Air NZ nerves cloud Virgin future

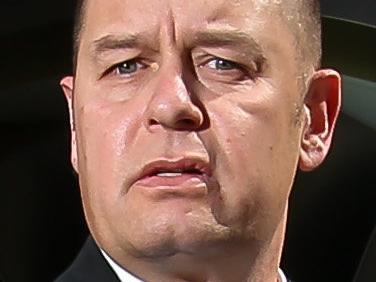

Air New Zealand chief Christopher Luxon has either lost faith in Virgin Australia, or lost his nerve.

Air New Zealand chief Christopher Luxon has either lost faith in Virgin Australia, or lost his nerve.

Virgin Australia’s biggest shareholder, Air New Zealand, may sell part or all of its 26pc stake in the airline.

A review of Virgin must look at whether its capital structure is behind its inability to generate cash, or its strategy, or both.

Virgin Australia search all aspects of its business for savings in a review its capital structure.

Virgin Australia has tapped major shareholders for a new loan facility as it pursues a review of its balance sheet.

Virgin Australia has opened a new front in its ground war with Qantas, unveiling a $200m terminal in Perth.

Virgin Australia will sell its eight 46-seat Fokker 50 turboprop aircraft in the first half of next year.

Virgin Australia has hit back at a Qantas attempt to muddy its plan to use Tigerair on routes to Bali.

Three Federal Court judges have condemned Virgin Australia’s treatment of a severely disabled man who needed to fly with a guide dog.

Record low oil prices will benefit Qantas and Virgin Australia as their fuel expenses plunge.

Virgin Australia expects to move into its long-delayed new Perth terminal by the end of November.

Virgin Australia has told the ACCC the renewal of its alliance with Abu Dhabi-based Etihad is vital to its success.

Air radar systems at some regional airports are not being fully used at lower altitudes, Virgin Australia pilots have warned.

AS the search for the Virgin Australia chair continues, some interesting names have emerged as Neil Chatfield’s replacement.

ALAN Joyce’s tough medicine on costs is delivering results.

MIDDLE Eastern carrier Etihad has increased its stake in Virgin Australia to 22.9 per cent, the maximum allowed by the Foreign Investment Review board.

VIRGIN Australia expects to deliver an underlying profit in the current quarter after a $355.6 million full-year loss for 2013-14.

LUKE Mangan has added spice and class to meals on Virgin.

AIRBUS appears to have gained a boost in its competition to win an order with Virgin Australia.

ONCE a place best avoided, Los Angeles International Airport is now one of the best — and Virgin Australia is right there with a lounge to linger in.

SHARING air traffic controllers poses a heightened risk to aircraft safety.

VIRGIN Australia has defended its safety protocols after a regional turboprop aircraft flew with damage to its tail section.

Original URL: https://www.theaustralian.com.au/topics/virgin-australia/page/31