Nvidia on track to be first trillion-dollar chip company

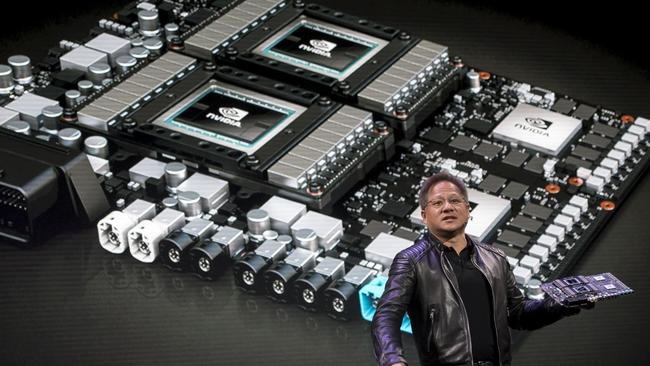

Shares in the Silicon Valley group founded by Taiwanese-American billionaire Jensen Huang have surged, leaving analysts breathless.

Demand to power the “AI revolution” is set to create the first chip company with a stock market value of $US1 trillion ($1.54 trillion).

Shares in Nvidia, the Silicon Valley group founded by a Taiwanese-American billionaire, surged by a quarter to fresh highs on Wall Street, putting it on the cusp of the landmark valuation after it issued “blowout” guidance for its second quarter on Wednesday night.

By the close in New York on Thursday, the stock had leapt by 24.4 per cent, or $US74.42, to $US379.80 valuing the company at about $US939 billion.

Nvidia has positioned itself at the centre of the race to develop artificial intelligence tools by becoming the main source of chips behind chatbots such as OpenAI’s ChatGPT.

The rally extends Nvidia’s lead as the world’s most valuable chip company and America’s fifth most valuable company in any sector, dwarfing the likes of Intel, a rival. Nvidia’s market capitalisation has more than doubled this year and its eagerly anticipated earnings update left analysts breathless.

Barclays said it was “just the beginning of a paradigm-altering generative AI wave” and Nvidia was “the one capturing nearly all the economics”.

Wedbush Securities called the guidance “jaw-dropping” and suggested a “historical inflection point” in the “AI revolution”.

Andrew Monk – the head of VSA Capital who was an early advocate of the potential of Arm, the chip designer based in Cambridge that Nvidia tried to acquire last year for $US66 billion – said Nvidia’s share rally was “massive for a mega cap” and confirmed “its position as the biggest short-term beneficiary of the AI race that has broken out in the technology industry”.

Based in Santa Clara, California, Nvidia was co-founded in 1993 by Jensen Huang, who has called the craze for AI and language-generating tools the “iPhone moment”, mimicking the watershed when Apple led the shift towards smartphones.

Huang, 60, was born in Taiwan, known as the semiconductor capital of the world, and lived in Thailand as a child before his parents took the family to United States. He imagined the idea for Nvidia on his 30th birthday at a Denny’s diner with Chris Malachowsky and Curtis Priem, two electrical engineers.

A $US40,000 investment of their own money to produce improved computer graphics for video games led to venture capital backing and the company was floated on the Nasdaq stock exchange in 1999.

Nvidia took off around 2016 when it shifted the focus of its graphics processing units from video games to AI. It is now capitalising on the huge demand for computing power that drives language-generating tools such as ChatGPT and the race between technology companies to offer the latest features to customers. Microsoft, which has backed OpenAI, has been adding the technology to its Bing search engine and business software products, while Google has introduced its own advanced AI tools.

The production of Nvidia’s chips is handled by contract manufacturers, such as Taiwan Semiconductor Manufacturing Co, the world’s largest, shares of which also rose in New York, adding 13.1 per cent to $US101.95 at lunchtime on Thursday.

Nvidia has sought to get ahead of the expected surge in demand by making specialised chips for AI customers and Huang said the company was “significantly increasing our supply”. It started full production of its latest AI chips in August last year, giving it some leeway in supplies when the popularity of chatbot apps took off.

The surge in demand comes amid a power struggle over chips between Washington and Beijing. The Biden administration has introduced American export controls to slow Chinese semiconductor manufacturing.

Elon Musk, the chief executive of Tesla, who is reported to be building an artificial intelligence start-up, has said that they are “considerably harder to get than drugs”.

Nvidia has forecast second-quarter sales of $US11 billion, more than 50 per cent higher than the consensus on Wall Street of $US7.1 billion and the $US6.7 billion generated in the same three-month period a year ago. That led sector experts scrambling to update their forecasts.

Analysts at Barclays said: “The expectation was always that Nvidia would see a jump in its data centre business, but this was at least a quarter early and extraordinary in magnitude”.

Nvidia’s data centre division has surpassed its gaming business in revenues over recent quarters as operators of big data centres update their computing infrastructure.

“A trillion dollars of installed global data centre infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process,” Huang said.

Hermann Hauser, the founder of Arm, said: “This is one of those events that comes round every decade or so … Nvidia is making hay while the sun shines … but there will be opportunities outside of Nvidia.”

Dan Ives, an analyst at Wedbush, said Nvidia was the best indicator of underlying AI demand in the market, which it said was the “core hearts and lungs of the AI revolution”.

“Wall Street was awaiting Nvidia’s quarter [earnings] and guidance to gauge the magnitude of this AI demand story, with many sceptics saying an AI bubble was forming, and instead Jensen & Co delivered guidance for the ages.

“In 22 years of covering tech stocks and large caps, we have never seen a guidance range of this magnitude on a large-cap tech name and this speaks to our thesis that the monetisation of AI for stalwarts like Microsoft, Alphabet, Amazon, Oracle, Meta, Apple and Salesforce is well under way in this Game of Thrones battle among tech players.”

The Times

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout