Business leaders fret about minority government deals as an economic ‘disaster’ in the making

The role of the Greens and teals in the 2025 federal election is striking fear into the hearts of some business leaders. Others just want to get on with governing.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A minority government forced into a pact with the Greens or the teals would set the economy up for disaster and consign Australia to three years of inaction on the critical issues of productivity, housing and living standards, business leaders say.

Flight Centre managing director Graham Turner dreaded a minority government influenced by the Greens, which he described as “a radical left rather than an environmental and sustainability focused party”.

“It would be a disaster for business in Australia,” said Mr Turner, whose wealth is estimated at $642m on the Richest 250 list and whose family privately funds a conservation trust. “A real issue would be a minority Labor/Green and maybe teal versus a LNP/teal minority government.”

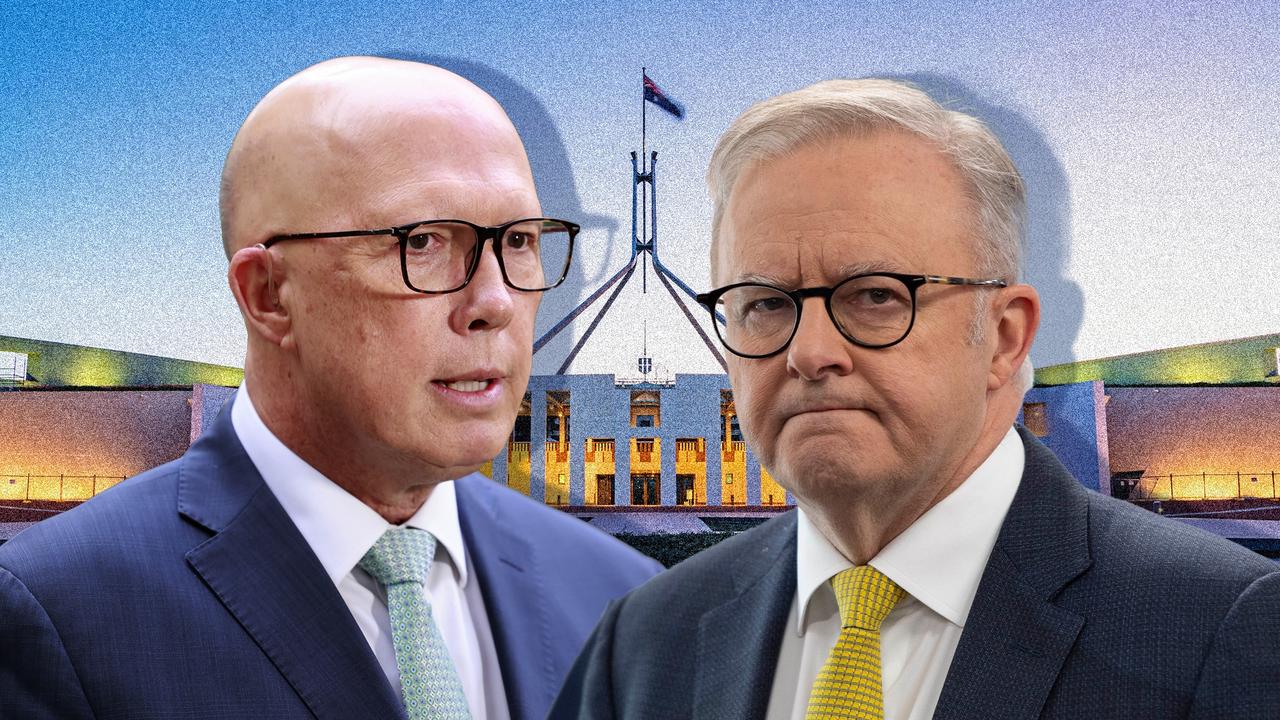

Polls suggest a minority government is the most likely outcome of the May federal election, with neither Labor nor the Coalition looking like they would secure enough votes to form government alone. Labor sealed a slim majority in the 2022 federal election.

Mr Turner’s concern was echoed by Garnaut Private Wealth executive chair Chris Garnaut, who said that a Labor-Greens or Labor-teals scenario would be “equally as bad”.

Both stood to be “disastrous” economically, calling them a “collective group of sanctimonious virtue signallers”.

“The only good news (would be) if a minority government is running the joint for three years (from) May 4, 2025, they will be thrown out on their arse on May 4, 2028,” he added.

As Australians prepare to head to the polls on May 3, CEOs want concrete policy action to make Australia more competitive.

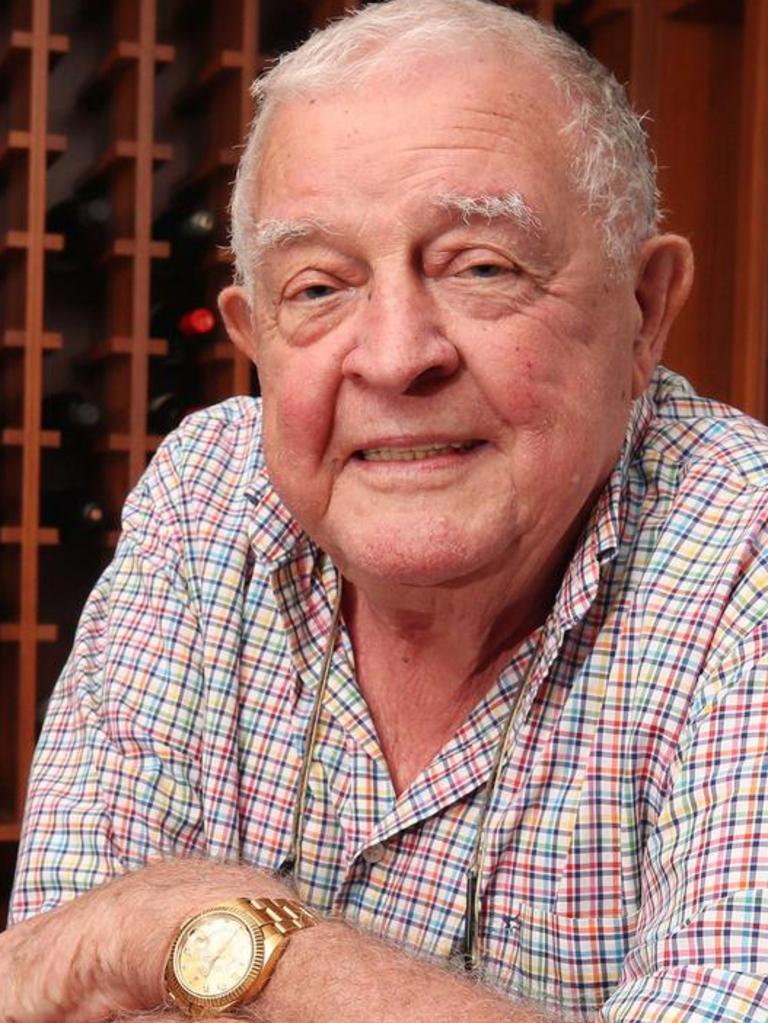

Pubs and pokies billionaire Bruce Mathieson said both sides of politics needed to get the economy moving again: “People need to be able to afford to spend again,” he said. “We are a very expensive country.”

He too would be concerned if the Greens were able to extend their influence in a minority government.

The challenge of making policy under a minority government was not lost on Business Council of Australia CEO Bran Black, who said it was up to voters.

“We always prefer the certainty that comes with a majority government. But at the end of the day, this is a matter that is ultimately for the electorate to make a call on,” he said.

Cost of living and housing supply were key issues the next government would need to address, along with making Australia much more competitive on the global stage, he added.

“We need to make sure Australia is as competitive a jurisdiction as possible for attracting the investment needed to drive economic growth. So what I’m looking for from both parties is a focus on genuine long-term economic planning ... we need to fight this sense of complacency that has developed (and a belief) that because we’ve done well in the past, we will continue to do well in the future.”

The company tax rate is one such area where Australia can act swiftly, according to the Financial Services Council. But Opposition Leader Peter Dutton has said he will not campaign on tax cuts, and Labor’s 2025-26 budget projects a decade of deficits ahead.

“Australia’s 30 per cent company tax rate for major companies is not globally competitive, especially with the OECD average heading toward 20 per cent – a gap that could grow even wider under the Trump administration,” Financial Services Council CEO Blake Briggs said. Tax reform could pay huge productivity dividends, he added.

“The FSC supports the next government commissioning a broad-ranging and evidence-based tax review to identify opportunities to generate economic growth in Australia and to bring an end to the constant tinkering with superannuation taxes that undermines confidence in our retirement system.”

Metricon chief executive Brad Duggan said the election should mark a “turning point” for the housing sector.

“We need no more announcements, no more promises, we just need action and I hope that’s what we get out of this election,” the boss of the home builder said.

Mr Duggan said there were three important areas that any new government should focus on.

“One of them is giving customers confidence in the build journey and to do that they really need to focus on ensuring planning reforms are forced onto state and local councils,” he said.

“They also need to build confidence in customers’ financing capabilities. We need a more positive sentiment coming out of the Reserve Bank, we need to look at the funding buffer of the APRA (Australian Prudential Regulation Authority) and we need to find a way to get our banks to fund first-home buyers.

“We also need a stable and consistent tax environment ... No more threats about capital gains tax, no more noise about superannuation changes and no more increases in land taxes.”

The Coalition’s super-for-housing scheme, which allows access to a portion of super savings to buy a first home, is a key election policy that plays to younger voters.

The Reserve Bank meets this week but economists expect it will leave Australia’s official cash rate target at 4.1 per cent.

Retailers shared Mr Duggan’s sentiment around policy settings, hoping for a message that emboldened consumers to spend.

Bapcor CEO Angus McKay said: “Whoever is in power should focus around driving greater stimulus to the consumer. So cost of living is front and centre for all consumers. We need this country to elevate levels of productivity.

“We’re in a dire need of that. And we need government to incentivise small business, because small business is what this country is backed by.”

Bunnings CEO Mike Schneider expects the cost of living to be a focal point of the election, even after the Treasurer’s budget promised an extra $5 a week from July next year and $10 a week from 2027-28 for low income earners.

“I think it’s a pretty uncertain time in the market anyway, and families are doing it tough from a cost of living point of view. And I’d imagine that’s going to be a really strong topic in the election. Every bit of data that I think everyone of us reads is that it’s going to be a pretty tightly run race,” he said.

Suncorp CEO Steve Johnston said home owners subject to extreme weather were a source of concern for both sides of politics and needed adequate protection through planning rules.

“Too many homes, businesses and communities are at risk every year from worsening extreme weather because decades of inadequate planning have led to them being built in harm’s way, while too few resources are invested in mitigating the threats,” he said.

“We believe reducing Australia’s exposure to extreme weather risks is a topic worthy of focus during the federal election. For every dollar spent mopping up after a disaster, a dollar should be invested in mitigation to help protect individuals, communities and the economy.”

Private wealth executive Mr Garnaut argued that Mr Dutton’s budget reply had offered sound ideas for businesses. “Good policies for business bring out aspirations in people which makes our country better,” he said.

Additional reporting: Chris Herde, Glen Norris and Ben Wilmot

More Coverage

Originally published as Business leaders fret about minority government deals as an economic ‘disaster’ in the making