Woman loses $40,000 in minutes after getting a simple text

A Melbourne woman has issued a chilling warning after $40,000 was stolen from her bank account after she received a simple text.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

A woman who lost $40,000 after getting a simple text, even though she called her bank fearing it was a scam, has issued a blunt warning to other Aussies.

Melbourne woman Harmony Antoinette was relaxing at home when she received a “strange” notification pop up on her phone asking her for a code.

Feeling suspicious, she decided to ring Commonwealth Bank directly to find out what was going on.

Having worked in financial services for 14 years, she knew the risk of scams – but sadly, it was too late.

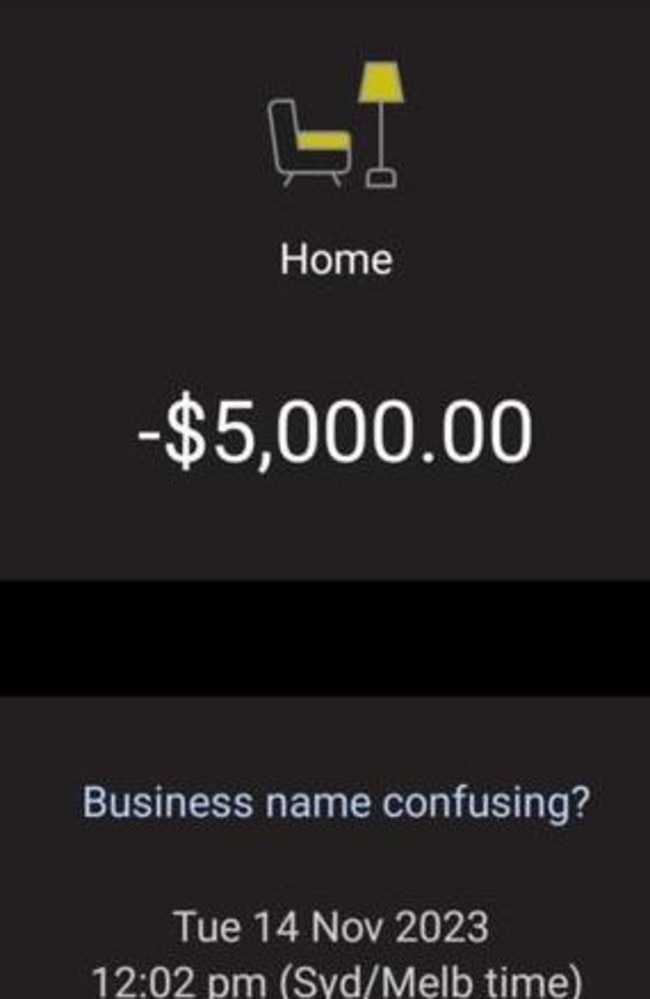

In less than an hour, Ms Antoinette had $40,000 taken out of her bank account.

“I called CommBank straight away, and within five minutes after getting those notifications my account was supposed to be blocked,” she told 7News.

“The lady I spoke to was lovely and reassuring and told me I had called in time and that the transactions could be reversed because I’d called so quickly, and she was very apologetic.

“The notification gave me a prompt to enter a code but instead of doing that I just called my bank.

“But there were no calls beforehand and no phishing links or cryptocurrency that looked dodgy.”

Ms Antoinette explained that she had no idea how this could have happened to her but did have one possible theory.

She said she had recently donated her old phone to an e-waste program in Melbourne, prompting her to think that this could have increased her risk of being scammed.

She claims she was told her online banking had been reset, but on the way to work began receiving concerning emails from different retailers.

“I got another notification that a transaction had been initiated by my wallet ID,” she said.

“One was from Catch (.com.au) about a purchase of over $2000 and the other one was from JB Hi-Fi about an attempted purchase they had rejected due to suspected fraud.”

Have you been the victim of a scam? Get in touch: jasmine.kazlauskas@news.com.au

She contacted the CBA fraud department and claims she was told that it seemed she had made the purchases.

“I explained this was not the case,” she explained.

“What motive would I have to make purchases and then state I didn’t? “

CommBank was able to reverse half the transaction, with $20,000 put back into her account overnight.

The other $20k was made of merchant deductions and is currently still missing.

She now fears being further victimised online, believing her personal information and identity may have been breached.

“I thought it would be OK because I’ve banked with CommBank for 14 years,” she said.

“I thought it should show that I’m a legitimate customer. But they were just making me feel like a criminal.”

After changing all her personal details online, Ms Antoinette proceeded to lodge a complaint with the Australian Cyber Security Centre.

“Why would I cause myself this much stress if I’d done this on purpose?” she said.

“I am really scared for my safety and my identity.”

While it is not clear what exactly occurred, it is believed that after donating her phone, a third party was able to access her device and passcodes registered to a CommBank Tap & Pay.

The disputed transactions were therefore not detected as suspicious as they were linked to a device which had been associated with her banking profile for three years.

A CBA spokesperson said that the bank “acknowledges the impact of scams on customers and the community broadly”.

“In this instance, the disputed transactions were made from a device registered to the customer’s CommBank app. As such, the transactions were not detected as suspicious or unusual,” they told 7News.

“We encourage customers to be vigilant and protect their personal information.

“Customers should remove the CommBank app and restore a device to its factory settings to erase all your personal data, including any passcodes before disposing of, giving away or selling a device.

“Customers can also deregister the CommBank app on another device within the app.”

The spokesperson added the bank is “continuing to engage directly with the customer in response to her complaint concerning the disputed transactions”.

News.com.au has reached out to Commonwealth Bank for comment.

Originally published as Woman loses $40,000 in minutes after getting a simple text