What David Teoh did next: build another TPG

He turned TPG into a telco powerhouse. Now entrepreneur David Teoh is on another mission that will make his rivals flinch.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The reclusive Sydney billionaire David Teoh is quietly building another TPG. And he is bringing his original backers along for the ride.

Teoh suddenly quit broadband major TPG when it secured its mega-merger with mobile carrier Vodafone nearly two years ago, but he is again replicating the telco disruption model that delivered his wealth.

The plainly named telco junior TUAS owns and operates a national low-cost 4G network in Singapore under the Simba Telecom brand, and is now building out 5G services across the island. Back in the TPG days, the Australian telco secured a portfolio of spectrum allowing it to become Singapore’s fourth mobile operator.

Teoh’s move is significant to Australia because many of the pre-Vodafone shareholders in TPG also have exposure to his latest telco bet.

Singapore is a sophisticated telco market and Teoh is taking his battle to the home of one of the region’s biggest telcos, the Optus-owner Singapore Telecom. It is expected Teoh will use this as a base for regional expansion – particularly in Malaysia where the Sydney-based Teoh was raised.

TUAS was spun out of TPG as part of the Vodafone merger and shortly after Teoh emerged as the executive chairman and retained a key shareholding in the business.

Another long-time TPG supporter Robert Millner of Washington H. Soul Pattinson sits on board of the Singapore-focused telco giving it the support of his $10bn investment house.

“We’re happy to back him (Teoh), he’s got a very good track record of delivery,” Millner tells The Australian. “He’s got great vision on these sorts of things”.

Over the past year TUAS shares have surged more than 60 per cent on the ASX with the telco spin-off now closing in on a $1bn market capitalisation.

Full year numbers released by TUAS show a telco in the growth phase – although it still has a lot of costs ahead of it. Revenue over the past year jumped 67 per cent – albeit from a small base – to $57.4m However after just two years of operation it delivered its first annual pre-tax earnings $15.5m in the year to end-July from a loss in the previous year of $2.5m.

Closely watched subscriber numbers have now passed 600,000, increasing 195,000 over 12 months as Teoh pulls the same aggressive pricing strategy used in the early days of TPG which helped it become a dominant player in broadband. From a standing start, it now has around 6 per cent of Singapore’s mobile market, putting it on track to hit 10 per cent by 2025.

Further subscriber growth is expected to come with Singapore in recent months opening its borders to foreign workers, which will be a big market for the discounted mobile plans.

With a lower cost base, Simba’s plans are priced as much as 70 per cent below its rivals. In recent weeks, Teoh launched free international mobile roaming inclusions between Singapore and Malaysia in a package that offers 130GB of data for the equivalent of just $10.50 a month.

Building a 5G network across a concentrated market like Singapore comes at a lower cost of a national rollout needed in Australia, and TUAS is targeting 60 per cent coverage across the island by the end of next year.

However, there are risks on the horizon. TUAS’ portfolio of 5G spectrum remains limited which means it is vulnerable to congestion compared to other players, while much of future growth in tech-savvy Singapore relies on the pace of its 5G rollout.

Rivals such as Starhub are well advanced, and TPG’s pricing strategy could be blown out of the water if it is forced to rent spectrum from others. Teoh has a track record of mergers to deliver growth, which is how TPG evolved from a small, puckish internet service provider into the nation’s third largest fully integrated telco.

The Singapore business is being watched by big investors. Based on Morgan Stanley numbers, TPG shares delivered compound annualised growth of 18 per cent over the past decade.

Teoh is still one of the biggest shareholders in TPG with a $1.2bn stake and his son Jack sits on the board of TPG, keeping the family connection.

Kathmandu keeps it real

Michael Daly, the boss of retailer Kathmandu doesn’t want to sugarcoat the challenge his adventure wear brand faces as it looks to take a big step into the US and Canada.

He has labelled those hyper-competitive retail markets as a “graveyard” for many Australian and New Zealand brands that have tried and failed to get a foothold there over decades.

Daly is taking a cautious approach to the expansion of the retailer better known for its puffy jackets and vests and is planning for a soft launch in the US in coming months.

But it’s not all entirely a new market, with the trans-Tasman retailer already exposed to the market through its acquisition of surfware player Rip Curl three years ago.

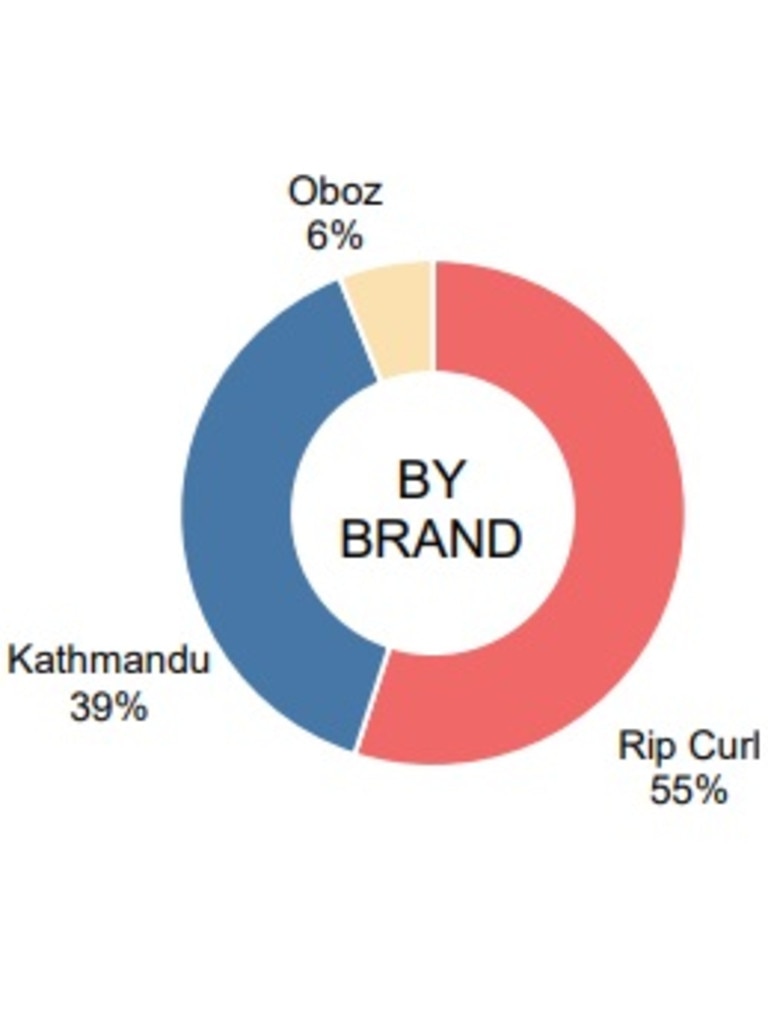

At the corporate level Kathmandu these days is called KMD Brands and the retailer sells around $200m in North America through Rip Curl and associated sneaker brand Oboz.

The big test will be if the existing Rip Curl salesforce is able to work with US wholesalers to sell Kathmandu products. If all goes well a specialist Kathmandu US website will be up and running within 12 months for retail sales and then a move into Europe will follow.

“The way I would tone our international expansion at Kathmandu is very much a soft launch approach at the moment,” Daly says. “Really it’s just testing our concepts and testing what works, getting some sort of brand awareness out there,” he says.

A full scale assault on the US market wouldn’t make sense with inflation there running hotter than Australia and US Federal Reserve warning or more super-sized rate hikes to come, stoking fears of a recession.

Kathmandu has been hit hard by Covid-19 lockdowns over the past few years. Sales have been crimped as more people stay at home, while supply squeezes impacted margins in the past two years. However, with mask mandates coming off in New Zealand last week and a bounce in fourth quarter sales, Daly is confident his retail business has turned a corner.

KMD on Tuesday posted a 6.2 per cent jump in full year sales to $NZ979.8m ($865m), although headline profit nearly halved to $NZ36.8m. Rip Curl has significantly changed the structure of KMD with more than half of its sales now coming from the surfware retailer.

The Kathmandu brand is also a useful barometer for tourism in Australia and New Zealand.

And at the moment, inbound tourism is still very quiet, with Kathmandu’s suburban mall-based stores all doing the heavy lifting in terms of sales.

“We just don’t think we’ve seen the European, American and the Chinese tourists return to Australia and New Zealand anywhere near the pre-Covid level, so that has a negative impact on our numbers”.

“We’re not getting those footfalls through the big CBD locations like Sydney, Melbourne, Auckland and Queenstown,” he says. But as more Australians and Kiwis want to travel, Daly is confident this will deliver consistent growth, particularly moving into the northern hemisphere winter.

johnstone@theaustralian.com.au

More Coverage

Originally published as What David Teoh did next: build another TPG