‘Horrendous’ rule to change after Queensland home buyers left thousands of dollars out of pocket

After home buyers lost tens of thousands of dollars in property deals gone wrong, a rule is about to be changed. But there’s a major catch.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A controversial rule used in Queensland’s property transactions is going to change after it left home buyers destitute.

On Monday, the Real Estate Institute of Queensland (REIQ) flagged that it would be releasing a new edition of the Houses and Land and Residential Community Title on January 20 next year.

In most other Australian states a two-week grace period is given if a property settlement deadline can’t be met in time, but not in Queensland. The contract can be terminated immediately.

And once the contract is torn up, the Queensland vendor is legally entitled to pocket the purchaser’s entire 10 per cent home deposit, meaning the buyer can lose everything.

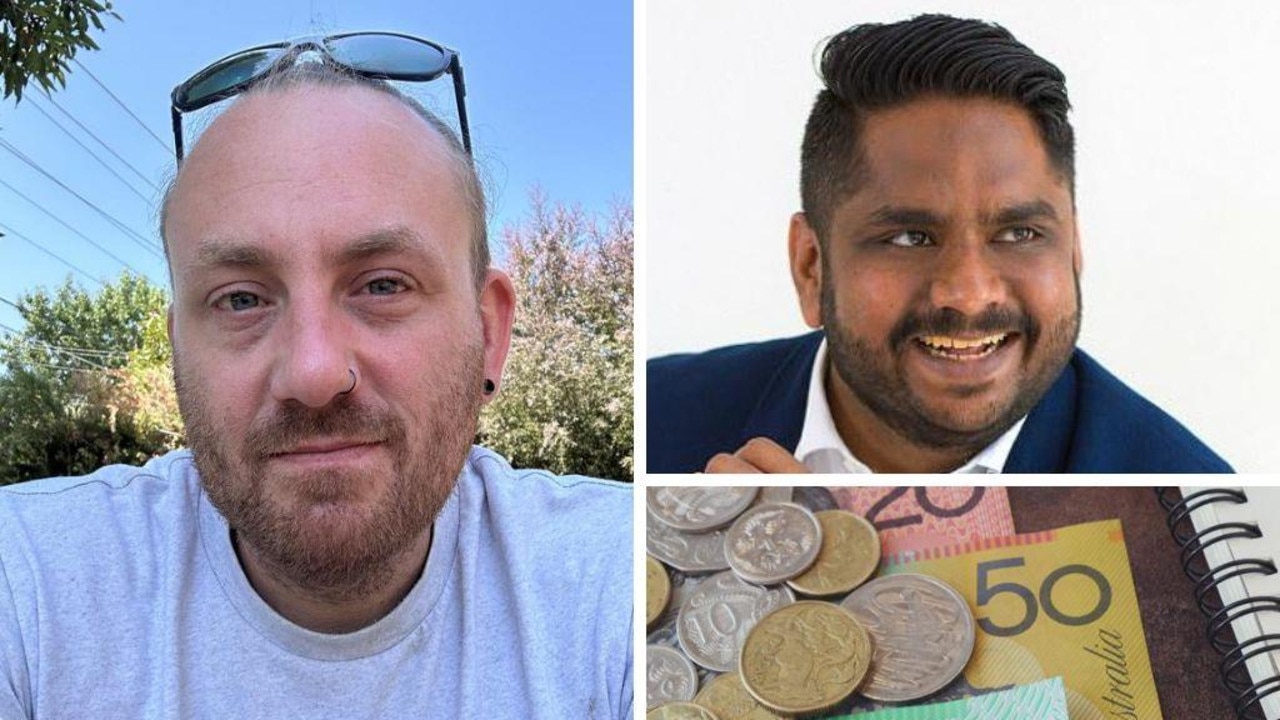

Last month, news.com.au reported on engaged couple Mark Trau and Maddie Goyder losing a $75,000 home deposit – that they had been saving up since teenagers — because a manual error meant their bank was 24 hours late at settling.

In an even more extreme case, Brisbane epidemiologist Dr Loretta McKinnon lost her dream home after the Commonwealth Bank delayed by 13 minutes on the date of settlement.

The amendment to the contractual requirements of a Queensland property deal will change this “sudden death” rule however, there’s still a major catch.

REIQ chief executive Antonia Mercorella said the state's contractual requirements were changing after her institute heard about deals falling through at the 11th hour.

“Because of the volume of transactions that’s happening and because of Covid-19, banks are often causing delays. What we’ve been seeing is that banks are often not ready. Obviously we recognise that is outside the control of either party,” she told news.com.au.

Ms Mercorella explained how Queensland prided itself on being the state with the “swiftest” property transactions, with most settlements taking just 30 days whereas other places usually require six to eight weeks.

“It’s the envy of many other jurisdictions,” she said.

Accordingly, Ms Mercorella has still allowed for a faster turnaround in the new contract provision compared to other states.

New standard property contracts must still be based around “time being of the essence”, she warned.

Instead of being given two weeks’ grace, Queensland property sellers or buyers are allowed a maximum of five extra business days to get their settlement in order.

The buyer or seller who can’t meet the deadline must apply for an extension in writing before 4pm on the day they were meant to settle.

More than one extension notice may be given but the settlement date nominated in the notice cannot be later than five business days after the original day.

“It is a contractual right, you can’t say no [to the extension request],” Ms Mercorella assured once the new rule came into effect.

That’s something that both Dr McKinnon and Mark Trau wished had been in place when they embarked on buying their very own homes.

Dr McKinnon, whose $29,000 home deposit is in limbo after a three-month legal battle with her vendor, said: “The fact that this rule is changing shows it’s really punitive on buyers.”

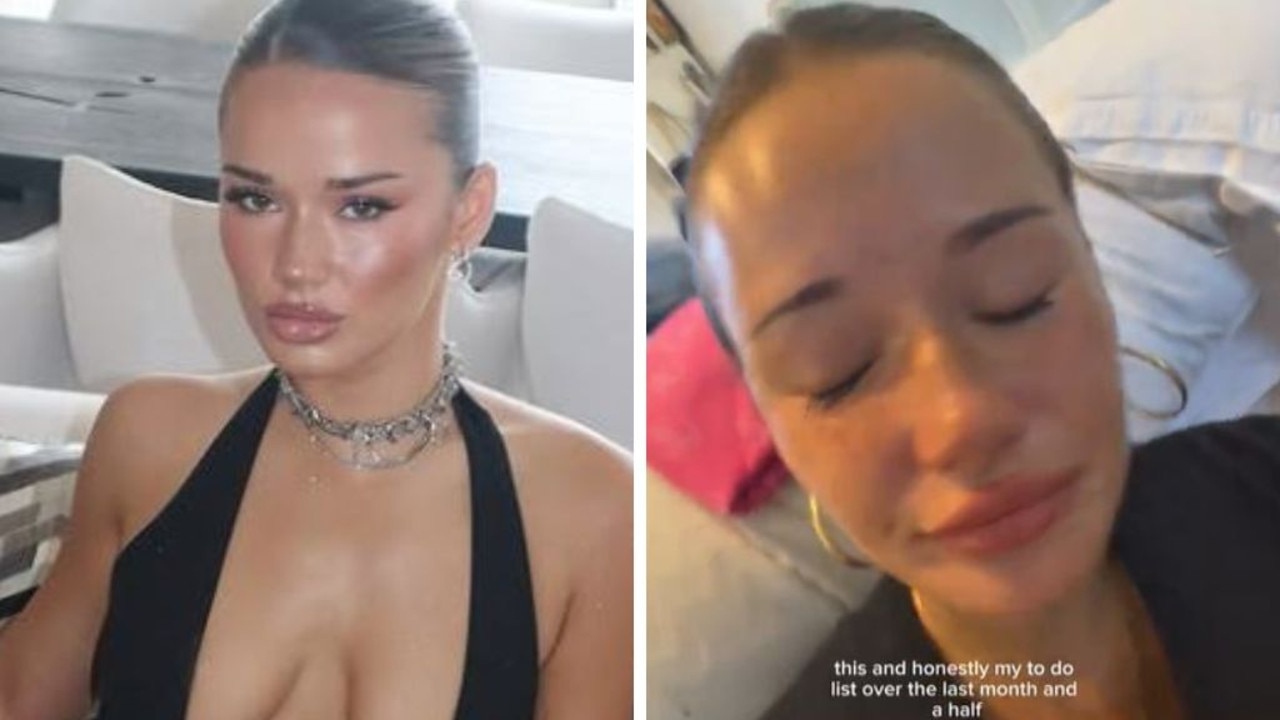

The 43-year-old epidemiology academic paid $580,000 for a three-bedroom, one-bathroom Brisbane home that was meant to settle on September 22.

However, she claims the Commonwealth Bank was too late to finalise the settlement because an incorrect box had been ticked in the documents.

By the time the bank fixed the mistake and the documents were processed it was 4.13pm, 13 minutes after the settlement deadline. As such, the contract was terminated after the seller refused to grant an extension.

“Thirteen minutes was what broke the deal,” Dr McKinnon said.

She believes the vendor was unwilling to extend the deal even by such a short amount of time because the house next door sold $200,000 higher than what Dr McKinnon had won the auction with, just two weeks later.

Against the backdrop of the nation’s property boom, she assumes the vendor expected they could get a lot more money from another buyer.

Dr McKinnon has also had to shell out tens of thousands in legal fees and is facing homelessness if the conflict isn’t resolved, because she is currently renting on the property she was planning to buy.

“I am losing thousands of dollars every week from the fallout,” she added. “I can’t eat, sleep or function. Many days I stay in bed and cry … So horrendous.”

The Commonwealth Bank has offered her $10,000 in compensation to cover her legal fees even though Dr McKinnon says her total losses amount to hundreds of thousands of dollars.

"We understand the settlement of the property Dr Loretta McKinnon had wished to purchase did not complete," a CBA representative told news.com.au.

"Unfortunately, necessary information required to complete settlement was not provided in a timely manner as per industry agreed settlement standards. Given these delays it was not possible for us to save settlement late in the day despite the efforts of our team.

"We understand the disappointment that a customer experiences when a settlement does not complete. We encourage customers to ensure that their agent ensure settlement materials are provided on a timely basis, especially in Queensland given state specific settlement requirements.

"CBA remains willing to work with Dr McKinnon to resolve her concerns."

Meanwhile, young Brisbane couple Mr Trau and Ms Goyder, aged 30 and 27, are all too familiar with the bizarre rule in Queensland’s property law.

Mr Trau said he was making “a number of frantic calls” as he saw the settlement deadline looming at the end of September for the $965,000 two-storey house in Brisbane where he was planning to start a family, but his bank, Westpac, wasn’t ready.

He made two pleas to the sellers, first for a week-long extension on settlement, and then a single day extension. Both were rejected and unfortunately, the settlement lapsed.

“It wasn’t until the next day at 11am Westpac said they were ready for settlement,” Mr Trau recalled.

By then, it was too late. The sellers were already looking at other offers.

The sellers then made a request for the $75,000 belonging to Mr Trau and Ms Goyder to be released to their accounts.

“It was part of the money we’d been saving up from the beginning of our working lives,” Mr Trau said.

“It [the $75,000] was everything. We’re not from wealthy families. We haven’t had any handouts from family, no second cousin’s aunty has passed away and left us a massive inheritance. We’ve worked hard for 10 plus years.”

The vendors ended up walking away with their home deposit and sold the house within hours of the purchase falling through for an extra $65,000. In all, the sellers made an extra $140,000 but then claimed to have lost most of it in legal and real estate fees.

“We didn’t know anything about this [law] until it stung us,” Mr Trau said.

He said he welcomed the new contractual obligations with open arms because “it seemed like Queensland law was almost archaic, the biggest thing was everything is skewed towards sellers.”

If the new contactual rules had been put in place earlier, “we would be living there [our dream home] right now,” he added.

“The market is moving so fast, we’re being left behind with what we can afford. We’re still renting, we’re still looking.”

Knowing the recommended contract is changing has heartened the young couple.

“We will feel so much better about buying our next house, we’d always have this in the back of our mind of happening again,” he said.

Westpac compensated Mr Trau and Ms Goyder with a $100,000 payout and apologised for their banking error.

Law change years in the making

Professor William Duncan, an expert in property law at the Queensland University of Technology, said changing this rule had been a discussion spanning back years.

“In a sense, it is sudden death in Queensland. The time of the settlement is critical in Queensland,” he previously told news.com.au.

He said the 14-day grace period given in other states “saves this kind of this thing from happening. Little things can go wrong, which is not the fault of either party”.

In other states, it takes a little longer to settle, between six to eight weeks compared to four or five weeks in Queensland on average.

“The law in NSW (and other states) is probably a little better,” he said. “I see nothing wrong with a longer period. This has been talked about on and off for years.”

Have a similar story? Continue the conversation | alex.turner-cohen@news.com.au

Originally published as ‘Horrendous’ rule to change after Queensland home buyers left thousands of dollars out of pocket