Investors watch on as US Federal Reserve cuts rates, RBA holds and China surprises

What are Australian investors meant to make of a flurry of economic activity in the world’s major markets?

This past fortnight has delivered quite a bit for investors to absorb.

The US central bank, the Federal Reserve, implemented a bigger-than-expected 50bp easing last week.

We also saw the Chinese central bank surprise markets with a package of measures designed to shore up growth.

And on the same day as the Chinese policy measures were announced, the RBA held the line on interest rates, leaving the cash rate unchanged.

What are investors meant to make of all this?

First, to the US. The US central bank is underpinning – to the extent it can – a soft landing for the economy. The Federal Reserve wants to support the labour market such that the increase in the unemployment rate from here is modest. To do so, policy needs to be considerably less restrictive than is currently the case; hence the need for a 50bp easing.

On the Fed’s current forecasts, the unemployment rate is expected to rise just 20 basis points from current levels by the end of 2025. Next year, GDP growth is expected to be a little above the economy’s long-run trend growth rates. And inflation is forecast to be pretty much at target by the end of next year. If you think that sounds like Goldilocks, then you know your fairy tales well.

This presents investors with something of a conundrum. If the Federal Reserve delivers an economy that reflects its current set of forecasts, then bond markets are probably mis-priced and bond prices may need to fall. But if bond prices fall (and bond yields rise), then equity markets – already on expensive valuations and close to record highs – might look vulnerable.

The other way to think about this conundrum is to say that if the Federal Reserve needs to deliver all the rate cuts currently priced by the bond market, then the economic reality is likely to be such that US equity markets won’t sustain elevated valuations and optimistic earnings estimates.

In contrast to the Federal Reserve, the RBA remains resolutely on hold. The arguments are well known – the RBA tightened less than others, has made less progress on disinflation relative to peers and still has a relatively tight labour market. Data released last week revealed that the economy has added 311,000 jobs in the first eight months of the year and that the unemployment rate remains low, at 4.2 per cent.

But there are pockets of weakness in the domestic economy, such as household consumption. Indeed, the RBA explicitly noted the possibility of downside risks to the economy should the expected pick-up in consumption be slower than anticipated.

But in the end, the RBA held the line: there was no change to policy and the bank expressed the need to remain vigilant to upside risks to inflation. However, there was some acknowledgment that the demand side of the economy had been a little weaker than expected. And so for the first time since March, the governor revealed in her press conference that the board did not explicitly consider the case for a rate hike.

From here, leading indicators of consumption and the labour market will be important for the outlook. Without further slowing in both of these indicators, the case for lower rates will remain elusive.

For investors, the key message is that rate relief is not coming soon. Australia’s central bank is diverging from others because it has so far delivered better labour market outcomes, less disinflation and has had a lower policy rate.

All else equal, this means that the Australian dollar should continue to outperform G10 peers. It also implies there is no urgency to switch floating rate fixed-interest exposures in portfolios to fixed-rate bond exposures.

Finally, it means exposure to sectors in equity markets that usually benefit from lower rates should be implemented in offshore markets. For example, relative monetary policy outcomes suggest there is not a compelling case for Australian small caps to outperform their US counterparts.

Moving on to China, one somewhat unexpected development last week was the announcement of a package of stimulus measures by Chinese authorities. These measures were larger than anticipated and represent the largest easing by the Chinese central bank since 2015. They included cuts to lending rates, a cut to banks’ reserve ratio, and new central bank-sponsored measures to support the stock market. Later in the week we heard more from Chinese policy makers, suggesting an intention to use fiscal policy to support the economy.

The measures are a positive step to try to address China’s shortfall in domestic demand and depressed private-sector sentiment. At the moment, they are providing some near-term support to commodity prices, the Australian dollar and the ASX200 resource sector.

But they are not the full answer to China’s economic woes. Complementary fiscal expansion is required to give investors confidence that Chinese authorities are serious about delivering growth consistent with the 5 per cent target. Ideally, part of the fiscal initiatives must be aimed at lowering the inventory of unsold homes in China.

Lowering the cost of credit doesn’t work if there is no demand for credit because prospective homebuyers are worried about a further fall in house prices. In contrast, supporting a quantity adjustment via lower inventories should go a long way in starting to change expectations about house prices.

At a minimum, these policy measures take out the downside risk to domestic resource stocks from lower commodity prices. But whether they deliver a sustainable lift to China’s economy will depend on policy makers’ intentions to complement recently announced measures with meaningful fiscal stimulus.

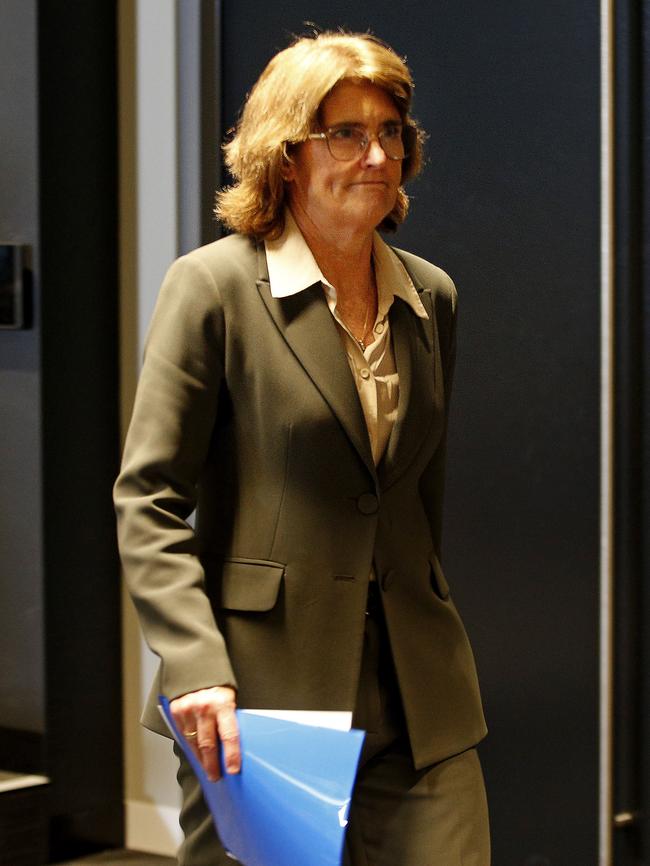

Sally Auld is the chief investment officer at JBWere.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout