Slow growth, higher inflation: RBA warns on risks to Australian economy from trade war

RBA governor Michele Bullock says Australia potentially faces slower growth and higher inflation thanks to the global trade conflict brought on by the Trump administration.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The Reserve Bank says Australia faces the prospect of slower growth alongside higher inflation in the global trade conflict, as the Trump administration prepares to fire off its next round of tariffs.

The central bank on Tuesday opted to keep the cash rate unchanged at 4.1 per cent, citing uncertainty in the outlook both domestically and overseas. The decision comes on the eve of US President Donald Trump’s so-called “Liberation Day” on April 2, when he has promised to impose reciprocal tariffs on the US’s trading partners.

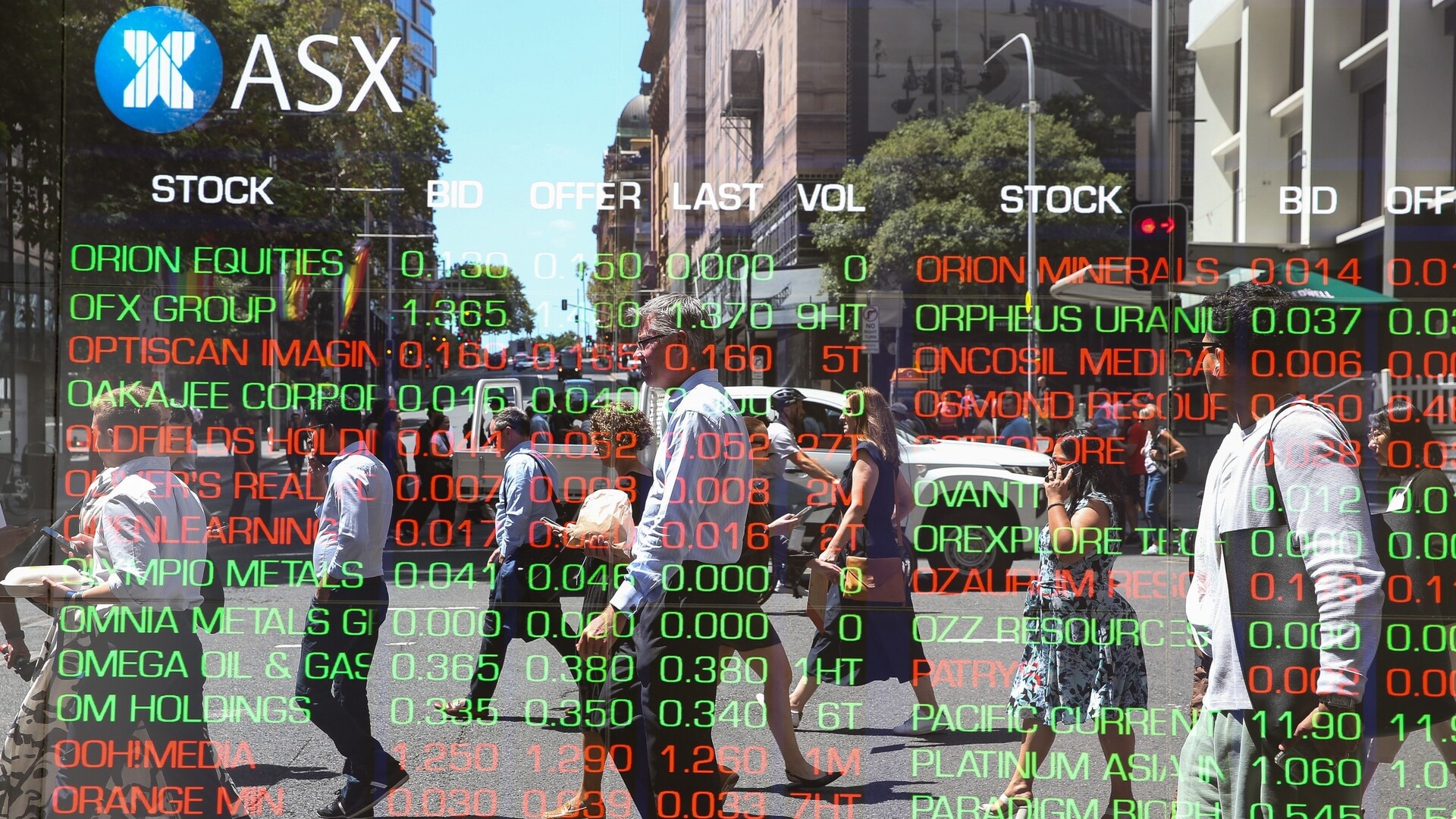

The ASX 200 finished the session up 1 per cent at 7925 points and the Australian dollar was trading at US62.45c, or flat for the session after erasing all of its gains after the RBA statement.

NAB’s head of market economics, Tapas Strickland, said there was nothing to suggest the RBA board would not cut in May, as long as economic data tracked to its forecasts.

“NAB continues to be of the view that the RBA will cut rates again in May. Our call thereafter is for three further rate cuts taking the cash rate to 3.1 per cent by February 2026,” he said.

The NAB economist said the global backdrop was a growing source of unease, after Reserve Bank governor Michele Bullock forecast that tariffs would slow global trade.

“Australia, as a small open economy, has benefited massively from open trade, so it’s not good for us. A world trading system that is fragmenting, that’s not good for us,” the RBA governor said in her press conference.

“The immediate impacts in terms of fragmentation, stopping of trade, increasing in price levels, they’ll all be felt. But the issue of longer-run impacts, that is going to be quite dramatic.”

Keeping the cash rate on hold was a consensus decision by the board, Ms Bullock said, as she revealed the RBA’s concerns that policy unpredictability overseas could put the brakes on growth. The impact on Australia’s inflation at this stage was “less clear”, she added, but all things being equal tariffs meant higher prices.

“The strategy is to bring inflation down and avoid a big increase in unemployment. And with low unemployment and inflation tracking down, we are well positioned for any shocks that might come,” Ms Bullock said.

“The question we’re asking ourselves is what (tariffs) might do to activity globally and inflation in Australia as we move on. At the moment, we’re not seeing signs that we’re being impacted by this. What will be important for us is particularly what happens with our major trading partners and China.

“Where you see these things often show up is in commodity prices and the exchange rate is a bit of a buffer for us. So when we get hit by lower commodity prices or a slowing world economy, the exchange rate helps us to adjust a little bit,” she said.

The RBA is not expecting Australia to dip into recession in the coming year but Ms Bullock did warn on the stagflation risk of slowing growth and rising prices, saying that would prove more difficult for the central bank to navigate.

“Inflation is the number one thing you have to keep in control. We’ll have an eye to what’s going on with unemployment but there’s no point taking the brakes off and letting inflation accelerate, because that will mean unemployment eventually has to go up.”

Ms Bullock expected there would be “some permanence” to the trade restrictions coming through, but Australia and the central bank were in a good position to deal with global shocks.

“The economy is in a reasonable position: inflation is coming down and unemployment is still relatively low. It’s up from its trough, but it’s still relatively low. And I think everyone’s been pleasantly surprised how the labour markets held up. So we’re in a good position there. The second point is when we went into the pandemic interest rates were about 1.5 per cent. They’re now much higher than that. If it turns out that there is a big growth impact on Australia, we do have room to move,” she said.

The RBA will next meet in May, after the federal election, on May 20. Traders are tipping the board will deliver a rate cut. The RBA cut rates from a 13-year high 4.35 per cent in February.

The RBA meeting came a week after Treasurer Jim Chalmers said in his budget speech that Treasury forecasts inflation to be restored to its target band six months earlier than anticipated.

“The soft landing we have been planning and preparing for is looking more and more likely,” the Treasurer said last Tuesday.

The RBA’s latest statement on monetary policy forecasts inflation to return to the 2-3 per cent target this year, with economic growth of 2.4 per cent in 2025 and 2.3 per cent in 2026 on a year-end basis.

Mr Trump has settled on a plan for his latest tariffs expected this week but has declined to reveal his targets. Dow Jones has described a divide within the administration over whether to proceed with reciprocal tariffs or a flat tariff rate.

More Coverage

Originally published as Slow growth, higher inflation: RBA warns on risks to Australian economy from trade war