‘All gone’: Man loses $16,000 in seconds after getting a text

A New South Wales man has lost over $16,000 in savings after falling victim to a sophisticated phone banking scam.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

A man has lost over $16,000 in a matter of seconds after getting a text message.

Jacob Harris told news.com.au that he never imagined he would be one of those people who fell victim to a scam.

The 29-year-old from Newcastle, New South Wales, is a well-educated businessman who has worked diligently throughout his adult life to save money for the future.

His hardworking nature, however, may have been what made him an easy target.

Back in January this year, he was having another busy day like usual; tons of phone calls, lots of meetings and plenty of tasks to tick off his ‘to do’ list.

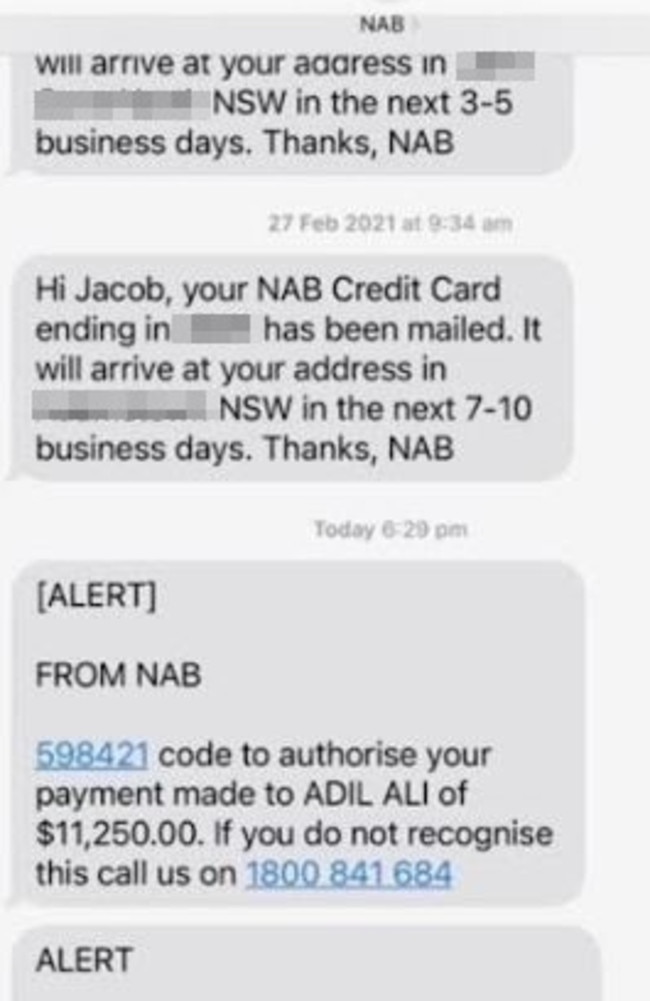

It was at this moment that Jacob received a very concerning text from his bank NAB, which suggested that his account was hacked and compromised.

Concerning text

He was instructed to call the number in the text straight away in order to keep his money safe, and the text appeared legitimate as it was from NAB’s real number.

“It was a super busy day and my mind was elsewhere when I got that text,” Jacob – who did not wish to be pictured – recalled.

“It said there was a large amount of money about to be transferred from my account, and if I hadn’t authorised the transaction to call the number.

“I thought I’ll quickly phone them and get it sorted. It all seemed legitimate, as when I scrolled up I could see that NAB had sent other texts in the past from that number.

“I called, and it said ‘welcome to the National Australia Bank’. I was even put on hold. It didn’t feel any different to what would usually happen when I called NAB.

“It wasn’t until later I found out that they actually say ‘welcome to NAB’, not the full name.

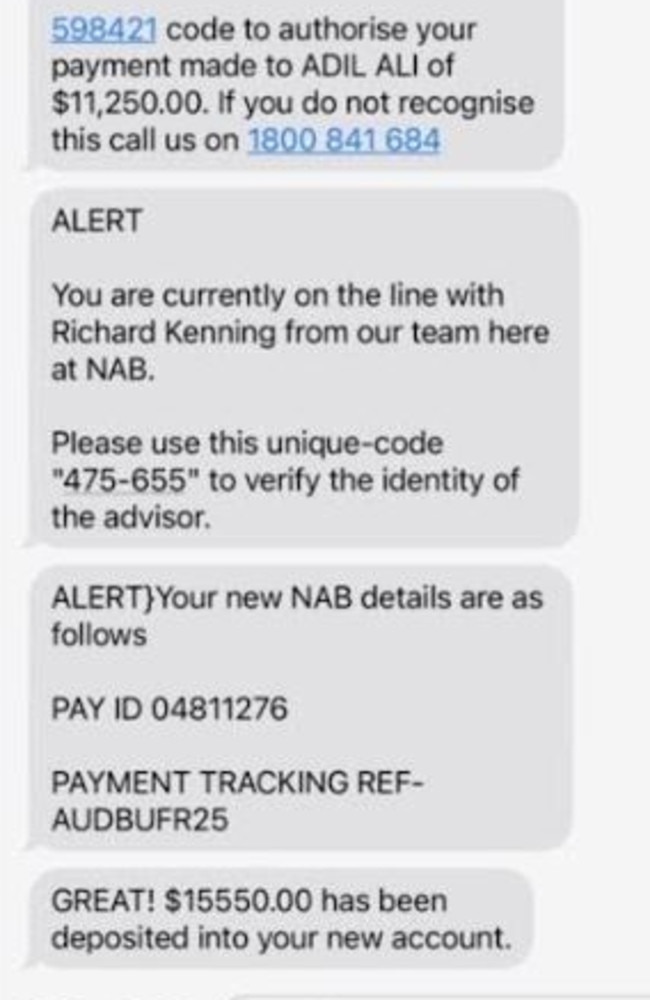

“The person on the other end had a British accent and sounded very calm and collected. They explained everything in a very matter of fact way, and it did not feel rushed.

“I didn’t suspect anything in the moment.”

The man on the phone told him that he was setting up an account in his name, and that he would need to transfer his savings over in order to secure his account.

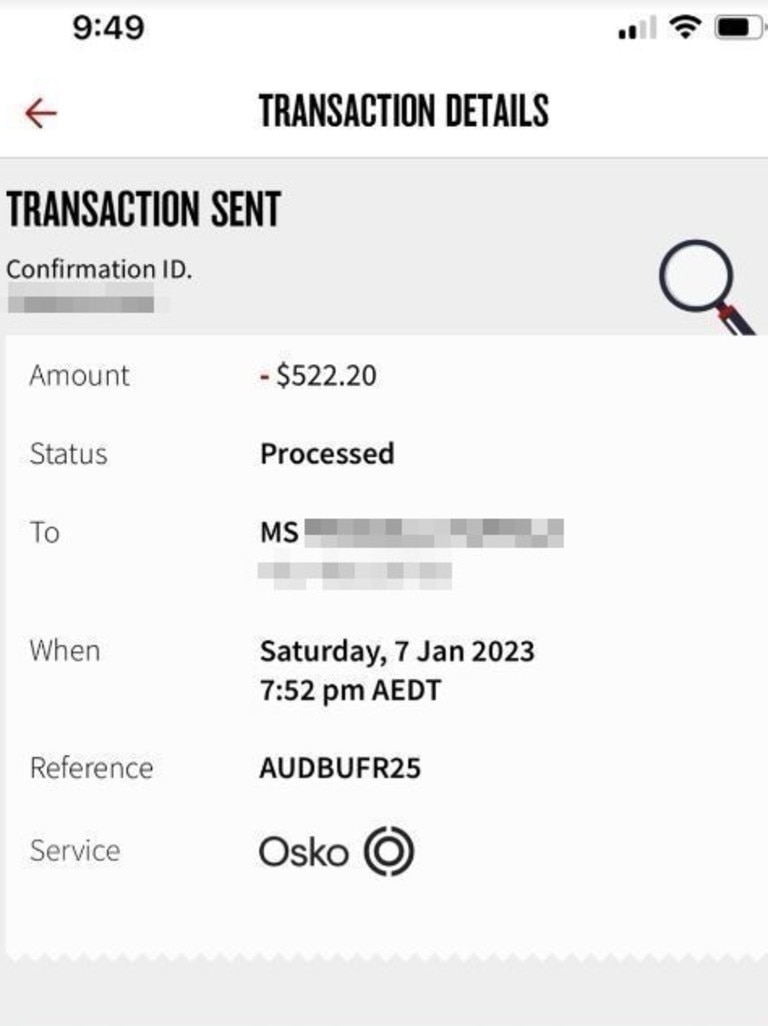

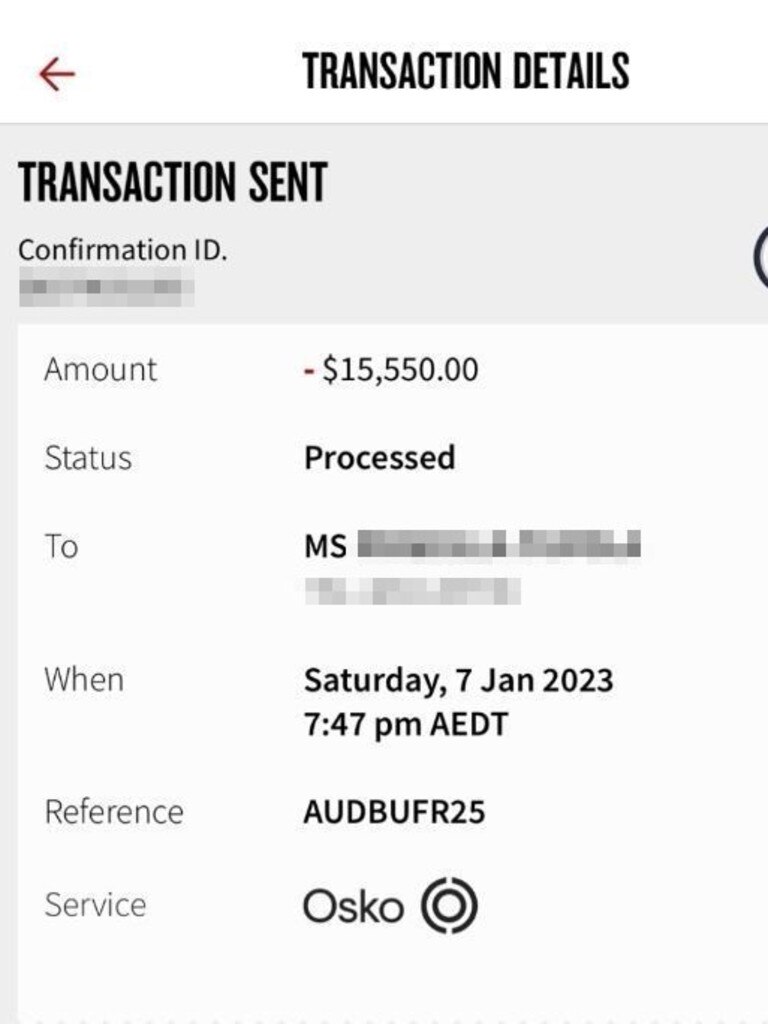

Jacob made two transactions on the phone, the first one was for $15,550 and the next one was for $522.20.

After sending the money, he became a little suspicious and asked the scammer a question to gauge his response.

Have you experienced something similar? Continue the conversation: jasmine.kazlauskas@news.com.au

“He asked me to confirm my details, I thought, wouldn’t he already have everything there,” he said.

“He told me it was to ensure that I wasn’t committing fraud. I then asked him – how did I know that he wasn’t a scammer?

“He replied and said ‘well, the text came from NAB didn’t it?’ and it had, so I thought that must have meant it was definitely legitimate.”

Worrying new trend

Although he did not realise it at the time, Jacob had been a victim of “spoofing” – a sneaky tactic commonly used by scammers to appear more legitimate to potential victims.

Spoofing a number allows scammers to send texts or emails posing as another entity, often posing as a large corporation or company.

“My mum was actually the one who caught on first,” Jacob said.

“She was here at the time it all happened, and she asked me if I was sure it was really from NAB after I told her about it.

“That’s when I went on google, and realised oh my god, it was a scam. I felt so sick with worry.

“I called NAB less than an hour after I transferred the funds, but it was too late. The money was all gone.”

Sadly, once the money had been transferred, there was nothing NAB could do to retrieve it.

As a gesture of goodwill, they did offer him a one-off compensation of $6,000 earlier this month.

Raising awareness

Jacob said he was thankful it was not his entire life savings, but was still a significant chunk of money that he had been putting aside for the future.

“I’m dumbfounded that it was all gone in an instant,” he added.

“I’m lucky that I have a great support system and I am in a healthy place mentally. For some people, that could be everything to their name.

“Others could be suffering from depression or anxiety, and something like this would really compound that. It could be such a terrible situation.”

He hopes that by sharing his story he can help raise awareness about these types of sophisticated scams and warn others to be extra vigilant when it comes to anything banking.

“I’m a youngish guy in the scheme of things, and I work in tech,” Jacob said.

“I thought I was really tech-savvy and couldn’t be fooled by something like this. But it just shows you, it can happen to anyone.

“I’ve noticed a lot of younger people have fallen victim to these type of scams. People often think it is older people who are most vulnerable, but that is not always the case.

“Everyone needs to be aware.

NAB’s response

A spokesperson for NAB warned that scams are on the rise and are becoming “increasingly sophisticated”.

“While we can’t comment on individual cases, we’ve seen a significant increase in scams in recent years and we know the results can be devastating on the people they impact, both emotionally and financially,” NAB Executive, Group Investigations and Fraud, Chris Sheehan said in a statement.

“This is a scam epidemic and it requires collaboration across Government, banking, telecommunications, online and social media industries, consumer groups and regulators in a Team Australia approach to address the problem.

“We conduct a thorough investigation into each case and our team makes every effort to help recover money for customers who have been scammed. Unfortunately, once the funds have left an account and are sent to another bank, it is extremely hard for us to retrieve them.

“These criminals are becoming increasingly sophisticated and operate with speed to move stolen funds.”

The bank also confirmed that scammers are using “spoofing” tactics to trick people.

“Scammers can use software that makes the phone number they’re calling or texting from appear on your device as belonging to a well-known organisation,” Mr Sheehan said.

“Criminals can send messages with the sender’s name set to ‘NAB’, or any other organisation, which means their messages can appear in the same thread as other official texts sent from NAB.

“When a customer receives a text message or call impersonating NAB, it means a criminal has ‘spoofed’ our number and is impersonating us. NAB’s systems have not been breached in any way.

“NAB will never ask a customer to confirm, update or disclose personal or banking information via a link in a text message or email. People need to know that their bank will never ask them to transfer money to another account to keep it safe.

“Your money is safe if it is in your account. Once you move your money to another account, you lose control of it, and it can be very difficult for your bank to recover it for you. Never be pressured by anyone to move your money out of your account.

“Scams impersonating NAB and other recognised brands continue to rise. This isn’t just a problem for banks and telcos, this is an issue for every public and private organisation to reduce the impact these scams are having on Australians.”

NAB added that their organisation has taken steps to combat these issues and are continuing to introduce new security measures.

“NAB has a comprehensive, bank wide strategy including around 60 initiatives that are either completed or underway to combat fraud and scams,” Mr Sheehan revealed.

“We recently announced new measures to stop criminals infiltrating bank phone numbers by placing NAB’s bank phone numbers on the ‘Do Not Originate’ list to help reduce scam calls impersonating NAB numbers. We’ve also added additional protections to reduce scam messages appearing in legitimate bank text message threads.

“These changes we’ve made recently have led to a reduction in spoofing cases and customer losses and made it harder for the criminals behind the scams but customers need to remain vigilant.

“If anyone out there believes they have been victim to a scam or notices any fraudulent activity, take action and contact your bank immediately.”

Originally published as ‘All gone’: Man loses $16,000 in seconds after getting a text