Iron ore soars as China boosts property but volatility a challenge for mining’s green ambitions

The price of iron ore surged again on Monday, but wild swings in commodity prices are posing a major challenge to the mining sector’s green ambitions.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Iron ore prices surged by close to 10 per cent on Monday, almost doubling last week’s gains, as Chinese authorities injected further stimulus into the country’s ailing property markets in a major boost for Australia’s biggest producers of the steelmaking commodity.

Iron ore futures contracts in Singapore were trading near $US112 a tonne late on Monday, up from $102.14 on Friday, after three of China’s biggest cities – Shanghai, Guangzhou and Shenzhen – announced over the weekend they were easing restrictions on home buyers in a bid to boost housing construction and activity.

The rally followed last week’s 11 per cent spike in prices, fuelled by Chinese authorities unveiling a raft of measures to boost the country’s flagging economy.

Jim Chalmers said the economic boost from Australia’s biggest iron ore buyer was overdue.

“It has been a considerable concern for me and for the government over a period of time now, that weakness in the Chinese economy, and you can see the way that markets have reacted to it, you can see the way that the iron ore price has reacted,” the federal Treasurer said on Monday. “I think it’s up about $US11 a tonne since this time last week.

“You can see that people were really hanging out for some additional steps from the Chinese government.”

As recently as last Monday iron ore was trading below $US90/tonne, amid a two-year slump weighed down by prolonged weaknesses in China’s economy and property market, and rising global stockpiles.

The federal government warned over the weekend that softer prices were likely to hit the country’s iron ore export earnings, which are forecast to fall from $138bn in 2023-24 to $107bn in the current financial year and $99bn in 2025-26.

Miners including Fortescue, BHP, Rio Tinto and Mineral Resources all traded higher on the brighter outlook, adding to last week’s sharemarket surge.

Mineral Resources led Monday’s gains, closing 5.9 per cent higher at $52.04, while BHP was up 2.7 per cent to $45.96, Fortescue rose 2.9 per cent to $20.68 and Rio Tinto finished the day 1.3 per cent higher at $129.13.

While China’s stimulus measures, announced over the past week, offer an improved outlook for exporters to the world’s biggest consumer of the steelmaking ingredient, the wild swings in prices also underline the financial uncertainty facing miners as they balance their operational requirements with the need for major long-term investments.

A KPMG report released on Monday says that increasing commodity price volatility remains one of the biggest obstacles to investment in decarbonisation projects.

The accounting firm’s 2024 Global Metals and Mining Outlook, based on a survey of more than 450 mining and metals executives and industry leaders, found that commodity price volatility has increased over the past 10 years, with the increase becoming more pronounced over the past two years – both in terms of input costs and output prices.

It says the uncertainty is making it harder for mining companies to press ahead with major decarbonisation projects, despite an “urgent” need for the industry to lower its carbon emissions.

“Greater price volatility is … the result of abrupt changes in the external environment. This makes it more difficult to predict and adapt to short-term trends in the business environment while focusing on long-term decarbonisation goals stretching into the next two decades,” the report says.

Two-thirds of executives surveyed by KPMG say the volatility of output prices has increased in the past two years, and 53 per cent say input price volatility has increased.

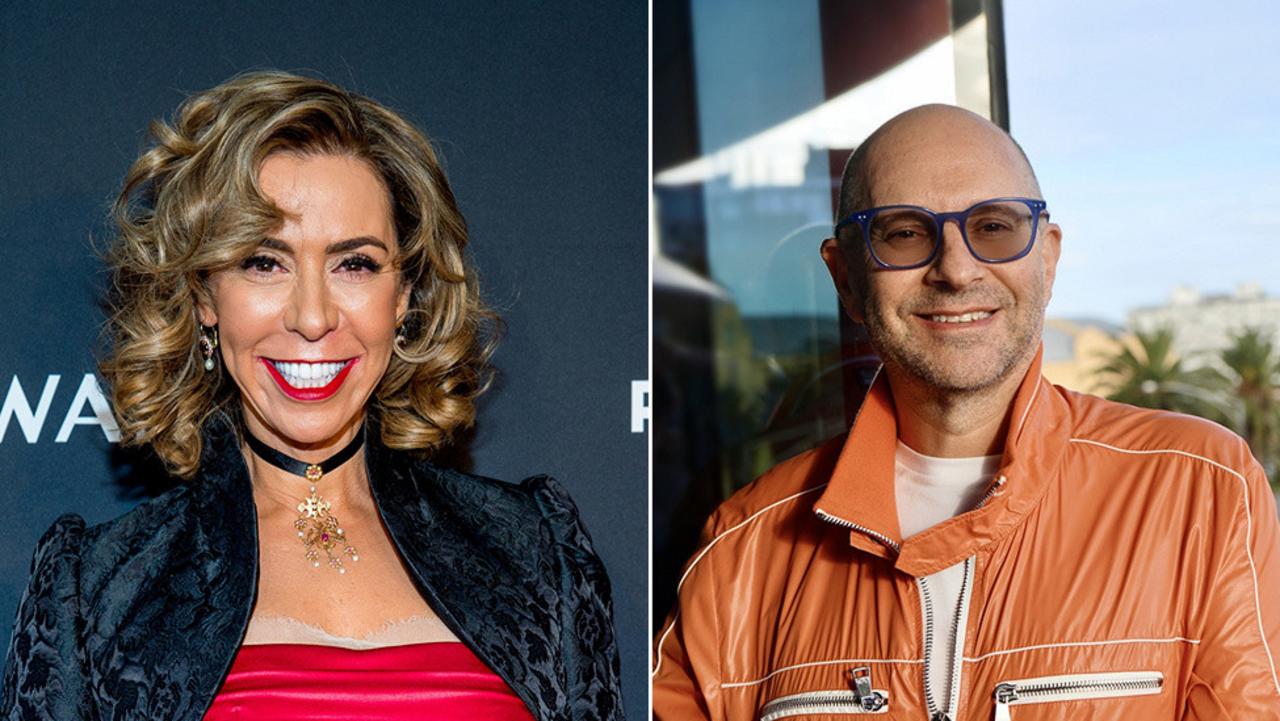

KPMG’s global mining lead Trevor Hart said many companies remained wary of committing to major investments during periods of financial uncertainty.

“The last time there were such elevated levels (commodity prices) was prior to the Global Financial Crisis of 2008-09, when increased capital expenditure and higher cost structures led to subsequent asset writedowns,” he said.

“Much of the past decade has been spent rebuilding balance sheets. Executives should bear this in mind as they invest in new technology and decarbonisation projects.

“A focus on productivity gains, technology deployment and funding strength are more important than ever.”

The Minerals Council of Australia aims for the industry to reach net zero emissions by 2050, in line with the goals of the Paris Agreement.

However some miners are promising swifter action, with Fortescue last week releasing a new “real zero” decarbonisation plan, detailing how the company plans to eliminate Scope 1 and 2 emissions by 2030 without voluntary carbon offsets and without carbon capture and storage.

Despite some progress across the industry, KPMG’s report says greenhouse gas emissions remain “stubbornly high, demanding urgent action”.

It says volatile commodity prices are just one of the obstacles facing mining companies as they look to decarbonise, with heightened geopolitical tensions, skills shortages and uncertainty over new technologies also posing as significant challenges.

“New technologies require new talent and there is a skills gap in meeting decarbonisation goals,” Mr Hart said.

“Increasingly, major mining companies operate in remote locations and are rolling out significant training programs, or they are building alliances with educational institutions in the countries where they operate.

“Mining companies must understand what skills they need and have a plan on how to acquire them. This is one of the key challenges for the sector in Australia and globally now and in the next five years.”

According to the report, 55 per cent of survey respondents say the most effective measure to help their company meet its decarbonisation objectives is investing in new technologies such as green hydrogen-based direct-reduced iron (DRI) steel production.

More Coverage

Originally published as Iron ore soars as China boosts property but volatility a challenge for mining’s green ambitions