RBA makes huge call on interest rates

After a six week reprieve, Australians will learn today whether interest rates will rise again.

After a six week reprieve, Australians will learn today whether interest rates will rise again.

Releasing its fresh quarterly forecasts, the central bank painted a gloomy picture on the path for inflation, with one essential cost for many playing a key role.

Releasing its fresh quarterly forecasts, the central bank painted a gloomy picture on the path for inflation, with one essential cost for many playing a key role.

Homeowners are feeling the pinch of the cost-of-living crisis, with the number of loans past due at ANZ increasing double digits.

With inflation still out of control, the International Monetary Fund has sounded a dire warning about the global economy. See what could follow the cost of living crisis.

Fresh forecasts have painted a grim picture where the inflation remains higher for longer but the Treasurer is optimistic Australia will avoid one thing.

Australians have been hit by the cost of living crisis with one major expense set to explode in coming months.

One of Australia’s top banking executives has given new insight into the grim future for countless homeowners.

When talking mortgages, this is the most common argument trotted out by Boomers. But it doesn’t prove anything.

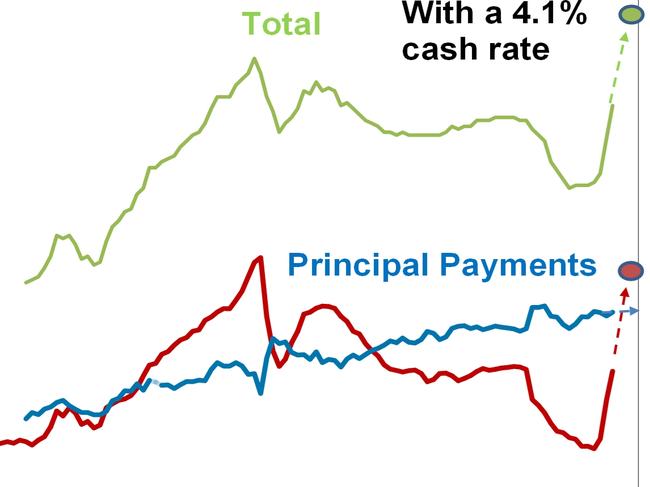

Nearly 900,000 Aussies could be in for bill shock when their cheap pandemic fixed-rate home loan expires by the end of the year.

A shift in how Aussie households are made up is only adding to a major rental crisis gripping the nation, Philip Lowe says.

The Reserve Bank has sounded the alarm on the amount Australian homeowners will soon be making in mortgage repayments.

A Sydney family are cutting back on subscriptions, shopping at Aldi and selling their Lexus for cash as their mortgage is set to double.

The RBA governor has warned interest rate rises are “not over” if inflation remains stubbornly high.

Original URL: https://www.thechronicle.com.au/business/economy/interest-rates/page/90