‘Nothing left’: Teen loses $37,000 falling victim to alleged NAB scam

An Aussie teenager has lost her life savings in a matter of seconds after falling victim to an alleged NAB phone scam.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A distraught teenager who claims to have been scammed out of $37,000 in a matter of seconds has issued a chilling warning.

After scoring her first casual job at 14, Aurora Casilli has been dreaming of the day she would have enough money to buy her very own home.

The 18-year-old from Albany, Western Australia, says she has always known the value of money and over the years, had meticulously saved every cent she possibly could.

At one stage, she was even working three different jobs to help fatten her savings account.

But now Aurora says all her years of dedication and hard work were wasted, as she now “has nothing to her name” after falling victim to an alleged phone scam.

“You never think something like this will happen to you,” she told news.com.au.

“I’m devastated. I’ve worked hard all my life, I was saving for a house.

“All those shifts, all the work I put in, and now this.

“While my friends were going out and buying nice things like makeup and clothes, I was saving. I was saving for my future.

“Now I have nothing. I have to start all over again.”

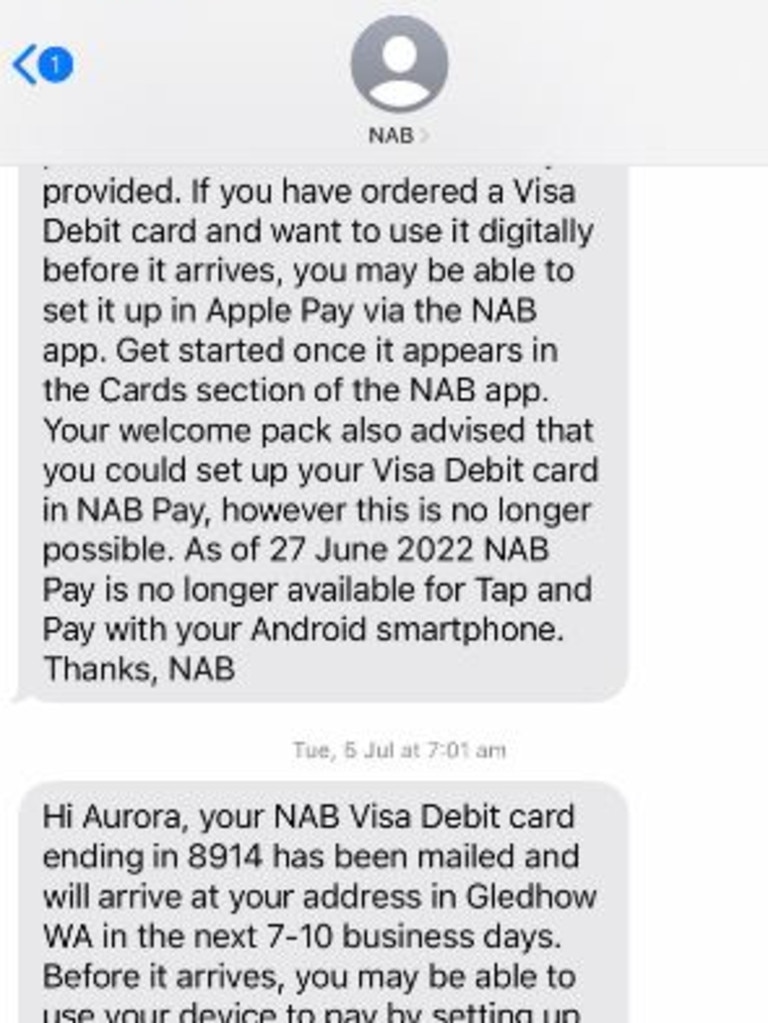

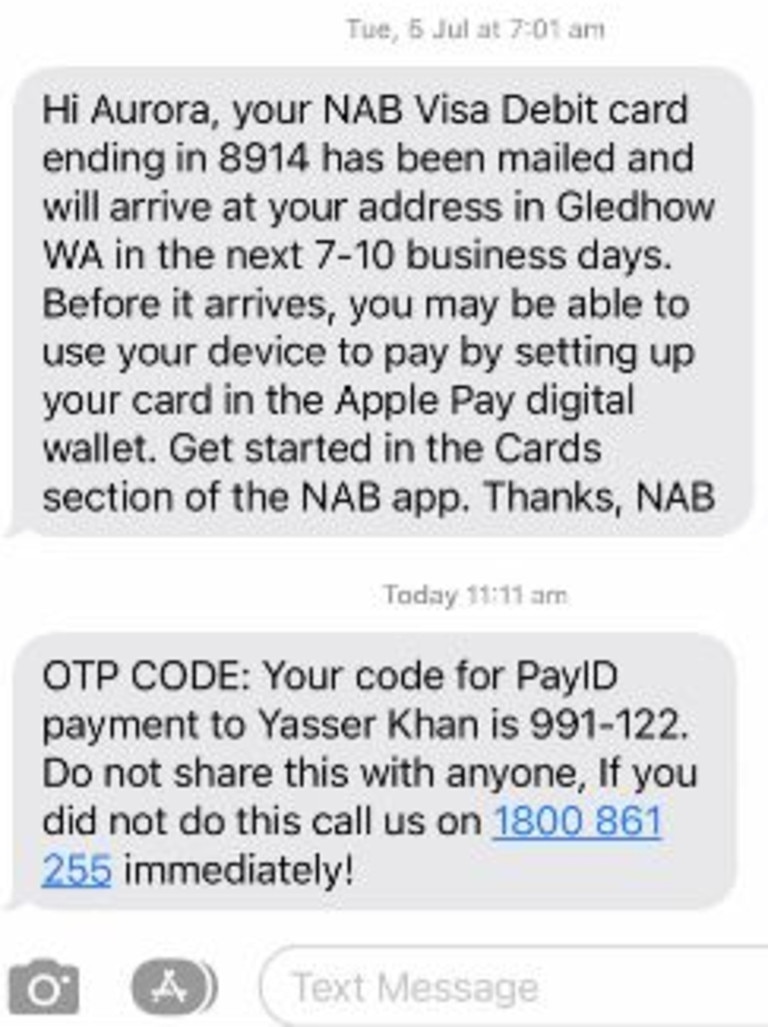

On December 3 last year, Aurora received an alarming text message that she believed was from her bank, which stated someone with a name she did not recognise was attempting to make a transfer from her account.

The message appeared to be from NAB, as it was from the same number and in the same text message thread as previous, legitimate communications from the bank.

This technique is known as spoofing, and is commonly used by scammers to appear more legitimate to potential victims.

Have you had a similar experience? Email jasmine.kazlauskas@news.com.au

The text urged her to call their 1800 number if she had not authorised the payment, which the teenager decided to dial as she was in a “state of panic”.

“I was just at home, about to make breakfast when the text came through,” she recalled.

“I panicked when I read it. All the money I had saved, and now I thought someone was in my account trying to make an unauthorised transfer.

“The text was from NAB, and was underneath others messages I got from them. It seemed legit to me, so I called the number in a panic.

“If it was from a random mobile number, I wouldn’t have believed it. But it seemed so real.”

Aurora explained that at the time, nothing seemed “off”.

The text appeared to be from NAB, and when she dialled the phone number for help, she claims the music and voice prompts were identical to when she called her bank in the past.

She even waited an hour on hold to talk to someone, which she says only added to the perceived legitimacy of the call.

Aurora was then greeted by what she describes as a “professional and polite” man with a British accent, who explained to her that someone had gained access to her bank account.

“He sounded like any normal person working at a bank,” she explained.

“You hear things on the news about scammers being from other countries and having broken English or heavy foreign accents.

“But he was just a man with a British accent that spoke in a professional way. It did not seem suspicious.”

For her financial security, she was told to transfer the entirety of her savings into another NAB account in her name, which the man was supposedly setting up for her on the phone.

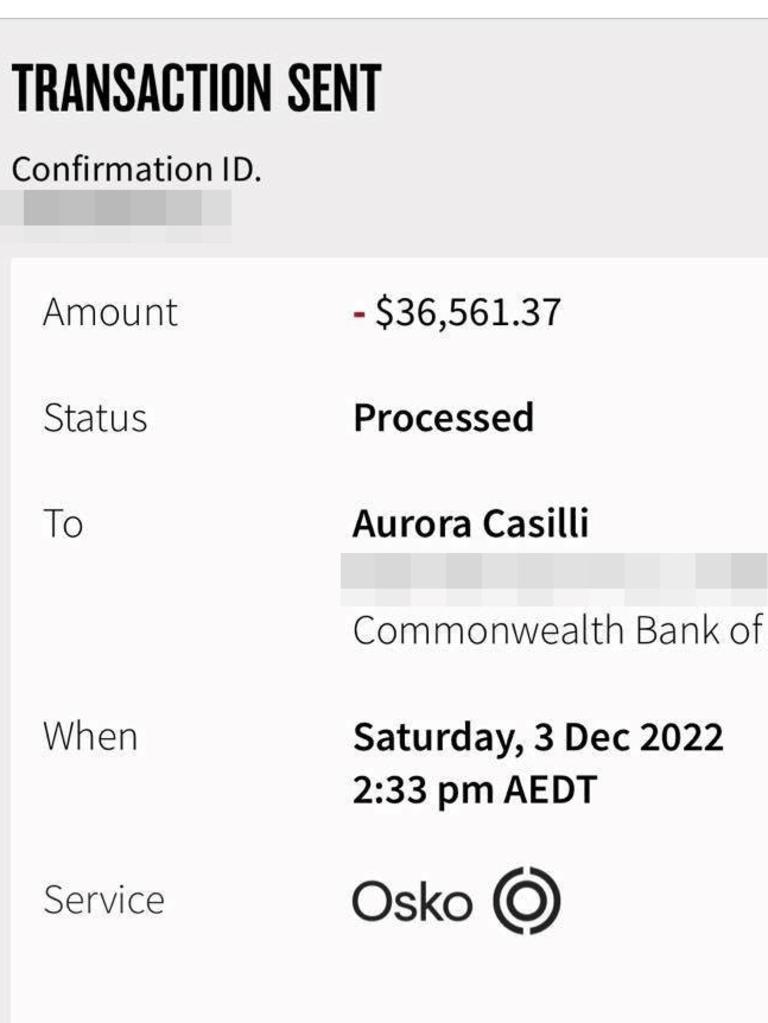

Aurora believed him, and quickly sent over $36,561.37 – her entire life savings.

Seconds after confirming the transfer, the man hung up.

After looking up the BSB, she realised that the account she transferred her savings into was actually a Commonwealth Bank account, not NAB.

“I felt sick, I just got this gut feeling that something was terribly wrong,” she said.

“I called back, and asked why he wanted me to transfer the money into a Commonwealth account. He hung up again.

“That’s when it hit home, I’d been scammed.”

The BSB of the Commonwealth Bank account that she had transferred the funds into is linked to a branch in Perth.

Aurora says she contacted Commonwealth to try and stop the transfer, however it was too late – the funds had already been taken out.

She says they are looking into the case and told her that they have “flagged” the account.

Aurora says she now has no money to her name, but is thankful for her boyfriend Matthew, 21, who is covering both their living expenses in their shared household.

“I was on the phone for hours trying to get through to CBA,” she said.

“It was so stressful, and then I’m told there is basically nothing that they could do.

“Once the funds are taken out, it is too late. I have no idea what happened to my money or what they are doing with it.”

Aurora reached out to NAB for help following the incident.

The bank looked into what had occurred and reached a formal decision on the matter on the January 3.

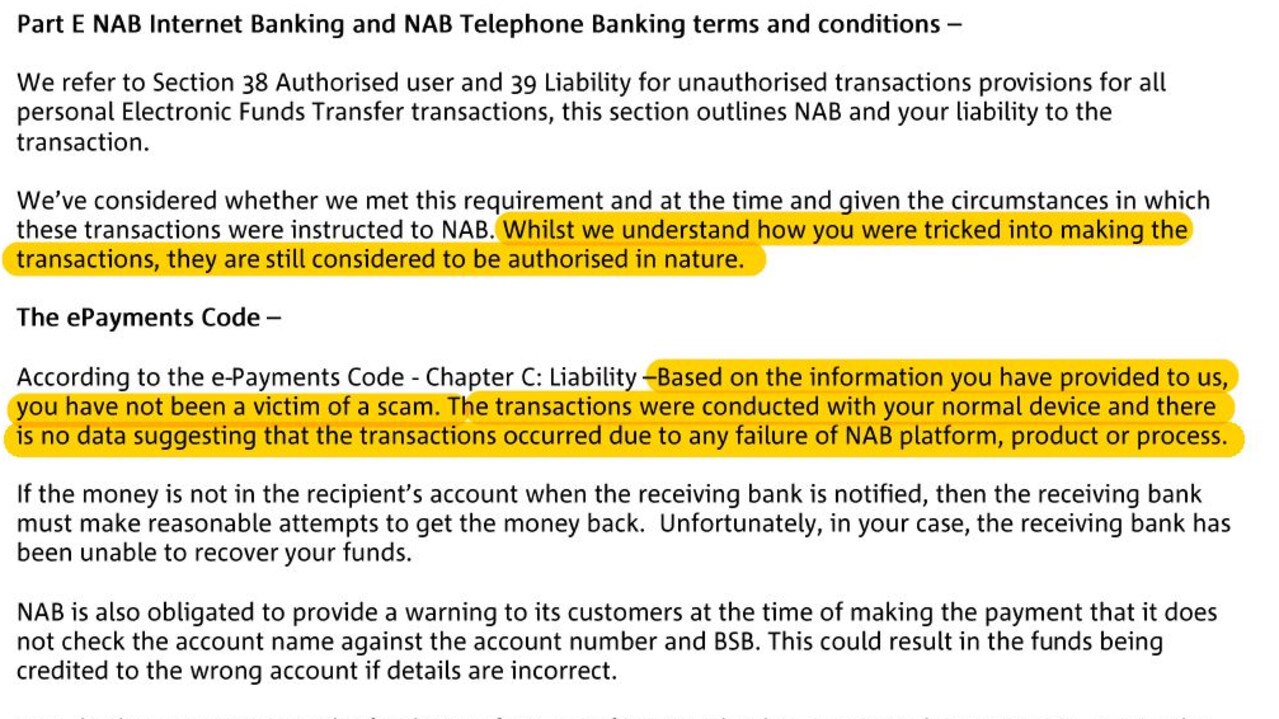

In a letter seen by news.com.au, NAB determined it was not liable for the lost funds, due to the payment being authorised by Aurora.

The document also stated that NAB did not consider Aurora to be a victim of a scam, as the payments were made with her normal device and there was nothing to suggest that this occurred due to a failure of the bank.

In a gesture of goodwill, the company offered her $3000, however the teenager declined.

“I just want to raise awareness so this doesn’t happen to others,” she said.

“If it can happen to me, it could happen to anyone. It is so scary what these scammers can do.

“I do think NAB should be held responsible and have more security measures in place, so that their customers do not get scammed.

“I also think banks in general need an urgent line for people in these situation. If I hadn’t been on hold for hours, maybe I could have gotten my money back.

“I’m honestly just heartbroken, and I hope nobody else will ever have to go through this.”

NAB responds to teen’s fraud nightmare

NAB’s Executive of Group Investigations and Fraud Chris Sheehan said the bank was unable to comment on individual cases but stressed the importance of staying vigilant and on guard against scammers.

“We’ve seen a significant increase in scams in recent years and it’s upsetting to see the devastating effects these can have,” he said in a statement.

“The prevalence of scams highlights they’re a society-wide issue and we all have a role to play in taking action, driving education and raising awareness.”

Mr Sheehan said scammers were able to use software that makes the phone number they’re calling or texting from appear on devices as belonging to official organisations such as banks, the tax office or police.

“When a customer receives a text message or call impersonating NAB, it means a criminal has ‘spoofed’ our number and is impersonating us. NAB’s systems have not been breached in any way,” he said.

“If someone is ever unsure if the person contacting them is from NAB, they should hang up, and call NAB on the number found on the back of their card.

“NAB will never ask a customer to confirm, update or disclose personal or banking information via a link in a text message or email. People should know that their bank will never ask them to transfer money to another account to keep it safe.”

Commonwealth Bank’s response

“We are always very concerned when we are made of aware of frauds and scams affecting customers and the wider community,” a CBA spokesperson told News.com.au.

“If a customer notices an unusual transaction on their account, they should contact us immediately to report it.

“Once we have been made aware of suspicious activity on an account we work closely with other banks to take action and we do our best to recover any funds.”

More Coverage

Originally published as ‘Nothing left’: Teen loses $37,000 falling victim to alleged NAB scam