Budget 2022: Inflation jumps to 7.3pc, putting pressure on RBA

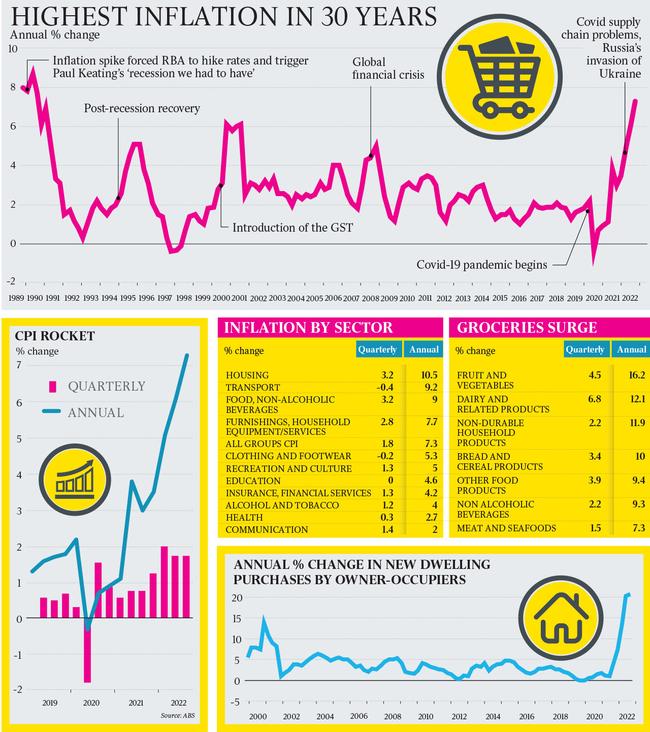

A renewed surge in consumer prices to a 32-year high has raised fears of slower growth and more aggressive interest rate hikes.

A renewed surge in consumer prices to a 32-year high has raised fears of slower growth and more aggressive interest rate hikes, with Jim Chalmers declaring inflation “public enemy number one” a day after delivering the Albanese government’s first budget.

The hotter-than-anticipated consumer price data, showing inflation running at 7.3 per cent, raised expectations it would now exceed the RBA and Treasury’s forecast for a peak of 7.75 per cent by December and stoked fears of another 0.5 percentage point interest rate hike on Tuesday.

The budget warned that higher than anticipated inflation could cut growth in the next financial year from 1.5 per cent to 0.75 per cent, risking a recession if the global downturn proved more severe.

Delivering his post-budget address at the National Press Club, the Treasurer said any steps to ease the pressure on workers’ budgets would simply make the inflation challenge worse.

“Inflation is the dragon we need to slay,” Dr Chalmers said.

After Fitch Ratings highlighted “longer-run pressures” on Australia’s AAA credit rating from climbing debt and deficits over the decade, Dr Chalmers said the “days of pretending that we don’t have structural pressures on the budget are over”.

He ruled out changes to the GST or hitting gas exporters with a windfall profits tax but did not rule out strengthening the petroleum resource rent tax as part of a suite of measures to slash spending and boost revenue.

As households brace for 56 per cent hikes in electricity prices over the coming two years and more mortgage pain, Dr Chalmers said the government would consider supports closer to next May’s budget.

Australian Bureau of Statistics data on Wednesday showed the price of essential goods and services climbed a massive 8.3 per cent over the year to September off the back of surging food prices and an 11 per cent jump in gas prices. Economists predicted the cash rate would rise from 2.6 to 2.85 per cent when the RBA board met next Tuesday, but that a double hike was now in prospect.

Peter Dutton, who will deliver his first budget-reply speech on Thursday night, ramped up attacks on Labor over its handling of the cost-of-living crisis and accused the government of “deceiving” voters with its promise to slash power prices by $275 within three years.

The Opposition Leader said the government had no “solution for increased energy prices” and flagged the Coalition would prepare policies to deal with household budget pressures fuelled by rate hikes, inflation and the global economic downturn.

“Australian families will be $2000 worse off by Christmas under this Labor budget and that’s not what they were promised,” Mr Dutton said.

Anthony Albanese criticised Mr Dutton’s claim as “made up figures”.

Mr Dutton’s budget-reply speech will focus on cost-of-living pressures, record energy price hikes and the Coalition’s economic record but was unlikely to rush out new major policies, as households braced for more pain ahead of the May budget.

With wages poised to lift from 2.6 per cent to only 3 per cent in September, according to recent RBA forecasts, workers face the prospect of a 4.3 per cent slump in real pay – the worst drop in the history of the data stretching back to the late 1990s.

Ahead of a fight in parliament this week over Labor’s proposed changes to multi-employer bargaining, ACTU secretary Sally McManus urged the government to do more to get real wages going again.

“Working people have been waiting a decade for a pay rise and have spent more than a year watching their wages go backwards,” Ms McManus said. “This is a systemic problem which we urgently need to address.”

The Prime Minister and Dr Chalmers, who launched a media blitz on Wednesday ahead of a nationwide tour to sell the budget, defended their record climate change investment while balancing the looming power crunch for households.

Dr Chalmers said the government was pursuing “a broad range of options” to address rising electricity and gas prices, which are likely to include imposing a price cap. The market intervention is expected to be finalised with state governments and energy regulators in coming weeks.

The ABS figures showed CPI had jumped from 6.1 per cent in August to 7.3 per cent over the year to September, the highest level since 1990, fuelled by growth in prices for homebuilding, gas and furniture.

The RBA’s core inflation measure also surpassed expectations, jumping from 4.9 per cent to 6.1 per cent, above the anticipated 5.5 per cent.

NAB chief economist Alan Oster said there was now evidence that inflationary pressures had escalated in recent months, and predicted the RBA next week would lift its forecast peak from 7.75 per cent in the December quarter to 8.5 per cent.

“In these circumstances, the RBA will need to move monetary policy into more clearly restrictive territory to ensure inflation returns to target, and as such we have revised up our terminal rate expectation to 3.6 per cent, from a previous estimate of 3.1 per cent,” Mr Oster said.

“We see a 25 basis-point move as likely, but a 50bp rise in November is possible, given (the) CPI.”

ABS program manager of prices Michelle Marquadt said the main contributors to the September quarter CPI were a 3.7 per cent increase in home construction costs, a 10.9 per cent gas price rise, and a 6.6 per cent lift in furniture prices. “Annual gas price reviews across the states and territories saw higher wholesale gas prices passed on to consumers in the September quarter. Electricity rose 3.2 per cent this quarter,” she said.

Without credit schemes offered by the Western Australia, Queensland and ACT governments, electricity would have risen 15.6 per cent in the quarter. Food prices continued to climb, offset by a 4.3 per cent drop in petrol prices.

Business groups, including the Business Council of Australia, Australian Chamber of Commerce and Industry, Australian Industry Group and Minerals Council of Australia, have expressed dismay over moves to shake up the industrial relations system at a time of record low investment, unstable inflation and a slowdown in productivity.

BCA chief executive Jennifer Westacott said low productivity was “the biggest handbrake on wages”.

“We’ve got a debt at a trillion dollars; the fastest-growing payment in the budget is the interest bill,” Ms Westacott said. “That’s faster than the NDIS over a decade, faster than education, faster than health. We’ve got feeble economic growth at 1.5 per cent. We want wages to go up. That’s about an industrial relations system that drives bargaining, which is the ticket to higher wages. And that doesn’t produce more complexity, that doesn’t produce more conflict and that doesn’t produce widespread industrial action.

“When I hear union leaders saying what we want is widespread industrial action, I don’t think the community wants widespread industrial action.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout