Qatar’s Virgin buy-in ignites airline turf war

A turf war is looming in the international travel space following approval of Qatar Airways’ investment in Virgin Australia, in an encouraging sign for travellers.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A turf war is looming in the international travel space following approval of Qatar Airways’ investment in Virgin Australia, in an encouraging sign for travellers.

Several rival airlines have already moved to counter new competition by adding capacity, fresh product and loyalty benefits in an effort to protect their patch.

Qantas has trimmed airfares on European routes to better compete with the new Virgin flights operated by Qatar, and Emirates will begin a third daily flight from Melbourne next month, on top of its expanded premium economy cabin offerings out of Brisbane.

Turkish Airlines and Singapore have also announced plans for more Australian flying, and Etihad is wooing Velocity gold members with the offer of a six-month status match.

New Virgin flights operated by Qatar, due to start in June, are believed to be behind the rash of competitive activity, with 50,000 seats already sold on the services out of Sydney, Brisbane and Perth.

Subject to regulatory approval, the flights now seem certain to take off as planned after

Treasurer Jim Chalmers announced the Foreign Investment Review Board would allow Qatar to buy into Virgin with certain conditions.

These include Australian representation on the Virgin board, protection of consumer data, and a three-year cap on the use of Qatar aircraft and crew to fly Virgin services to Doha.

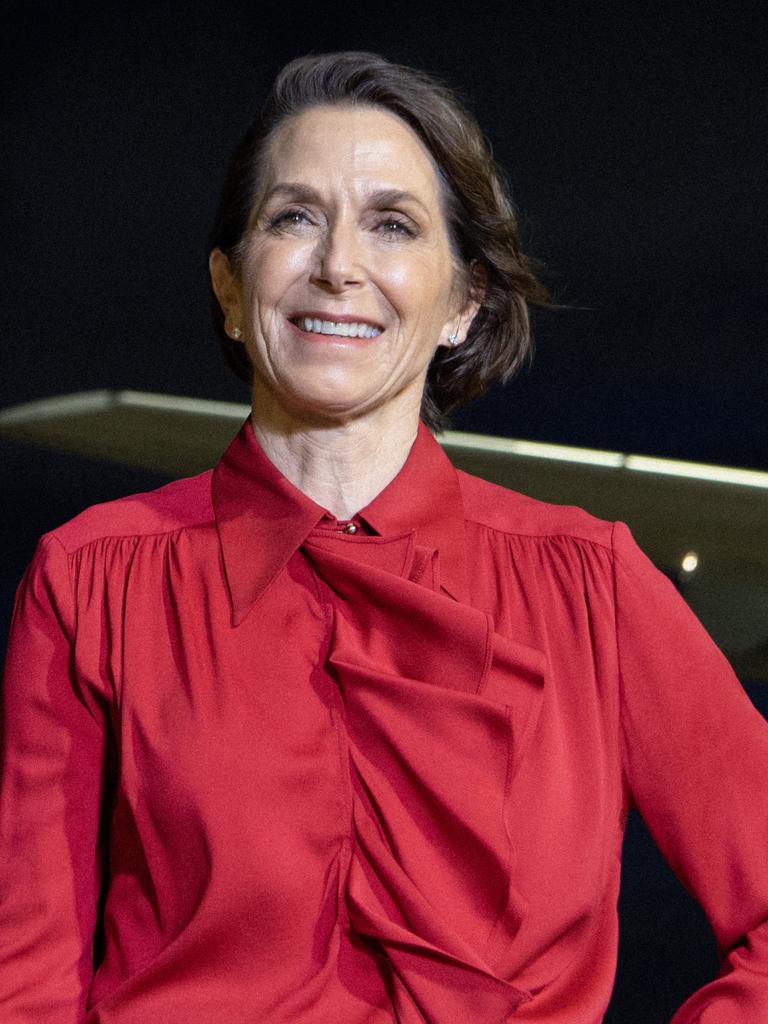

Virgin Australia chief executive Jayne Hrdlicka declared the deal one of the greatest accomplishments of her career, and said it would mean better experiences for customers.

“This gives us an opportunity to continue to reduce our costs and to offset inflation, and then to also ensure that we can be super competitive in the way that we price and bring our products to consumers,” Ms Hrdlicka said.

Sale fares remained available on routes such as Sydney-Paris and Brisbane-Rome for $2000 return in economy, and around $10,000 in business.

In an encouraging sign, Qantas is also discounting fares to Europe, with similar prices to Virgin in economy on Sydney-Paris, $5000 return for premium economy and $10,000 in business.

Qantas was not quite ready to declare a price war with Virgin but CEO Vanessa Hudson said the company “welcomed competition” and would “back themselves”.

“We believe in what we’ve got to offer today, particularly with the service we provide, and we are so excited about what our future holds with new ultra long-haul Project Sunrise flights,” Ms Hudson said.

“We know that the proposition we’re going to bring (to international flying) is going to give us that advantage.”

At the same time, Ms Hrdlicka revealed she would stay on at Virgin until a replacement was found, despite her desire “for a break” after an intense 12 months.

Virgin Australia announced in February 2024 that “now was the time” for Ms Hrdlicka to transition from the role of CEO, as the airline struggled with operational performance and delayed plans for an initial public offering.

Since then, Virgin has overtaken Qantas as the most reliable airline in terms of on-time performance and cancellation rates, and increased passenger numbers, and has made a strong profit.

Sealing the Qatar deal was the cherry on top, with Ms Hrdlicka describing it as “one of the biggest accomplishments” of her career.

“This was a tricky thing to do on lots of levels, and at the end of it, it comes down to great relationships,” she said.

“The relationship that we have with Qatar is exceptional and it’s going from strength to strength. We bring great opportunity to each other and that’s the most exciting part of this.”

As well as the 28 additional flights a week to Doha, the deal was expected to help Virgin further reduce its cost base by working in collaboration with suppliers and airports.

Ms Hrdlicka said that would only benefit customers by ensuring Virgin remained “super-competitive” in the way the airline priced and delivered its product.

Given the momentum around the partnership, she said the “obvious next step” to take in terms of liquidity was an IPO but that was a matter for Virgin’s owner, Bain Capital.

“We’re in great form, we’re performing well across the board, and so it will just come down to timing, from our investor standpoint,” Ms Hrdlicka said.

Although she was committed to sticking around until a new CEO was in place, she hinted that could happen sooner rather than later.

As Ms Hrdlicka battled a virus after working day and night for a “sustained period of time”, she was “really looking forward to taking a break”.

“That’s the most important thing to me, to have a break to really rest up, catch up on a number of things that are important to me in my life,” said Ms Hrdlicka, who lost her husband to cancer in 2023 and her father last year.

“I’ve got my youngest son in year 12, so I’m looking forward to being able to support him a little bit better over the course of this year, once we get to a place where we’ve got somebody transitioned into the role.”

Originally published as Qatar’s Virgin buy-in ignites airline turf war