‘Blow your brains out’: Scammer’s chilling threat after stealing $130k

This is the chilling moment a smug scammer taunted and threatened a Sydney man after stealing $130,000 of his savings.

A devastated businessman has shared the chilling moment a scammer taunted and threatened him over the phone after stealing $130,000.

Sydney man Paul Trefry said his “stomach dropped” when he realised he had been duped in a sophisticated phone scam last month.

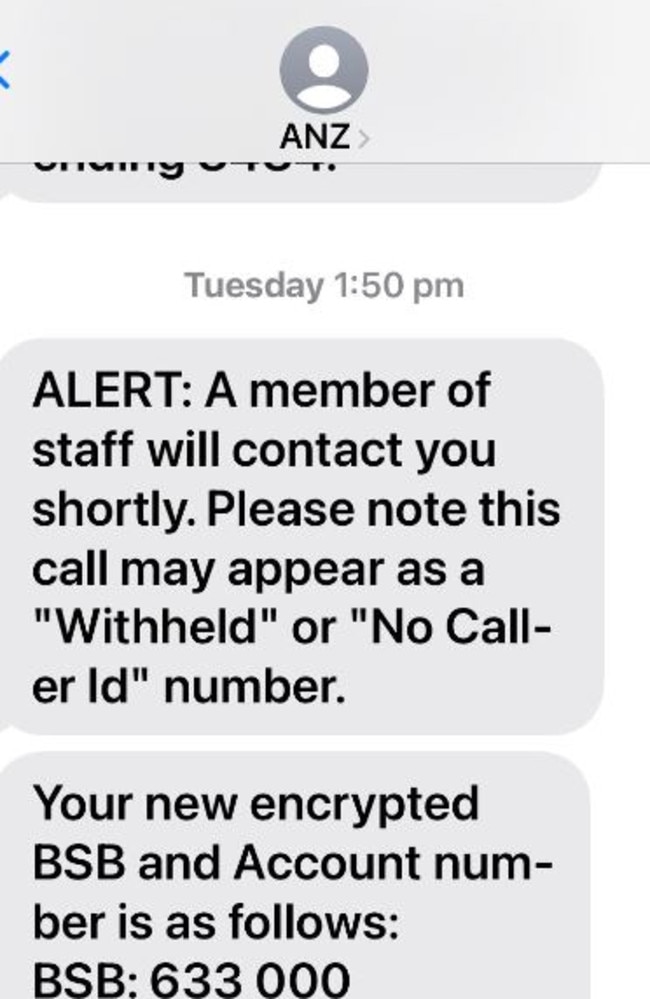

The 56-year-old sculptor explained that he had received a concerning text, which appeared to be from his usual bank ANZ, suggesting that his account was compromised.

The text urged him to ring a number in order to secure his account - which he did.

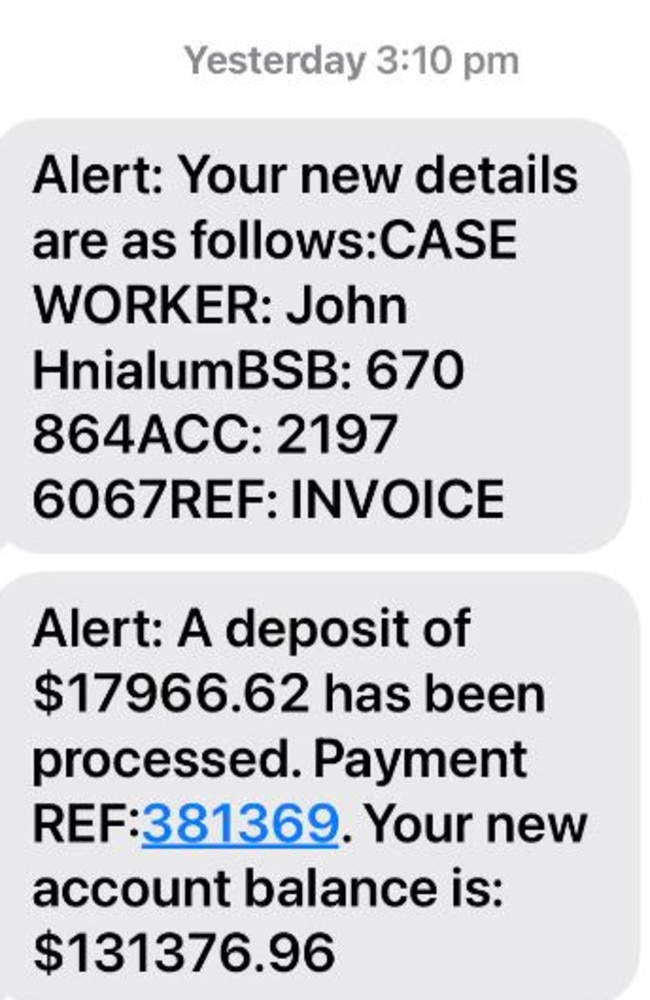

The ‘agent’ on the phone claimed to be from ANZ and directed him to transfer his savings into another bank account in order to “keep it safe”.

But in reality, it was simply the start of an elaborate and sophisticated scam.

“I got a text message from ANZ, it was in the same thread as all the previous texts I’d gotten from them,” Paul told news.com.au.

“It contained the same messages such as your new card is on the way and things of that nature. So I thought it was legitimate.

“The text said my business account had been compromised and that someone tried to put a deposit on a BMW in New Zealand. There were also two other attempts to withdraw money.

“They said I had two options. Either I could cancel my card and it would take a week to get a new one, or I could transfer the money into a new account.

“Running a business, I use my credit card daily. I couldn’t be without it, so I went for the second option.”

Paul explained that he is usually quite on the ball when it comes to scams, but did not realise this was one due to how legitimate it all appeared.

However, he then got a call from ANZ after they noticed the unusual activity on his account.

That is when he was told the unthinkable: he had been scammed.

“My stomach dropped”

“I couldn’t believe it,” he said.

“The guy on the phone was unbelievably courteous and knowledgeable. He had a British accent, which is not what we usually think of when we think about scams.

“I transferred the money over a few days, it all seemed so legitimate. Then I got a phone call from the real ANZ, and they were asking about one of the withdrawals.

“I said well I have just been doing what you guys have told me to do. He then said that ANZ would never ask a customer to transfer money into another account.

“They asked me if the man had a British accent, and I said he did. Then he explained it was a really sophisticated scam that had been going around for a while.

“I got this sinking feeling in my stomach and realised I had just been done for over $130,000.”

“How does it feel?”

The scammers had arranged to call Paul back under the guise of helping him transfer more money for safeguarding.

However once Paul realised what was happening, he decided to record the call and unbelievably, the two men involved confessed to stealing his $130,000.

But instead of simply hanging up, the duo began cruelly mocking and taunting Paul over what they had done, even telling him what they had spent his hard-earned cash on.

In the full recording obtained by news.com.au, one scammer can be heard laughing that he was about to go on a holiday with the money, while the other bragged about spending Paul’s money on prostitutes and cocaine.

The scammers also claimed to have purchased Paul’s personal details for just $20.

Have you been the victim of a scam? Continue the conversation: jasmine.kazlauskas@news.com.au

“You’ve been robbed of $130,000 at this point in time, how does that make you feel?” one of the scammers taunted.

“It was great dealing with you Paul, thank you. I am probably going to take a vacation very soon.

“I bought your details for $20, then I called you and swindled you.”

“Do you want to know what I did with most your money Paul?” the other bragged.

“Shall I tell you how I spent most of your money? The first thing I did was buy a prostitute and cocaine.”

When Paul asked him where he lived, the scammer responded with a vile death threat.

“I’m loading here, I’ve got a sawn off shotgun with your name on it,” the scammer threatened.

“I’m going to shoot you in the f**king face. I’ll blow your f**king brains out Paul.”

They even went so far as to wish Paul’s mother a “horrible death” along with other vile threats that are too explicit to include in this article.

Paul said is he not worried about the threats but hopes that the brazen criminals behind the elaborate plot can be one day brought to justice.

Since losing the money, he has had to make the difficult decision to lay off one his contractors and is unable to pay himself a wage at his business.

Instead, he is working for nothing in order to get back to a financially stable position.

Paul added that he believes the banks could be doing more when it comes to raising awareness about scams.

“I just wish ANZ were better at letting customers know about this type of thing” he said.

“I know there is some information on their website somewhere, but I wouldn’t be checking there unless I had thought I’d been scammed.

“If they had only sent a text message or an email about it, I would be aware. But I honestly had no idea this was an issue.

“I am thankful that they were able to recover some of the money, but I still feel sick that I have lost so much.

“I hope nobody else has to go through this, but it happens every day to so many innocent people.”

ANZ’s response

ANZ Head of Customer Protection, Shaq Johnson, told news.com.au that the particular scam that Paul had been victim of was particularly callous.

“All scams are appalling, but this example particularly demonstrates the callousness of these sophisticated international criminal networks,” he told news.com.au.

“Scams are an insidious problem which impacts the entire community, and we are working closely with other banks, other industries and government as we tackle this society-wide issue.

“In this case, our customer was alerted to this scam by our customer protection teams after it was identified by our scam and fraud security settings.

“We successfully reversed one large payment, and recovered a significant sum from another financial institution that had received the funds. We continue to liaise with the other financial institution to see if the remaining funds can be recovered.

“This matter is currently being reviewed by the independent Australian Financial Complaints Authority. We will continue to actively engage with AFCA during this process.”

Mr Johnson explained that ANZ had a number of measures in place to stop scams from occurring.

“We have a range of measures in place to protect our customers from fraud and scams, including our Fraud Detection Teams and systems which operate 24 hours a day, 7 days a week and identify thousands of suspicious transactions every day,” he said.

“We review our scams and fraud prevention settings daily, as sophisticated scammers frequently change or amend their methodologies.

“In recent times Australia has seen an increase in sophisticated scams where criminals impersonate Australian organisations, including banks.

“These scammers try to panic their victims, may convince them to reveal security information like PINs or one-time passwords, and may ask them to transfer funds to a different account.

“ANZ will never ask our customers to share their card number, PIN, password, registration numbers, or a one-time password for payments. We will never ask our customers to transfer money to another account.”

He added that ANZ was aware of the rise of “spoofing” as a scam tactic.

“Unfortunately SMS spoofing, where a scammer purports to be sending an SMS from a legitimate organisation, has been a common criminal tactic across Australia in recent months,” Mr Johnson explained.

“These do not originate from official channels. To address this, ANZ is working to put in place measures to prevent criminals from adopting the ‘ANZ’ label.

“We have also worked to alert our customers to this specific tactic by pushing alert messages directly to all customers that use our internet Banking or ANZ App to warn specifically against this type of scam.

“Since December 2022 our homepage has also carried an alert for customers specifically regarding the increase in fake phone and text scams.

“We always attempt to recover funds customers have lost to scams or fraud. However, the ability to recover funds depends on a number of factors including whether they are transferred to another financial institution, how quickly it is reported to us and the speed in which funds are then on-transferred by scammers. In many instances, cyber criminals on-transfer funds within minutes, or use them to purchase cryptocurrency.

“ANZ customers who believe they may have been a victim of a scam should contact us immediately, on 13 33 50 or visit us at http://www.anz.com.au/security/report-fraud/ for more information.”