

Major power player AGL Energy warned last week that wholesale power prices will stay high for years as the power grid rolls through a bumpy transition, with higher coal and gas supplies and a rocky path to a renewables-led market.

Several years of rock-bottom power prices piled pressure on the big utilities, and along with surging renewable energy supplies and soft demand, was a reason for splitting AGL into two separately listed businesses.

More pressure could emerge in the current second quarter following the breakdown of a coal-fired generator at AGL Energy‘s Loy Yang A plant in Victoria.

The faster than expected exit of coal-fired power generation from Australia‘s power grid meant significant investment in replacement capacity was needed to ensure stability, Moody’s Investors Service said.

The closure dates for big coal plants in NSW and Victoria have been brought forward by AGL Energy and Origin Energy because of profitability concerns as solar and wind eat into margins.

A raft of supply issues have also emerged as a risk for power users. NSW faces an increased risk of blackouts by 2025-26, with Victoria and Queensland also set to be squeezed before the end of the decade due to uncertainty over whether enough generation will be online once Australia’s largest coal plant shuts down.

The decision by Origin Energy to accelerate the closure of NSW’s Eraring coal station to mid-2025, up to seven years early, has forced the Australian Energy Market Operator to revise forecasts. The plant accounts for 20 per cent of the state’s capacity.

It found that NSW faces a reliability gap or heightened risk of blackouts of 590MW by 2025-26, four years earlier than the 2029-30 gap identified by AEMO in August 2021 in its last electricity outlook report. While new generation such as EnergyAustralia’s Tallawarra B gas plant has been added, AGL Energy’s Hunter Valley gas turbine has been withdrawn by AEMO. Overall, some 1083MW of committed capacity has been added in NSW since its last report in August 2021.

Victoria may also be juggling a 330MW shortfall after EnergyAustralia’s Yallourn coal plant closes in 2028, while Queensland could be landed with a 770MW gap the following year in 2029-30.

Originally published as Power prices soar as fuel costs, coal-power outages and increased demand hit home