A Facebook failure would be a global disaster

Facebook has become so powerful its collapse would have ‘catastrophic social and economic consequences’, researchers say.

Facebook has become so powerful its collapse would have “catastrophic social and economic consequences”, researchers say.

The world’s largest social media company has become so essential to many societies, it is suggested that a special framework should be in place if it folds, similar to those for banks, critical infrastructure and national utilities.

A study by a team at Oxford University’s Internet Institute argues that regulators have not made sufficient plans for what would happen if the platform, which has 2.7 billion users, went under. “The potential demise of Facebook might seem highly unlikely but the implications need to be taken seriously”, lead author Carl Ohman said.

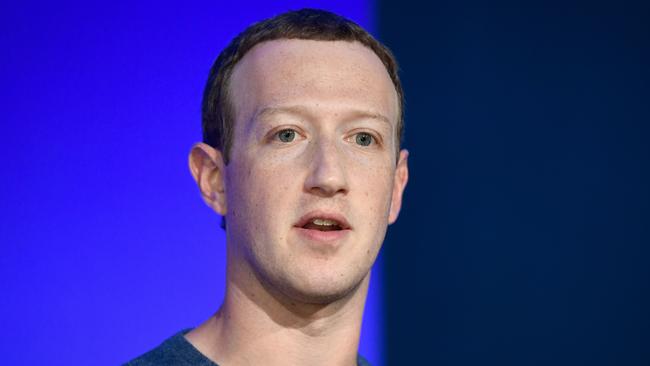

Facebook, co-founded by Mark Zuckerberg in 2004, is the biggest social media company in the world. Once Instagram, WhatsApp and Messenger are added, it has 3.14 billion active users, two-fifths of the world’s population.

The Internet Institute study found that because everything a user does on Facebook is recorded and becomes part of the company’s data archive, the platform’s collapse would mean a huge loss of control over this personal data.

“Companies regularly fail and disappear, taking with them troves of customer-user data that receive only limited protection and attention under existing law,” Mr Ohman said.

This is also an issue for the families of people who have died but still have live Facebook accounts. “There is no protection for the sale of deceased users’ data in insolvency,” the paper states.

Mr Ohman adds that Facebook has become an “essential infrastructure for maintaining social relations, commerce and political organisation” in developing countries such as Laos.

He says a regulatory framework for Facebook should be developed that is similar to how regulators treat financial institutions considered “too big to fail” and whose collapse would cause a financial crisis.

The Times