Xi Jinping’s energy plan for China: Everything, everywhere, all at once

Eleven nuclear power stations signed off in a single meeting, more than 1000 thermal coal-fired power stations. China is taking an everything, everywhere, all at once approach to its electricity mix.

Solar projects as big as Singapore. Eleven nuclear power stations signed off in a single meeting. A fleet of more than 1000 thermal coal-fired power stations … and still growing.

As Australia heads to a federal election that pitches nuclear power against a ramp up of renewables, China is taking an everything, everywhere, all at once approach to its electricity mix.

To travel around China is to witness a rollout of renewables on a scale beyond anywhere else in the world. You can see it from the window of every domestic flight or fast train trip.

Yet all this new solar, wind, hydro and nuclear power is still not enough to meet the growing electricity demands of China’s 1.4 billion people and its economy that remains for so many products the “factory of the world”.

New thermal coal-fired power stations continue to make up the difference.

“Forget about kicking thermal [coal] out of the mix,” David Fishman, a Shanghai-based energy consultant, says. “China is just trying to cover its demand growth with renewables.”

Chinese energy experts call it the country’s “ ‘two-way’ growth trend”, a simultaneous rollout of renewables and coal. Privately, many are aware it is becoming increasingly conspicuous.

Unlike in Australia or the rest of the rich world, China’s gargantuan electricity demand is still growing — even as the Chinese economy slows. This year it has risen by some 7 per cent, a rate that has surprised many long-term analysts of China’s energy market.

The sums in China are staggering. Just the growth in Chinese electricity usage this year was around three times Australia’s entire electricity consumption.

For all the hype about its raft of “world’s biggest” renewable projects, China is transitioning its electricity network at a far slower rate than Australia.

Beijing has set a renewables target of 40 per cent for 2030, a modest increase from the just over 35 per cent it now derives from hydro, wind, solar and nuclear.

The Albanese government has set a target of 82 per cent by 2030, twice the current level.

China is changing its energy mix but the world’s mightiest one-party state is doing it on its terms. There are no university students or former government ministers in kayaks blockading its coal ports.

Desire to dominate

Xi Jinping outlined his approach in a major speech in 2022 at a twice-a-decade party congress. “We will advance initiatives to reach peak carbon emissions in a well-planned and phased way,” he told senior comrades.

Xi said China would follow “the principle of building the new before discarding the old”.

As is Australia, China is blessed with huge coal reserves. Unlike Australia, Beijing is unapologetic about making the most of them and the same with its gas reserves.

“Coal will be used in a cleaner and more efficient way, and greater efforts will be made to explore and develop petroleum and natural gas, discover more untapped reserves, and increase production,” said Xi in that same keynote speech.

It’s not as catchy as Donald Trump’s “Drill, baby, drill” catchphrase but it’s the same idea.

China’s leader departs from the US president-elect, and from Australia’s energy debate, with his plurality. Xi and his top comrades are for coal, gas and oil, but they are also for “clean, low-carbon, and high-efficiency energy use”, solar, wind and new sources such as green hydrogen if they can be made cost-competitive.

Sounding a bit like Adam Bandt, Xi says he is for “ecological conservation”. Then sounding like Peter Dutton, he’s also for developing nuclear power “in an active, safe, and orderly manner”.

It’s less fashionable in the current era to describe the Chinese leadership class as “technocratic”, but many experts think it still fits China’s approach to its energy mix.

“It’s not activist-driven at all,” says Fishman, the Shanghai-based energy consultant. “It’s like you took a bunch of physics students and a bunch of economists and you put them in a room together and said ‘Choose a technology path’.”

While Xi’s Communist Party won’t be rushed as it transitions China’s electricity network, it sees a huge opportunity in the global shift.

“China wants to dominate the industries of the future,” says Tim Buckley, the Sydney-based head of Climate Energy Finance, a clean energy think tank.

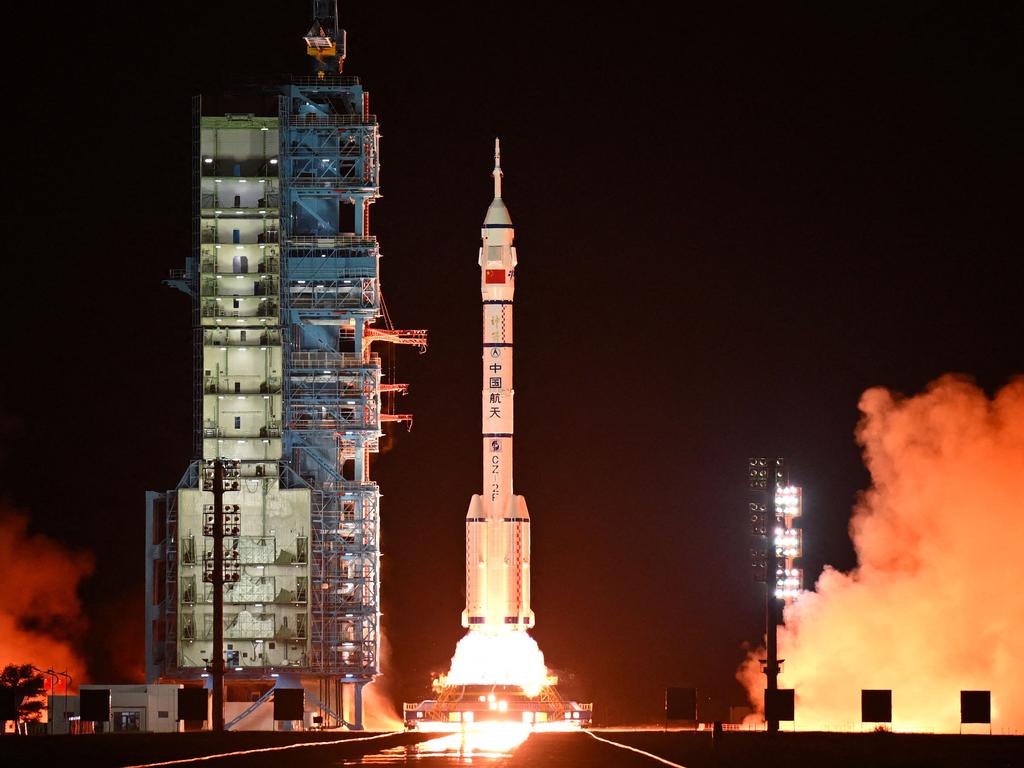

In sector after sector from wind farms to solar panels to battery storage to the rollout of new fourth-generation nuclear power technology, China now leads the world.

“I have been watching China for 15 years and they’ve exceeded every expectation I had in terms of their investment and the longevity of their strategic thinking,” says Buckley, who used to be the head of research at Citigroup’s Australian hub.

He acknowledges there is now a growing tension, however, between China’s approach to its domestic electricity network and its role as the factory for the world’s green transition.

“Do they need to stop walking on both sides of the street? Absolutely,” he says.

“China, you’re the world’s leader in every zero emissions technology. It’s time you stop pretending you’re an emerging market. You’re not. Act like a leader.”

Energy security

For all their energy agnosticism, China’s leaders have overseen their fair share of supply debacles in recent years.

In late 2020, amid bitingly cold winter weather, hundreds of millions of people in China had their power drastically reduced as coal supplies ran low – a problem compounded by Xi’s far from technocratic decision to blacklist Australian coal imports to punish the Morrison government.

People were told not to use their heaters until temperatures fell below 3C.

The next year, a devastating drought in southwest China reduced output at its hydropower stations, which normally supply some 15 per cent of the country’s generation.

“Whoever is in the lifts will be trapped,” read notes in buildings around the country, as hundreds of millions of people endured rolling blackouts.

Beijing made clear that security of supply was its top energy priority and downgraded the urgency of its green transition.

Energy spikes after Vladimir Putin’s invasion of Ukraine in 2022 only reinforced the Chinese leadership’s opinion.

Its response was to embrace “the old”, rolling out new coal power stations at a pace unlike anywhere else in the world.

In 2023, China accounted for a 95 per cent of the world’s new coal power construction activity.

Australia, with an electricity network about 3 per cent the size of China’s, hasn’t commissioned a new coal power station since West Australia’s Bluewaters Power Station in 2009. Australia’s electricity demand has been flat for decades.

“At the end of the day, they’re all about energy security, not getting off their coal addiction,” says Buckley.

Much of China’s ongoing coal power rollout is to create “flexible” baseload power to complement its renewables projects.

Chinese coal stations already run for less of the day than their counterparts in Australia and analysts expect their running time will fall further as cleaner sources are added to China’s grid.

Building multi-billion-dollar power stations remains a useful way for Chinese provincial leaders to boost economic growth rates, one of their key performance metrics and an increasingly challenging one as China’s economy struggles with a property slump, weak consumer confidence and a challenging international environment.

”There’s 5000 workers. There’s a huge amount of cement. There’s a huge amount of steel. There’s a railway line. There’s all sorts of roadworks,” says Buckley.

China’s new-generation coal power stations do not feature on the itineraries of most foreigners who visit China to inspect the country’s energy transition, but they remain the backbone of its energy system.

More than 60 per cent of China’s electricity generation comes from coal.

China is by far the biggest user of coal in the world, burning almost five times much as does India, the second biggest user.

The Chinese state council’s August white paper on “China’s energy transition” says the country’s capacity tariff mechanism will “transition coal from being the primary power source into serving a supporting and balancing role”.

It is vague on the timelines and targets that will get it to “net zero” in 2060 – 10 years after every other rich world economy, including Australia.

“By the middle of the century, China will have become a great modern socialist country with a clean, low-carbon, safe and efficient energy system,” China’s white paper says.

“Its energy efficiency will be among the world’s highest, with non-fossil fuels as its main energy sources, as the country looks to achieve carbon neutrality by 2060.”

Nuclear pipeline

Transitioning China’s enormous, sooty energy mix into something cleaner is going to be orders of magnitude more complicated than Australia’s change.

The scale of China’s electricity consumption is like nowhere else in the world: it is twice the size of the world’s second biggest user, the US, and still growing.

Even after it grew by almost 600 per cent over the past two decades, China’s per capita electricity consumption is still only two-thirds of that in Australia. It shows no sign of slowing down.

A fair chunk of that growth was to power the factories that are building the made-in-China wind farms, solar panels and EVs that Australia and much of the world are importing to facilitate their energy transitions.

An ever-growing catalogue of mind-blowing Chinese renewable energy projects are being announced and then built with “China speed”, but they still aren’t outpacing the country’s total new electricity demand.

They are getting close though. Lauri Myllyvirta, a senior fellow with the Asia Society Policy Institute’s China Climate Hub, keeps a useful monthly tally based on Chinese government announcements and statistics

In just the first nine months of the year, China added more wind power (38GW) than the total wind power capacity in Britain. That rate of growth was up 10 per cent from the year before.

In June, a subsidiary of the Chinese state-owned behemoth China Green Development Group switched on a 3.5GW solar farm Xinjiang, in China’s sunny, and infamous, far west. That Xinjiang project’s status as the world’s biggest solar project is going to be overtaken by a preposterously big 8GW rollout in China’s Inner Mongolia by another state-owned power company. It is projected to cost $US11 billion ($17bn) and will be larger than Singapore.

Hydropower nudged up 2 per cent for the year and remains by far the biggest source of renewable energy in China.

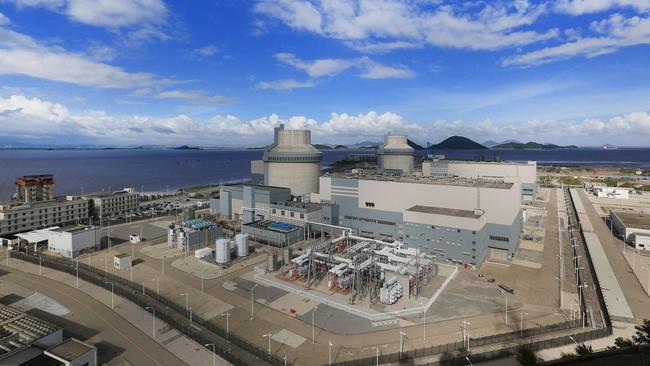

China’s nuclear rollout does not get as much attention as its photogenic solar and wind projects but it also towers over the rest of the world.

The latest, in Fujian province in China’s southeast, was hooked up to the grid two weeks ago. It was constructed in 61 months, a pace unimaginable in a high-wage liberal democracy.

“China builds these things by throwing 10,000 people at the program, like ants coming together to move an elephant,” says Fishman.

He tells The Australian that pace of construction would be impossible in a high-wage, high-regulation economy like Australia’s, which has no experience building nuclear power stations.

Half of the nuclear power stations under construction in the world are in China. Eleven more were signed off by Premier Li Qiang at a single meeting in August. Many analysts forecast that China will likely approve and construct them at that rate – 10 or so a year — for the next three decades.

The Coalition’s plan is to build a total of seven nuclear power stations over the same period.

China’s pipeline of nuclear stations could allow Beijing to retire its dirtiest coal power stations and finally bring down the amount of power it gets from coal.

Breakthroughs in green hydrogen could help further.

Further developments in battery storage could also allow a higher share of renewables.

Carbon capture is also being pursued, which could extend the life of its coal fleet.

China’s electricity mix will depend in part on what technology becomes scalable and economic in the coming decade. It will also turn on whether Beijing can rein in the growth of its electricity use.

The Chinese government’s commitment for its carbon emissions to peak in 2030 could make that a date when its decades of electricity growth finally tapers.

Until then, Beijing is likely to keep growing the world’s biggest network of coal-fired power stations. Another eight large coal power projects were quietly approved in recent months, each with working lives of 40 to 60 years.

More are expected next year.

It is an approach that has frustrated champions of China’s huge investments into new renewable energy technologies, even if they can appreciate Beijing’s self-interest. “Being cynical, the more they pollute today, the more they can be a hero in the future,” says Buckley.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout