Indigenous voice: Why big business is steering clear of the debate

Business should have a legitimate say on both sides of the referendum debate without the fear of political or social blowback.

As the temperature gets turned right up ahead of the Indigenous voice referendum, much of corporate Australia has lost its own voice on the issue.

The contrast is stark to the same-sex marriage vote six years ago when supermarkets, airlines and banks were on the front foot urging customers to back change. Even compulsory Covid vaccines were a hot button topic where the big end of town was prepared to weigh in.

Why are chief executives so quiet this time?

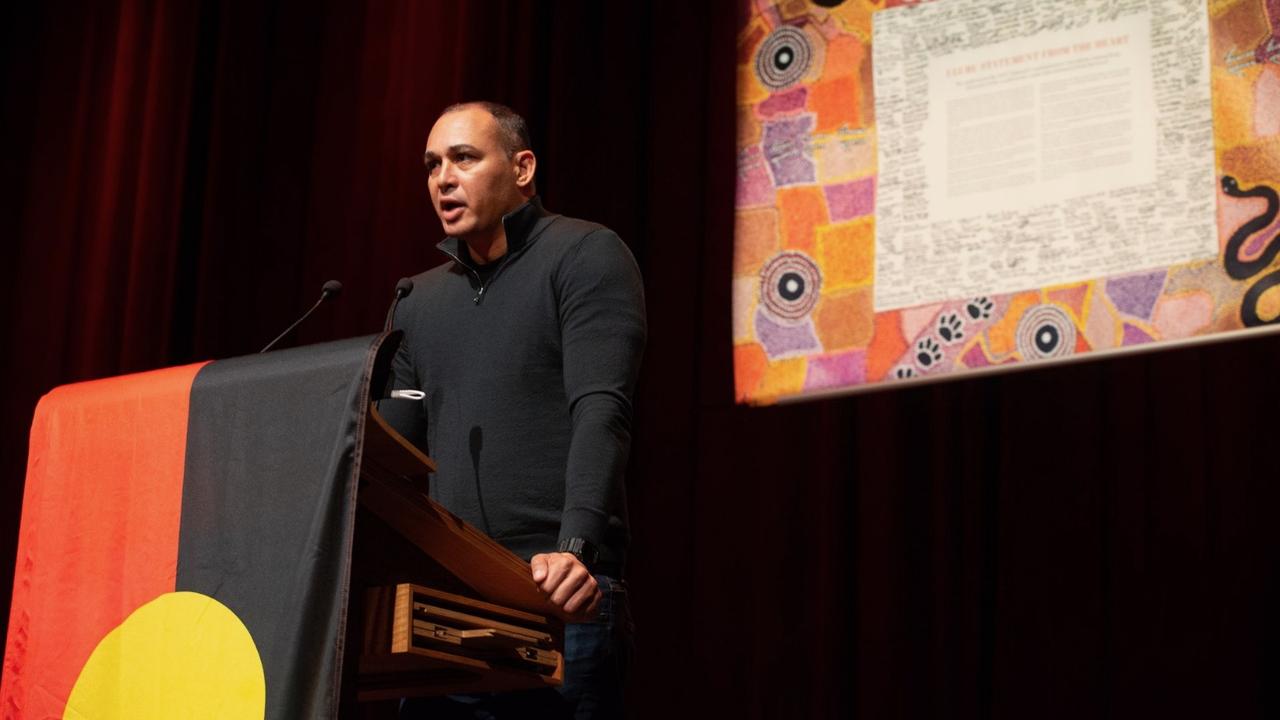

The fuse was lit this week when Reconciliation Australia and 70 organisations including ANZ, Commonwealth Bank, Westpac, IAG, Wesfarmers and Telstra released a statement of support to enshrine constitutional recognition and the creation of an Indigenous voice to parliament. The corporate names were sitting alongside not-for-profits and unions in support.

One executive at a top 20 company said there was a considered debate right through the management about whether to back the voice but ultimately the view settled that it aligned with their broader corporate vision of helping to create a better Australia. “If we can’t back that on this issue we might as well rip up our purpose.”

The executive’s firm signed on to the statement and the approach they are taking is talking to their own staff although with the volume turned down. “We’re not going to be out there,” they said.

Corporates see more at stake when it comes to constitutional change (as opposed to legislative) and the voice is now largely being divided on party lines.

Deep down big business knows they have massive reputational baggage across both sides of politics. There is a view their willingness to go public or wheel out a fat-cat chief executive in support or even against would be counter-productive for the debate.

Political heat

BHP, Rio Tinto and Wesfarmers this week felt the political heat as it emerged they were financial backers to the Yes23 campaign. This even extended to full page ads in Nines’ AFR mocking Wesfarmers chair Michael Chaney and Yes23 campaign lead and unionist Thomas Mayo.

But it was this moment of big business getting on board that all Opposition Leader Peter Dutton needed. It has given him a chance to find a better enemy for the voice to hit than potential voters. Step up big business.

And with the perception that corporate Australia has been driving the inflation bubble that is hurting ordinary households, this has given Dutton even more ammunition to show the motivation of the voice is really driven by elites and those that are badly out of touch.

Wesfarmers hasn’t owned Coles for five years but this didn’t stop Dutton accusing the supermarket, as well as Wesfarmers-owned Bunnings, of having an “activist CEO” and demanding they instead focus on cutting prices. Coles was not a signatory of the Reconciliation Australia document, but has stated its support for constitutional change for reconciliation.

Corporates are usually smarter at the long game than politicians. Most know the best thing to do is shut up and let the debate happen on the ground. However, this is perversely creating a vacuum where the debate is being led by one side of politics rather than a cross section.

The voice’s Yes campaign is being guided by CT Group (the well-connected advisory previously known as Crosby Textor) but it does need financial support. And it’s here where some companies with a direct stake in reconciliation have been prepared to offer their voice – shareholders’ funds – to back their position.

This means the campaign was always going to find a natural partner among its historic adversary in the big miners.

Social licence

Despite Rio Tinto’s massive governance failures around Juukan Gorge cave destruction, big miners have known for decades their social licence to operate relies on trust and strong relations with the Indigenous communities they operate. This became even more obvious after Juukan Gorge, one mining executive told The Australian.

It is understood inside BHP’s boardroom – which is made up of international and Australian-based directors – there was very little debate about signing on to the Yes campaign. It was a similar situation at Rio Tinto which has a long way to go in rebuilding trust.

BHP for one has 8 per cent of its Australian workforce from an Indigenous background and the miner has spent years attempting to build trust with landowners. Much of that comes down to employment opportunities where it spends hundreds of millions with Indigenous suppliers.

Wesfarmers, too, is building a lithium mine in Western Australia and through its broader business that extends to Bunnings, Kmart and Target, it employs 4000 Indigenous staff and has thousands more Indigenous customers and suppliers.

Executive general manager Naomi Flutter says Wesfarmers has long benefited from working with Indigenous staff members. She said the focus for donating to Yes23 is to promote informed and respectful discussion. Wesfarmers won’t be telling staff how to vote because it is a personal decision, she adds.

Inside one of the banks that signed on to Reconciliation Australia the boardroom debate was much more contested with a view that the voice was getting away from its core business of loans and deposits. The counterfactual in the debate was that business should not have a position on social issues rather than opposing the idea of the voice.

Banks and miners and others The Australian has spoken to this week strongly reject suggestions ESG investors and green funds are pressuring them into a position.

A big difference between today’s voice referendum and the same-sex marriage debate is one of consequence, says one bank executive. That vote was a plebiscite and the social change had no economic impact. The voice could potentially have a real impact on the way they do business. The executive points to the Covid vaccine program. Here business strongly got on board and was prepared to wear the blowback because there was a much bigger economic payoff at stake.

While the inclination is for business to sit out, it does need a nuanced response.

Business should have a legitimate voice on both sides of the referendum debate without the fear of political or even social blowback. The vote could directly impact how they invest, recruit and take part in reconciliation. For business the voice is too big to stay silent.

Bubs reset

In the heat of a bitter battle with founder Kristy Carr and facing a shareholder revolt, infant formula play Bubs had little choice but to attempt a reset.

However, the release of a five-point plan to become cashflow positive and profitable by 2025 relies on a lot going right.

It is also a leap of faith for shareholders, given the company needs a new chief executive, a full-time chief financial officer, a stable board and supportive investor base.

The broader environment is also working against Bubs, where costs are rising and the US economy where it has pinned much of its hopes is verging on a recession.

Carr and former executive chairman Dennis Lin were ejected from the company in recent months, under claims by the current board of governance issues, and following a collapse in revenue from its much-heralded China push.

The pair are now orchestrating a boardroom spill and have secured enough support for an extraordinary general meeting, set down for later this month. Part of their plan is to install former A2 milk boss Peter Nathan as Bubs CEO.

Bubs’ search for a new CEO has been paused ahead of this month’s EGM with the process to resume after the vote.

Early on Thursday Bubs released the results of a two-month strategic review, but this has conveniently become an electoral pitch to support of Bubs’ current board under new chair Katrina Rathie. That review had been led by independent director Reg Weine with input from advisers Kidder Williams.

The key pitch is that, under the previous regime, Bubs has accumulated losses of $240m and has been a serial capital raiser, going back to the market at least seven times. For those tipping more funds in this has seen the value of their investment implode by as much as 80 per cent.

The forward plan is a bigger pivot to US premium markets. with Bubs now hitting $1m in monthly sales over the Amazon platform. There is also interest from retailers in what Bubs estimates to be significant opportunity in the premium end of the infant formula market.

Of course, entry into the US all hinges on getting permanent access to the market, with an approval process underway with the Food & Drug Administration. The outcome of this may not be known until later 2025.

Also slated for change is a reset in the troubled China market where Bubs plans to pivot back to its core of goat infant formula from the A2 milk strain. Elsewhere, it needs to leverage the Alibaba e-commerce platform but Weine was clear that Alibaba (also a shareholder in Bubs) was but one of many channels to grow in China.

At the same time, Bubs is exploring private label manufacturing with its hi-tech canning plant outside Melbourne currently running at just a third of capacity.

Other areas include cutting cash burn and lowering annual operating expenses by around $10m. The plan is to hit cashflow positive by the June quarter of 2025.

All this could be a moot point with the direction of the company hinging on the fate of a vote. Until then shareholders are no closer to finding their way through the mess.

johnstone@theaustralian.com.au

More Coverage

Originally published as Indigenous voice: Why big business is steering clear of the debate