Bigger blackout risk with Yallourn shutdown, says AEMO

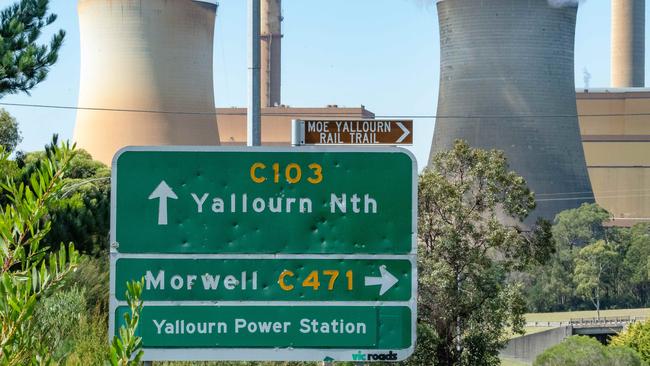

The early retirement of the Yallourn power station will mean bigger blackout risks across two states unless something can be found to fill the gap, say energy regulators.

Victoria and South Australia face a rising risk of blackouts by 2028-29 after the decision by power giant EnergyAustralia to bring forward the closure of the Yallourn coal plant.

The exit of Yallourn by 2028, four years earlier than its planned retirement date, will mean reliability standards are breached unless new on-demand generation is installed to replace the coal station‘s baseload capacity, the Australian Energy Market Operator said.

The power grid’s reliability measure “will be exceeded in both states in 2028-29 and 2029-30, unless there is further commitment of dispatchable capacity,” AEMO’s chief system design officer Dr Alex Wonhas said.

The decision to shut Yallourn, which supplies 22 per cent of Victoria’s electricity and 8 per cent of the national market, triggered a reassessment of AEMO’s Electricity Statement of Opportunities, which it uses to forecast the needs of the national electricity market.

The operator said in August the declining reliability of coal plants and the exit of the Liddell plant in NSW had raised risks later this decade and the closure of Yallourn has added to risks in both 2028-29 and also in the following year.

Still, the market operator ultimately expects enough new generation to be built with 5000 megawatts of capacity committed to be built across the national electricity market. EnergyAustralia has two big projects that will also go some way to filling the gap although AEMO said neither have yet met its commitment criteria.

EnergyAustralia will expand its existing Tallawarra gas power plant in NSW’s Illawarra with a 300MW facility while it also plans a 350MW big battery by 2026 at the Yallourn site.

“With the right market settings, more dispatchable capacity is expected to be built and address these reliability concerns. Pleasingly, additional projects have already been announced. While they are not yet qualifying under AEMO’s commitment criteria, they are very likely to proceed and will materially improve the forecast reliability outlook,” AEMO said in a statement.

More than 40 projects totalling nearly 4,900MW completed registration or began exporting to the grid last year, according to AEMO, while a further 300 generation and storage projects totalling 55,000 MWs are proposed across the power grid.

Coal, which currently provides 70 per cent of electricity, will contribute less than a third of supply by 2040 and is now widely expected to be forced out earlier than planned retirement dates as competition from renewables and carbon constraints render plants uneconomic.

Under the government’s preferred strategy, electricity retailers would pay the owners of dispatchable generators such as coal-fired, gas-fired and hydro plants as well as batteries to guarantee future capacity when the grid is facing periods of peak demand that threatens reliability.

The ESB‘s post 2025 reforms could see a radical shake-up of Australia’s power grid including mechanisms to ensure enough reliable generation is in place, more closely handling the exit of under threat coal plants and developing a national underwriting scheme to avoid states splintering on energy policy.

New measures suggest governments work with industry to identify back-up sites should coal plants suddenly exit due to technical failure and a new market assessment that would weigh whether coal stations could still operate commercially beyond an early closure date if the system requires it.

Energy Minister Angus Taylor has said the early closure of Victoria’s Yallourn coal power station raises reliability and price concerns while placing added pressure on the market to deliver new supplies.

The Morrison government has previously raised fears the closure in 2022 of AGL Energy‘s Liddell coal plant did not repeat the market chaos that ensued after the closure at short notice of Engie’s Hazelwood plant in 2017.

It will model the impact of Yallourn‘s early closure amid concerns over high bills.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout