China threatens to demolish house that Jack Ma built

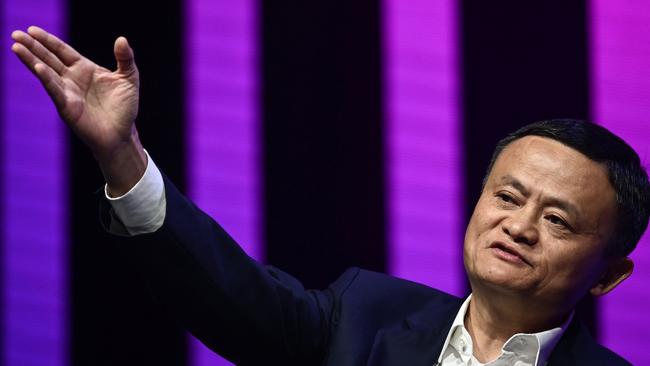

Since billionaire Jack Ma challenged the supremacy of Beijing’s regulatory system, his empire has been thrown into a tailspin.

Since Jack Ma challenged the supremacy of Beijing’s regulatory system and the state-backed banks a couple of months ago, his empire has been thrown into a tailspin.

In an impolitic speech delivered at the Bund summit in Shanghai in front of senior officials, the outspoken founder of Alibaba, the ecommerce giant, and Ant Group, the digital payments company, accused traditional lenders of operating with a “pawn shop” mentality.

Mr Ma, 56, one of China’s wealthiest and most prominent tycoons and a critic of the regulatory financial framework, warned that economic growth would be throttled if credit was withheld from innovative businesses and he likened global banking regulations to an “old people’s club”.

The response from Beijing has been dramatic. Clampdowns, fines and investigations into Mr Ma’s many interests have followed swiftly.

The English teacher-turned-international symbol of the country’s burgeoning private sector is now pitched against the Chinese state. As a consequence, Alibaba’s shares have dropped by a quarter since their peak shortly after the October speech, wiping more than $US10 billion ($13bn) from his paper fortune.

More broadly, the episode has raised questions over the extent of Beijing’s interventions, the outlook for the country’s other entrepreneurs and the scale of Mr Ma’s future empire.

Such has been the downturn in relations that Mr Ma – uncharacteristically absent from public view since the speech – was advised by the government to stay in China, according to Bloomberg. He also was replaced as a judge in the final of an African business talent show that he created, which a spokesman attributed to a scheduling conflict.

Beijing’s intervention began emphatically in November, when the planned $US37bn flotation of Ant Group in Shanghai and Hong Kong – which would have been the world’s largest, surpassing that of Saudi Aramco – suddenly unravelled on the eve of the listing. The float was blocked after China’s financial regulators moved to tighten online lending. Mr Ma was told that loan sizes would be capped and that upstart lenders would need to hold more capital.

Ant Group, based in Hangzhou, is 33 per cent-owned by Alibaba, one of China’s biggest ecommerce companies with group revenues of 510 billion yuan ($101bn) last year. Ant developed from the Alipay app launched in 2003 as a payment service by Alibaba to allow its users to pay for goods online.

Later it expanded into consumer lending, connecting borrowers and lenders. Alipay, which has more than 730 million monthly users, competes with Wechat Pay, owned by Tencent, the Chinese social media and technology giant, and both are increasingly popular alternatives to cash.

Beijing’s scrutiny intensified this week when it emerged that Chinese regulators were reviewing equity investments held by Ant, potentially forcing it to divest stakes in technology and financial technology start-ups deemed to create unfair competition.

The intervention threatens to curtail Ant Group’s influence over China’s fast-growing fintech industry. It also comes days after China’s central bank pressed Ant to restructure and to put up more capital for its consumer lending business.

Pan Gongsheng, deputy governor of the People’s Bank of China, urged the company to address alleged financial regulatory violations after a meeting last weekend with officials in which concerns over its corporate governance, response to regulatory demands and the squeezing out of competitors were raised.

The authorities also have targeted Alibaba. Beijing launched an antitrust investigation into the group on Christmas Eve and in November, in what signalled the first significant regulatory curbs against the digital sector, issued draft rules aimed at preventing monopolistic behaviour among internet platforms.

Antitrust issues have risen to the top of the Chinese Communist Party’s agenda and were made a priority for this year at a politburo meeting last month, according to the Xinhua state news agency.

Ant has said that it will “comply with all regulatory requirements” and Alibaba said that it would co-operate with the investigation.

China and its state-controlled media have been seeking to portray the interventions as designed to bolster competition in its fast-growing internet sector and to prevent consumers getting into too much debt. Yet observers suspect that Mr Ma’s financial and ecommerce empire is being specifically reined in.

Duncan Clark, chairman of BDA China, a Beijing-based investment advisory firm, author of Alibaba: The House That Jack Ma Built, and vice-chairman of the China-Britain Business Council, said that the reaction to the speech was “pretty dramatic” and had got the attention of President Xi. “It enabled people who had been pushing against [Mr Ma] to finally take action,” he said.

Mr Clark said that China was “striking back” in an attempt to ensure that the private sector in the south did not disconnect from the party in the country’s north, by asserting control over entrepreneurs. Foremost in their sights was Mr Ma, who has charisma, chutzpah and an unparalleled megaphone. He added, though, that the party’s tightening of controls over the financial sector was probably necessary to curtail risky lending.

“Financial stability affects everybody, so I think it is a valid case for close regulation of fintech,” Mr Clark said. “But if they also go after the broader economy and make it more difficult for entrepreneurs, it raises questions for entrepreneurs and growth.

“This is the challenge in China. How can entrepreneurs navigate the shifting regulatory climate where lines are not always clear and they are moving? Jack Ma has been very good at navigating those trends – but occasionally he hasn’t.”

Another source, who asked not to be named, said that although Beijing was justified in tackling over-leverage and risks to the financial system, the actions appeared to be politically motivated against Mr Ma. “He was fiercely critical about the Chinese financial system and the bank. He was trying to revolutionise the system.” The source said that Pony Ma, head of Tencent and no relation – and who has overtaken his rival at Alibaba to become China’s richest person – kept a much lower profile.

“[Pony Ma] doesn’t speak much. He doesn’t go everywhere to give speeches. Jack Ma feels like a visionary. He wants to say this is the future. This is good for us as a country, as a nation. They [other entrepreneurs] don’t speak like that,” the source said.

The clampdown has not been directed solely at Mr Ma’s empire. China’s market regulator said this week that it had fined several ecommerce companies – JD.com, Alibaba’s Tmall and Vipshop, backed by Tencent – 500,000 yuan each after consumer complaints over the companies’ pricing strategies related to Singles’ Day promotions in November. Earlier in the month Alibaba and another Tencent-backed company were fined for allegedly failing to suitably report past deals for antitrust reviews.

China says that it wants to prevent practices such as ecommerce marketplaces restricting brands from selling on multiple platforms, a complaint levelled against Alibaba by merchants and its competitors.

The flurry of fines and restrictions has raised concerns among investors about what sort of company will emerge and what other challenges lie ahead. “The consequences for Ant are much more serious than for Alibaba,” Mr Clark said.

Disruption to the core Alibaba ecommerce business is thought unlikely as the Chinese economy is increasingly reliant on consumer growth, he said. HSBC, the Asia-focused bank, in a note on Alibaba before the recent regulatory interventions, had said that “the best is yet to come”.

There is speculation over a break-up of Ant Group or even of Beijing taking a stake. However, returning Ant to its roots as a digital payments company would be problematic, Mr Clark said. That business was loss-making, which would make it “very difficult” to get the float away.

Ant is considering folding most of its financial businesses, including consumer lending, into a holding company that would be subject to the tighter regulations placed on traditional forms, Reuters reported this past week.

As for Mr Ma, he is not expected to suffer a personal downfall, although his influence will have been checked. Public contrition and a joint statement could emerge, Mr Clark said. “There is a kind of a script to this [in China]”.

The final chapter of Mr Clark’s book, published in 2016, was titled Icon or Icarus, reflecting a flamboyant businessman who had already risked flying too closely to the Sun. “There was a sense with Jack that he’s too big to nail. But this is showing that he’s not. It reminds others that even if you’re the richest man, your wealth comes ultimately with the acquiescence at least of the party.”

The Times

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout