How you pay for small business $1.7bn a year card fees

Small businesses are desperate to change laws to give them a “fair go” as they are being crippled by fees, which have forced some to pass them on to customers, while others don’t have a choice.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

Small and medium sized businesses are paying an extra $1.7bn in card fees compared to the big end of town, a new analysis of Reserve Bank data reveals.

RBA data shows that Australia’s smallest businesses, such as cafes and convenience stores, are paying about three times as much to process transactions as big players like supermarkets.

While businesses with less than $1m in annual sales pay an average of about 1.5 per cent to process transactions, those with turnover of more than $10m are paying an average of just 0.5 per cent.

The huge gap – equivalent to $4.6m a day – has prompted self-described “payment nerds” and small business advocates to form a new group, Independent Payments Forum Australia, to fight for lower fees and a better deal.

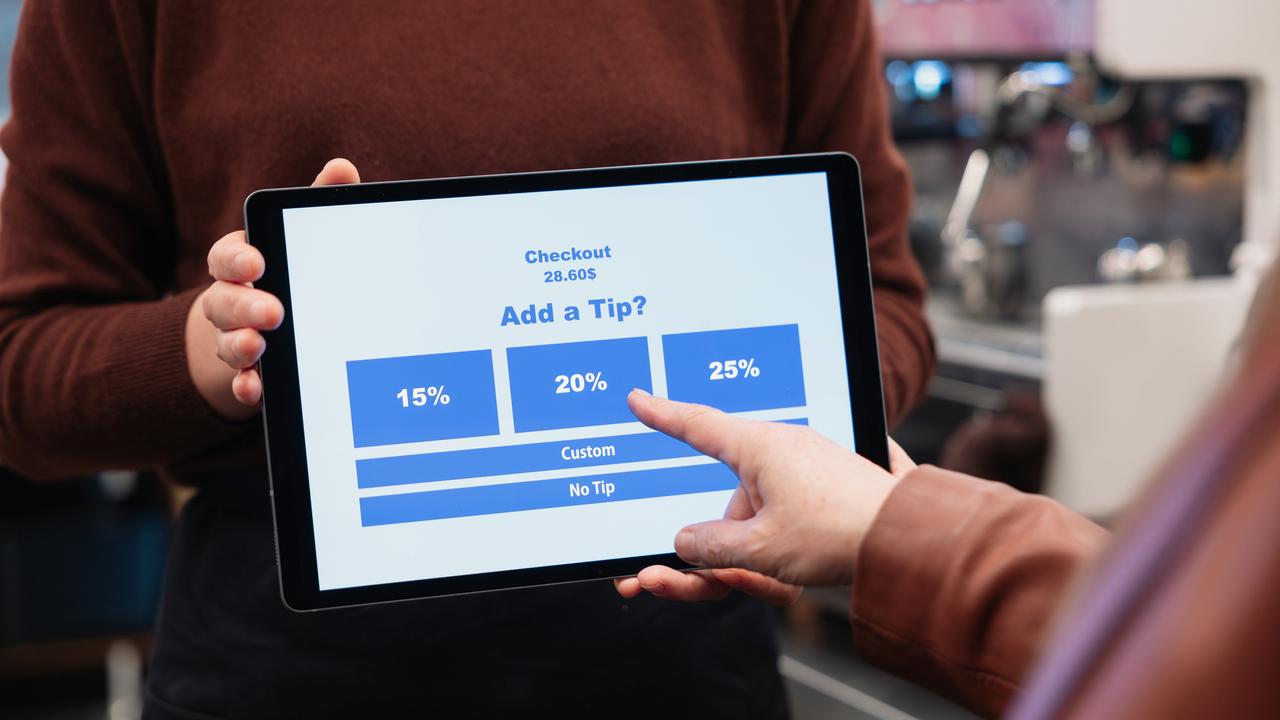

Consumers suffer from the higher fees because small businesses pass on the costs, payments consultant Brad Kelly, who is one of IPFA’s founders, said.

“Unfortunately, the big players in payments have very deep pockets and armies of lobbyists to represent their positions,” he said.

“We think there’s an urgent need to insist that payment fees and regulations are kept fair, and that networks provide reliable services, as our society moves away from cash.”

He said small and medium businesses were paying more because banks and payment providers haven’t properly implemented a policy called “least cost routing”, where transactions are supposed to be funnelled into the cheapest available channel.

This is usually eftpos, which according to RBA data costs an average of 29c for a $100 debt purchase, while Visa and MasterCard costs an average of 51c for the same transaction – or even more if credit is used.

The RBA has declared that getting least cost routing working is a priority, but many parts of the payment system are still not using it.

“The knock on effect is that we all pay for it, through higher prices for goods and services,” Mr Kelly said.

Melissa Murphy, the owner of Suntop Plaza cafe in Melbourne suburb Brunswick East, said she paid 1.6 per cent per transaction to Square, a US payment provider run by Twitter founder Jack Dorsey.

“I don’t pass it on,” she said.

“It just means you’re not making as much money as people think you are because of the cost of your coffee.”

She said she preferred cash but has to offer card payments because customers want it.

“It (cash) means reconciling every day is more challenging and takes more time, but also when a producer comes up and drops off produce you pay them cash and you’re done,” she said.

IPFA’s other founders are former Australian Retail Association chief Russell Zimmerman and two other payments experts Warwick Ponder and Peter Drennan.

The group said it was working closely with other industry groups including convenience stores and small businesses.

“Businesses and their customers are doing it tough, and we need to ensure that payments remain affordable for everyone as cash usage declines,” Australian Association of Convenience Stores boss Theo Foukkare said.

“There is no doubt that the cost of debit payments for many small businesses is crippling. We simply don’t have the right rules in place to ensure we’re getting a fair go.”

Council of Small Business Organisations Australia chief executive Luke Achterstraat, said that because most Australians were struggling with the cost of living “we must improve our payments system so small businesses and consumers can keep more of their money in their own pockets”.

Mr Ponder said the IPFA’s analysis was based on a total value of transactions in Australia of about $1tn a year, the market share of small and medium sized businesses and the card fees that RBA data shows they pay.

The Australian Competition and Consumer Commission is currently suing MasterCard, alleging it undermined competition on fees by striking sweetheart deals with 20 big retail customers as the prospect of least cost routing being introduced loomed in 2017.

The deals allegedly gave the big players cheaper rates in return for using MasterCard’s network to process payments.

MasterCard denies doing anything wrong and the case, which is shrouded in secrecy, is set for trial in the Federal Court next March.

More Coverage

Originally published as How you pay for small business $1.7bn a year card fees