Behind the invisible force sapping away at Chalmers’ budget

Making workplace rules less flexible could have big implications for the nation’s long-term wealth.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

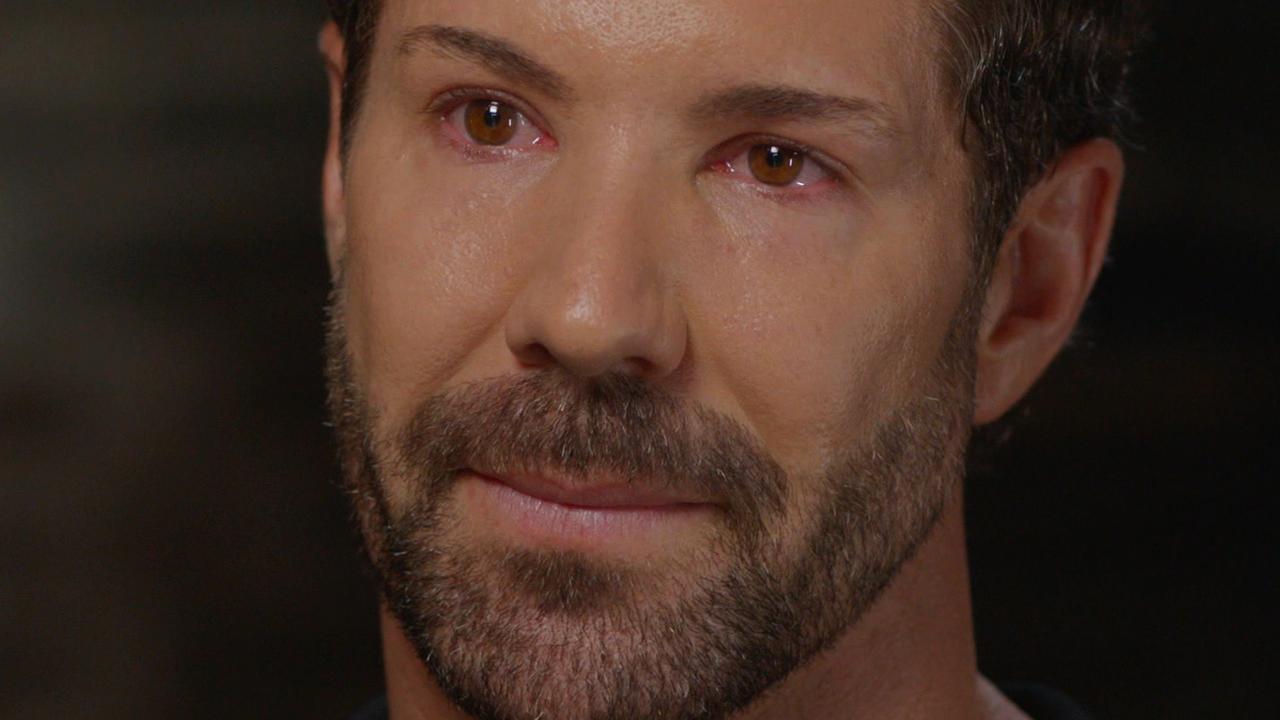

Gary Banks, the legendary economist who became the foundation chair of the Productivity Commission, has warned about “turning back the clock” on industrial relations as he raises doubts about whether the budget’s freshly lowered targets for productivity growth can even be met.

The looming battle on industrial relations, centred on the Albanese government’s plan to expand rigid multi-employer bargaining deals, is set to take the shine off Treasurer’s Jim Chalmers’ commitment to Budget restraint.

Proposed workplace laws that could see collective wages set across industries are to be tabled as early as Thursday. The new rules come as Treasury this week warned the nation’s progress on labour productivity growth was already slowing.

Making workplace rules less flexible could have big implications for the nation’s long-term wealth, Banks says.

Indeed, lacklustre productivity growth is the invisible force sapping away at future budgets. Any lift in the nation’s productive capacity – or its ability to do more with less – will lead to higher national income and in turn a smaller overall debt burden. But the trend for Australia over the years under successive governments has been steadily reversing.

The slowdown is broadly based across most industries and follows other advanced economies, suggesting there are common trends at play.

Chalmers got it right in this week’s budget by acknowledging the slowdown and has rebased forecasts for lower productivity growth in Australia of just 1.2 per cent. This aligns it with the longer run average of the past two decades, rather than the more ambitious target of 1.5 per cent which had been closer to the average of 30 years.

Treasury expects this lower productivity growth assumption to cascade through the years, ultimately slicing 1.75 per cent from GDP in a decade’s time. This reduces the overall wealth pie of the nation and makes it harder to reduce debt.

Banks says this week’s lowered figure represents a more honest appraisal of our prospects.

“It was no longer sensible to use the long-run average (1.5 per cent) when we’ve done so much worse for over a decade now. Moreover, there was nothing in the budget to suggest that this might change,” he tells The Australian.

“Whether even 1.2 per cent is achievable must be in doubt, given the further diversion of resources into low productivity services in this budget. What’s more, the move to turn back the clock on industrial relations will make it even harder for firms to innovate and improve productivity,” he says.

Banks, who is now retired, was appointed the first chairman of the Productivity Commission in 1998 and held the role for 15 years. Since then he has held senior posts with the OECD, the WTO and the World Bank.

He says another key area holding the economy’s prospects back is the “policy-induced dysfunction in the energy market”.

Banks labels electricity as one of the great generic technologies responsible for economic progress. But the patchwork of regulation and rough road we are now on for the energy transition “will see costs for business rise and output disrupted”. The budget this week forecast electricity price to surge 30 per cent next year in addition to this year’s rises.

Other areas pushed in this week’s budget, such as new infrastructure spending, increased TAFE funding and $4.7bn to be spent on cheaper childcare, “have been oversold” given the long lead time needed for these measures to translate into productivity growth, he says.

While there more downside than upside for Australia’s productivity growth in the near term, one factor could certainly help – although it comes with pain.

“One exception on the upside could be the impact of higher interest rates in forcing the exit of ‘zombie’ firms that are currently barely profitable. To the extent that ‘creative destruction’ sees poorer performers displaced by better performers, overall productivity could rise.”

Inflation danger

Meanwhile, a bigger-than-expected jump in inflation has already put a dent in Chalmers’ brand new budget, adding to risks that rising prices are starting to become entrenched and pushing the nation uncomfortably close to a recessionary path next financial year.

There are big implications for future budgets in getting the call wrong around inflation. An entrenched spike in prices could see Canberra’s forecast of an already-skinny economic growth rate of 1.5 per cent in 2024 trimmed even further. This sets the scene for rising unemployment and eroding real wages for everyone.

That’s why Chalmers has labelled inflation as “public enemy No.1”, saying it inflicts a hammer blow on Australians, but particularly vulnerable Australians. Higher-than-expected inflation also does some serious panel-beating to his budget bottom line.

Treasury this week forecast inflation to peak at around 7.75 per cent in the current December quarter and to remain outside the Reserve Bank’s target until 2025. But showing how difficult it is for policymakers to get hold of the trend, less than 20 hours after the budget documents were released, new September quarter figures showed inflation momentum gathering pace.

ABS figures reported the headline consumer price index running at 7.3 per cent annualised – already nearing the forecast peak. Underlying inflation – which excludes seasonal moves – is running at 6.1 per cent. Economists were tipping the underlying rate to come in at 5.5 per cent.

Front line

Coles chief executive Steven Cain is right on the front lines of inflation. He saw prices across his supermarket chain rise on average 7 per cent in the September quarter, mostly due to higher fresh fruit and vegetables as earlier flooding on the east coast took its toll. The cost of bread is now pushing up with wheat in tight supply given the hit to major global producer Ukraine.

Cain expects supply-side-driven inflation to continue to increase this quarter, given the latest floods have hit some of the biggest food-producing regions in Victoria and NSW.

“We’re not immune to inflation in our own business and we’re seeing that in fuel costs, logistics, salary and wages and construction costs on projects,” Cain adds.

Coles has just finished off a round of interviews with 8000 customers to find out what is going on with their lives in the face of cost-of-living pressures. Cain says 20 per cent said were facing extreme pressure and 60 per cent were concerned. He also noted that 75 per cent of those surveyed were starting to change their behaviour, including minimising food waste and planning weekly meals much better.

More positively, Cain has stuck by his long-held view that inflation should start moderating sometime in the new calendar year – absent any more major weather events. Fresh fruit prices are likely to lead the way, but processed food that is energy-intensive or relies on offshore supply chains could remain elevated.

“The rate of supplier price requests is fairly constant but … there’s a lot in the system to cycle through … it’s different by supplier and category, but I personally don’t see this lasting forever. It will moderate and I personally think it’s going to be in the new year,” the Coles boss says.

Coles is attempting to counter the price spike by “locking” prices across more than 1000 products until the end of January, which could come off his bottom line as underlying prices rise.

Construction is another industry gripped by price spikes but there could be some positive signs.

Brett Draffen, the chief investment officer of developer Mirvac, says cost inflation and supply restrictions are persisting although “the rapid price growth in some materials is starting to moderate”.

Bear case

Treasury has already attempted to simulate a bear case where Australian inflation peaks at 8.75 per cent in the December quarter and stays high until the June quarter of 2024, or one year longer than expected – and the results are concerning.

Higher inflation for longer will start to see bigger “second-round” effects as more businesses pass through input cost pressures. Higher inflation will also shake already rock-bottom consumer confidence and it will mean lower real disposable income. The additional negative shocks to household income, including a higher than forecast cash rate, would see a further significant slowing in real spending. Under these conditions economic growth would be pared back by 0.25 per cent in the current financial year, and it could take annual growth next financial year to just 0.75 per cent. Unemployment would drift back up above 5 per cent by June 2024, which is higher than forecast.

The good news is the Albanese government is fully aware of the major pressures on the economy from inflation, debt and the structural spending pressures and prepared to talk about them. The not so good news is there is little appetite to do something fundamental about them – and the longer the big issues are left unanswered the more our fiscal options narrow.

johnstone@theaustralian.com.au

More Coverage

Originally published as Behind the invisible force sapping away at Chalmers’ budget