Aussie shares soar to crack 8000 barrier

Aussies shares continued to rally higher on Monday, crossing the 8000 threshold for the first time in history on speculation of imminent rate cuts in the US.

Aussies shares continued to rally higher on Monday, crossing the 8000 threshold for the first time in history on speculation of imminent rate cuts in the US.

The Australian sharemarket has closed out the week on a record high as investors position themselves for imminent US Federal Reserve rate cuts.

The benchmark ASX200 has flown close to record highs on Thursday following a huge night of trading on Wall St.

A disturbing inequality between one group of Aussies and everyone else has been highlighted in a new report.

One major bank has unveiled a major update on its credit and debit cards that’s intended to help one group manage their money.

The surprise move rocked Qantas shares and the optics around the outgoing CEO’s long term confidence in the airline look terrible.

An Australian banking giant has been issued with a record fine after taking “ineffective” steps to address an issue that annoys customers.

Australians are being warned not to be sucked into psychological stress amid the cost of living crisis that could end up in them losing money.

Dimensional is the world’s biggest fund manager that you have never heard of. And it is backing markets over machines.

The miner has severely damaged calls for restraint around workplace rule changes and pay rises.

With yet more interest rate rises expected from the Reserve Bank, one of the country’s largest lenders has announced it will buck a “big four” trend.

The scandal is far from over and is threatening to spread offshore. However, PwC’s demise could seriously disrupt corporate activity.

Real estate companies have lost more than $100,000 to phone scammers pretending to be from major banks.

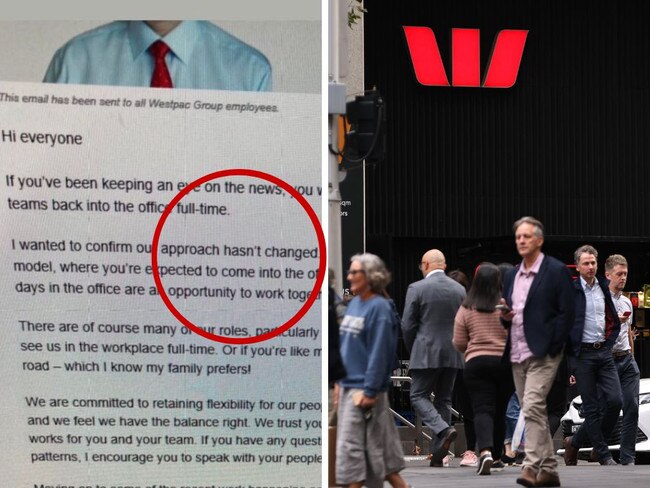

Westpac’s CEO has weighed in on the work-from-home controversy with a subtle dig at rival CommBank.

Original URL: https://www.thechronicle.com.au/business/companies/banking/page/76