Brisbane couple loses $75k house deposit to ‘perfect storm’

The young Brisbane couple felt “numb” when they realised they’d lost their life savings and their dream house thanks to a big bank mistake.

A Brisbane couple has been left devastated after losing their hard-earned $75,000 house deposit to a “perfect storm” that involved “greedy” sellers and a screw up from their bank.

Mark Trau, 30, and Maddie Goyder, 27, are warning other aspiring homeowners what to look out for after losing a huge chunk of their cash to unfortunate circumstances.

The pair, who have been together for more than 10 years and recently got engaged, were looking to buy a home in Brisbane where they could start a family.

They offered $965,000 for a 564 square metre two-storey house in Jindalee, with four bedrooms, two bathrooms, and a pool.

The sellers gladly agreed however at settlement on October 20 their bank, Westpac, wasn’t ready in time.

As a result, the deal lapsed and legally the sellers were entitled to their entire deposit.

Instead of listening to their pleas to extend the deadline, the owners were happy to pocket their $75,000 and sell to somebody else afterwards, according to Mr Trau.

“It was part of the money we’d been saving up from the beginning of our working lives,” he told news.com.au.

“It [the $75,000] was everything. We’re not from wealthy families. We haven’t had any handouts from family, no second cousin’s aunty has passed away and left us a massive inheritance. We’ve worked hard for 10 plus years.”

Mr Trau said he was making “a number of frantic calls” as he saw the settlement deadline looming at the end of last month.

“My solicitors had said if we don’t settle in time — as in Queensland contracts, time is of the essence — you can be liable to forfeit your deposit,” he explained.

In most other Australian states you have a two-week grace period if your settlement goes under. Not so in Queensland.

He also made two pleas to the sellers, first for a week extension, and then a single day extension. Both were rejected, causing him to suspect an “ulterior motive”.

Unfortunately, the settlement lapsed.

“It wasn’t until the next day at 11am Westpac said they were ready for settlement,” Mr Trau recalled.

By then, it was too late. The sellers were already looking at other offers, he was warned.

The sellers then made a request for the $75,000 belonging to Mr Trau and Ms Goyder to be released to their accounts.

“People when they see money signs in front of their face can throw all humanity out the window, and not worry about anyone else but themselves,” Mr Trau said.

“Especially nearer to the end when there was an indication that we needed a slight extension and they saw the chance to get more money.”

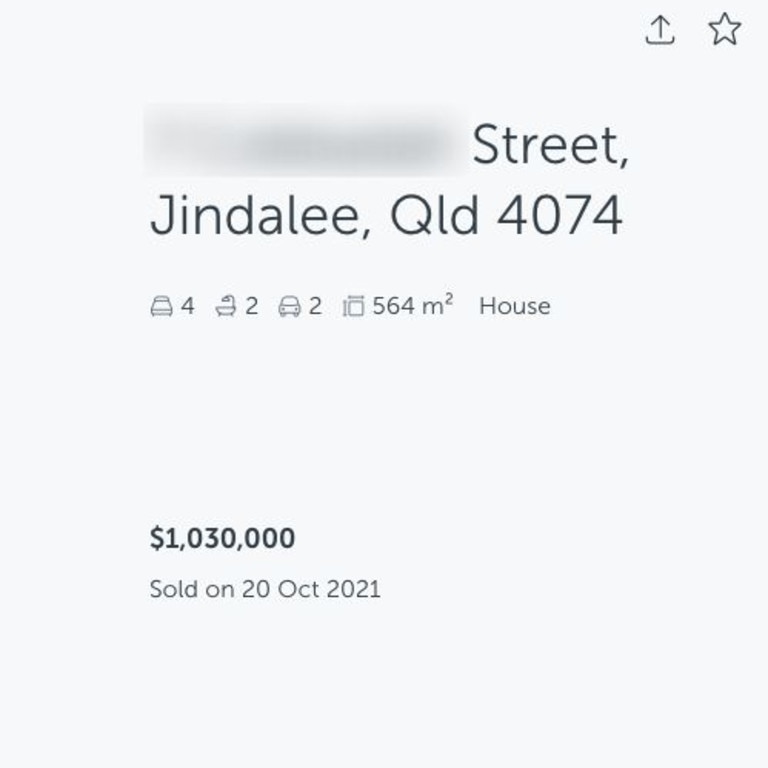

The property ended up selling for $1,030,000, with the date of the purchase listed as October 20 — the same day Mr Trau’s deal feel through.

He suspects the sellers must have signed their new deal later that night.

Overall, the sellers walked out with an extra $140,000 in their pocket compared to the original deal — $75,000 from the deposit and an extra $65,000 from the higher purchase price — while Mr Trau and Ms Goyder were left destitute.

“It changed dramatically what we were able to afford,” he said.

“We were very close not having somewhere to live for a day or two.”

The couple, with Mr Trau working as a public servant and Ms Goyder a primary school teacher, faced homelessness as they couldn’t afford anywhere else and planned to surf couches from friends and family.

Luckily a rental came through at the last minute.

The newly-engaged Brisbane man said he didn’t know who to blame more — the bank or the sellers.

“You almost didn’t know who to be angry or annoyed at, it was the perfect storm of the bank being only slightly late for administrative processes, then you’ve given these sellers a very strong hand … and they’ve used it as a money grabbing tactic,” Mr Trau added.

He described the “numb” feeling he got when he realised they’d lost the entire deposit.

The distraught couple even sent “the most heartfelt letter” to the sellers “about what that money means to us, where we’ve come from” but got no response.

Luckily, it all worked out for the young couple.

They alerted Westpac to their plight and the bank agreed to reimburse them as they acknowledged they had made a manual processing error.

This week, Mr Trau and Ms Goyder were given $100,000 by the bank. The cost covered the deposit as well as their solicitor fees. The bank also factored in $5,000 each for the stress and anxiety it caused them over the last few weeks.

A Westpac spokesperson said in a statement to news.com.au: “We apologise for the experience this couple had while trying to buy their home.

“We’ve done a review of this case and worked with our customers to quickly resolve the issue and put it right.

“While we are limited on what we can say due to privacy, we will continue to work with our customers to support them as they look to buy a home.”

As for the sellers, news.com.au contacted their solicitor’s agency to pass on our questions but never heard back from the now very cashed up homeowners.

alex.turner-cohen@news.com.au