Xi Jinping faces ‘too big to fail’ corporate catastrophe

In what is described as China’s ‘Lehman Brothers', Beijing is considering whether to let debt-burdened building giant Evergrande go bankrupt.

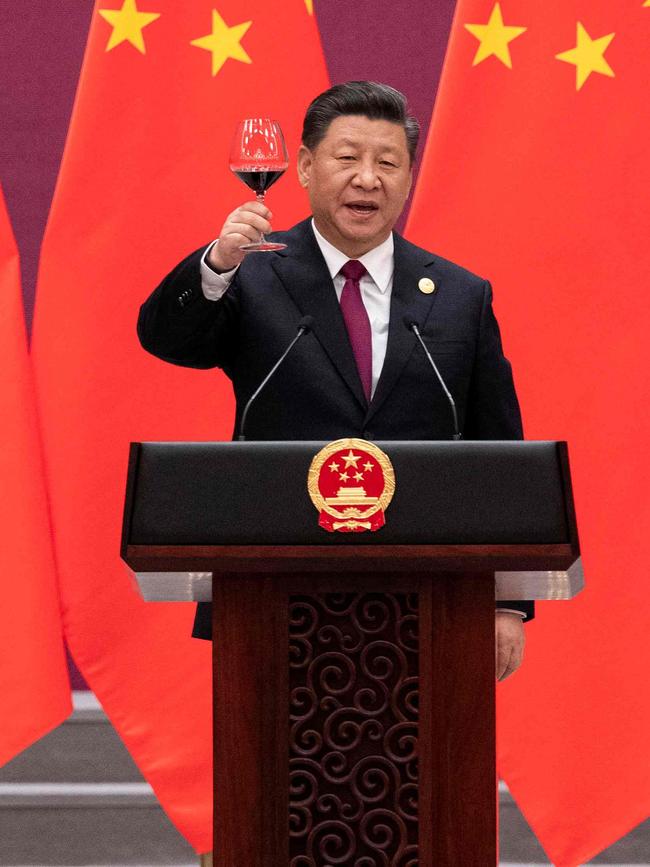

President Xi Jinping was facing the most serious test of his approach to Chinese capitalism last night as Beijing decided whether it could allow a corporate giant burdened with hundreds of billions in debt to go bankrupt.

In what was described as “China’s Lehman Brothers” crisis, Beijing was considering whether to provide a bailout to Evergrande, a property multinational that has risen to become one of China’s biggest companies. It borrowed heavily to finance its rapid expansion and has debts of $416 billion. The latest round of payments on those debts is said to be due today.

Should Evergrande be allowed to fail, experts warned that it could be the tip of an iceberg affecting China’s financial system and beyond. Evergrande, meanwhile, has halted work on the majority of its housing projects.

The company, founded in 1996, rode the country’s property boom to become the 122nd largest group in the world by revenue. Its founder, Xu Jiayin, was once the richest person in China and the company once owned a leading professional football club.

The crisis comes as Xi appeals to rank-and-file Chinese with policies to make housing more affordable and curb what he has described as excessive wealth among the country’s elite. This year he began a crackdown on the independence of Chinese businesses, ordering tech firms and their leaders to contribute more to society. Last year Beijing brought in rules to control the amount owed by property developers.

China demolished 15 high rise apartments because developers got broke along the way when building pic.twitter.com/SJFbpwFetF

— BANK$ (@Polycarpboss) September 7, 2021

Xu reportedly admitted this month that the company had made a “strategic error” in 2017 with its expansion ambitions from its base in the southern city of Shenzhen. Experts suggested that if Xi decided to bail out the company it would be to ensure “social stability”.

The commentator Sun Lan told the Hong Kong news website hk01.com that Xi would not allow a company as big as Evergrande to go bust before he celebrated his third term as the leader of the Chinese Communist Party next year. “Even if the government is to lend help, it is not because Evergrande is too big to fail, but it is to save the industry to ensure social stability, especially ahead of the 20th party congress,” Sun said. “Behind the Evergrande crisis are hundreds of thousands of ordinary people and their families, including some of the ordinary employees of Evergrande, investors, and countless families who have not been given their homes. They are the biggest victims.”

The shockwaves of Evergrande’s failure would be felt across the financial world, Sun added. Work has stopped on more than 500 of its 800 construction projects, leaving thousands out of work.

Hang Ziya, another commentator, argued that Beijing was prepared to let the company fail to set an example for others. “Evergrande should give up any illusion of using the threat of bankruptcy to blackmail the government and force the state to rescue it,” Hang said. “The official stance is very clear: whoever misjudges the market and the policy must bear the consequences.”

Chinese state media largely ignored the story. Global Times, the Communist Party’s propaganda organ aimed at a foreign audience, was an exception but it ran the story under the upbeat headline: Evergrande starts repayment plan by offering investors properties.

In a statement, Evergrande Group said it had faced “unprecedented difficulties” and promised to make good on its existing deals and contracts. “We will try all means to resume normal operation and go all out to protect the rights of our clients,” it added.

It has ordered six senior executives to return investments that were paid out ahead of schedule after a public furore.

-

Q&A

1. What is Evergrande, and what’s the problem?

Evergrande is China’s largest property developer that over 25 years has built millions of apartments by borrowing money. Today interest payments are due on debts estimated at $416 billion and it appears unable to pay them. Without a bailout it faces going bankrupt.

2. How did this happen?

Rising prices caused a property bubble that appears about to burst. Supply of apartments exceeds demand and many new apartment blocks stand empty or unfinished. The government saw it coming and began a campaign against property speculation. This appears to have precipitated the crisis.

3. What does this mean for China?

The government faces a dilemma. It could simply order its state-owned banks to roll over Evergrande’s debts. But this would have the effect of rewarding irresponsible borrowing. More likely, it will allow the company to fail. This will be a disaster for Evergrande’s creditors, suppliers and employees, as well as the customers who have paid for 1.6 million unfinished apartments.

4. What about the rest of the world?

The fear of “contagion” beyond the Chinese property sector to the world economy has already driven down share prices. Any slowdown in Chinese economic growth affects companies that export there, and Europe is more exposed than any other region.

The Times