Alan Joyce Qantas $17m share dump shows poor judgment

The surprise move rocked Qantas shares and the optics around the outgoing CEO’s long term confidence in the airline look terrible.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Alan Joyce was heading off to Istanbul when he made the call to dump nearly $17m worth of shares – nearly his entire stake in the airline.

The holding was built up over 15 years as a chief executive and comes ahead of his retirement in November.

The share sale represents stunningly poor judgment from Joyce, who will continue to draw a wage as a chief executive for the next five months and is expected to stand up during that time urging investors and customer to continue to back the Qantas story.

Following the sale of 2.5 million shares, Joyce will have 229,000 left. This is worth $1.45m at current market prices and has fallen below the minimum threshold that Qantas’ board recommends top executives should have.

Not only did the sale rock Qantas shares sending them down more than 4 per cent, the optics look terrible about his longer-term confidence in the airline under new chief executive Vanessa Hudson.

It is also sends a message from the boss that the shares have most likely peaked in the current cycle.

Joyce is in Istanbul for the annual conference of airline industry body IATA, along with Hudson who was last month named incoming CEO.

Joyce is responsible for the entire Qantas platform, rebuilding it from the ground up over a decade and a half, and investors should be confident their CEO – who has been paid well for most of these years – has skin in the game over the long term.

The share sale follows The Australian’s Lisa Allen revealing that Joyce and his husband, Shane Lloyd, last week purchased a luxury penthouse in Sydney’s The Rocks for $9m.

Qantas points out Joyce has been a top-20 holder in the airline through his tenure. He still has exposure with millions in share rights scheduled to vest in coming years – the first batch this year – depending on performance hurdles being met.

Most of these are expected to be in the money as some were priced during the pandemic.

Qantas has emerged strong coming out of Covid-19, with record profits and debt being paid down. However, the airline faces rising costs, a slowing economy and more competition on international routes.

At the same time, it has a massive investment spend looming which could top $10bn over the next five years, mostly on its domestic fleet renewal.

There’s nothing wrong with chief executives selling down substantial holdings for diversification or to fund a large transaction, but it usually happens well after they have left the company. It’s rare while they are still on the payroll.

Joyce should look to former Macquarie Group chief executive Nicholas Moore who even after five years remains one of the biggest shareholders in his old investment bank with a stake worth $130m.

That’s backing the strategy.

ASX’s costly path

Helen Lofthouse has a big agenda in front of her: winning back the confidence of regulators, undertaking an expensive technology overhauling while maintaining an old system and keeping the Australian Securities Exchange at the front of growth for global capital markets.

The ASX chief executive has given herself five years and the big question is – can she do it all?

In delivering the ASX’s first strategy briefing to investors since it listed on its own market more than two decades ago Lofthouse has sought to reset the conversation around the ASX.

She wants her own investor base and all ASX users from stockbrokers, fund managers to companies listed on the boards to know the stock market is tackling head on the underlying technology issues and internal governance questions that have bubbled to the surface in the past two years.

And a starting point to all this she recognises she needs to reinvest into the ASX brand. After years of underspending this will now come at a massive cost.

Lofthouse’s biggest near-term challenge is getting back the trust of regulators. The ASX is on a tight leash from markets watchdog ASIC as well as the Reserve Bank which were both furious after being blindsided about just how far off the track the maligned clearing and settlement platform (CHESS) replacement program had gone.

ASX’s shelved its replacement last year as it became clear its option for an unproven blockchain-powered clearing and settlements platform was going to struggle to get off the ground. Now it has gone back to the drawing board for a new platform which includes a more conventional platform.

This week ASX released a road map to meet ASIC’s demands to keep the ageing CHESS system in place for at least until 2032, this includes tackling more than 30 major risk areas.

Over the next few years Lofthouse needs to tackle the CHESS replacement. She needs to keep the existing ageing clearing platform operating to a high standard. There are broader technology upgrades including around derivatives trading to keep the trading platform ahead of the market. There are also ever increasing demands around cyber security.

“There’s a big program of work for sure, but we’ve got confidence in that ability to execute on it,” Lofthouse tells The Australian in an interview.

“One of the things that we are absolutely looking at extremely carefully is how do we make sure that we’ve got the right capabilities in place,” she says.

Central to Tuesday’s strategy is about putting the ASX on a different financial footing so that it has the resources to make the investments needed.

Expense jump

To pay for this on ASX will slashing dividend and warned investment costs are set to jump at least 12 per cent for this year and as much as 15 per cent next financial year. Investors had feared this was coming but still sent ASX shares sliding more than 10 per cent.

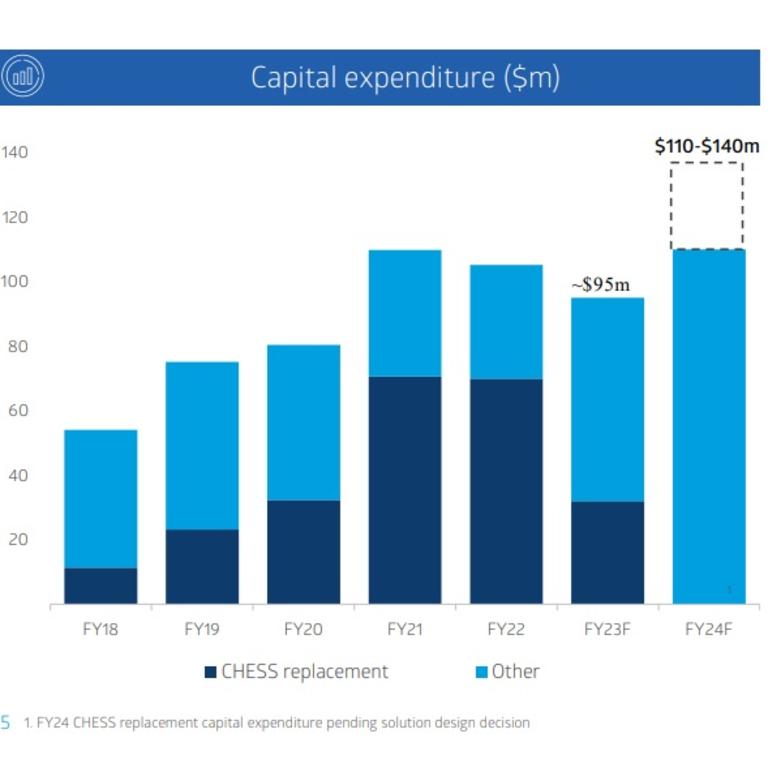

In the coming year the ASX will spend between $110m-$140m across technology, regulatory and risk. Spending will remain elevated at these levels for the next few years.

All this means that dividend payments will be between 80 per cent and 90 per cent of underlying profit which is likely to scare investors. Previously the ASX targeted 90 per cent payout.

At the same time the ASX is taking a knife to expenses, including trimming jobs in some areas, cutting back the use of consultants, as well as introducing automation into its systems where it can work. It is also preparing to go to debt markets for the first time in years to raise up to $300m through a corporate bond issue.

Lofthouse, who was elevated to the role last year from running ASX’s flagship markets business rebuilt the executive team built around a new chief financial officer (Andrew Tobin) and a new chief information officer, the former Westpac tech executive Tim Whiteley. At the board level four new directors have joined in the past year.

Lofthouse says her priorities are focused around “regulatory commitments and restoring trust”.

It's a big promise and has been given ASX’s recent track means the expectations of the market are set even higher. Lofthouse says all technology projects have their own unique challenges but concedes it is an “unusual outcome” for any company to completely shelve such a core piece of work.

Lofthouse had been CEO for just three days in August when she made the big call to essentially pull the plug on the CHESS replacement program that had been approved back in 2017. The former ASX markets boss ordered an independent review of the where the project was up to and then declared the project over in November.

“The conclusion that we came to was that the specific solution design that we’d let you know, that we’d put in place, just wasn’t going to be able to meet the really high standards that we set as critical market infrastructure,” Lofthouse says.

IPO Drought

Beyond technology, Lofthouse is looking for ASX to play a role in new renewables markets, including carbon futures. Other areas, it is seeking to monetise the millions of data points that it generates each day, particularly as new technology like AI is set to play a bigger role in the markets.

M&A is on the longer term agenda as ASX seeks to push into new markets. However, this will be concentrated in ASX’s immediate region of expertise.

Nor is Lofthouse concerned about the so-called drought of new stock market listings. A spate of big ticket acquisitions over the past two years haven’t been replenished by new companies listing on the ASX.

She points out listings are cyclical by nature, and the higher interest rate environment will naturally dampen appetite for new issues.

“And if you think about the broader economic environment, when you’ve got a lot of uncertainty and you’ve got a rising interest rate environment those factors typically do make the IPO market quite challenging”.

This is also a global phenomenon. Last year, the ASX had 107 new listings – albeit mostly of small to mid-sized caps. This was only outpaced by Canada’s Toronto Stock Exchange, and by volume, coming in ahead of financial centres including London, New York and Hong Kong.

Lofthouse views new listings as a global playing field, with the ASX competing with exchanges around the world for new capital.

johnstone@theaustralian.com.au

Originally published as Alan Joyce Qantas $17m share dump shows poor judgment